When you click on links to various merchants on this site and make a purchase, this can result in this site earning a small commission. More information about our affiliate programs can be found here.

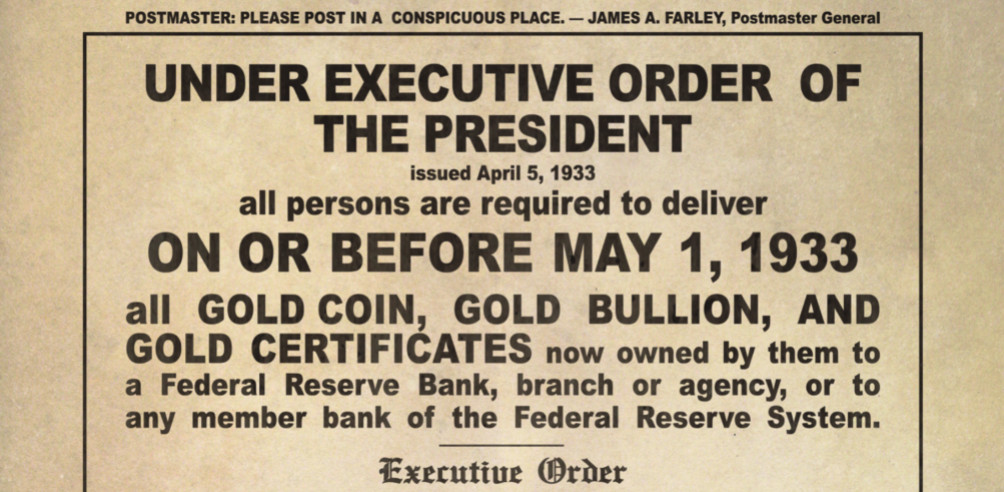

As a result of the Supreme Court decision in June 2018 many online bullion retailers have begun to collect sales tax on orders being shipped to states that view bullion as a taxable item.

State Sales Tax on Silver and Gold bullion varies throughout the country. Some states see bullion as a collectible susceptible to tax, while others view it as an investment or cash alternative that is non-taxable.

Online bullion dealers such as APMEX and JM Bullion have already begun charging sales tax on some orders placed through their websites and eBay stores.

Below is a list states and whether or not they charge sales tax on Coins, Paper Money, and/or Precious Metals. Tax laws are constantly changing. The information below should be used as a guide. Confirm with the online precious metals, bullion or coin dealer prior to purchase to find out if they collect sales tax in your particular locale.

State Sales Tax

- Alabama

The State charges 4% on everything. Many local County & City add additional taxes between 4-5%. - Alaska

No state sales tax, though local governments may still tax. - Arizona

No sales tax collected on precious metals or coins. - Arkansas

Sales tax is collected on precious metals. - California

Precious metals and coin purchases are exempt if the amount is over $1,500. - Colorado

Sales Tax precious metals, bullion and coins varies by city. There is no state sales tax.. - Connecticut

Coins that are collectable are exempt from state sales tax. Precious metals purchases under $1,000 are charged sales tax. - Delaware

No sales tax precious metals and coins. - District of Colombia

Sales tax is collected precious metals and coins. - Florida

No sales tax on U.S. coins. Precious metals purchases greater than $500 are taxed. - Georgia

No sales tax on coins or precious metals. - Hawaii

Coins and precious metals purchases are charged excise tax. - Idaho

No sales tax on bullion or coin purchases. - Illinois

No sales tax on precious metals or coins. - Indiana

No sales tax on coins or bullion. - Iowa

No sales tax bullion or coins. - Kansas

Coin and precious metals purchases are subject to sales tax in Kansas. - Kentucky

Coin and precious metals purchases are subject to sales tax in Kentucky. - Louisiana

Coin and bullion purchases over $1,000 are exempt from sales tax. - Maine

Sales tax is collected on all bullion and coin purchases. - Maryland

Collectible coins and bullion are exempt on purchases over $1000. - Massachusetts

Coin and precious metals are exempt on purchases over $1000. - Michigan

No sales tax bullion or coins. - Minnesota

Coin and precious metals purchases are subject to sales tax in Minnesota. - Mississippi

Coin and precious metals purchases are subject to sales tax in Kentucky. - Missouri

No sales tax bullion or coins. - Montana

No sales tax bullion or coins by the state. Some communities charge a 3% provisional tax. - Nebraska

No sales tax bullion or coins. - Nevada

Sales tax is collected on coins that sell for more than 50% of Face Value. Private Mint Bars and Rounds are exempt. - New Hampshire

No sales tax bullion or coins. - New Jersey

Coin and precious metals purchases are subject to sales tax in New Jersey. - New Mexico

Coin and precious metals purchases are subject to sales tax in New Mexico. - New York

Coin and precious metals purchases are subject to sales tax in New York. Bullion purchases over $1,000 are exempt - North Carolina

Coin and precious metals purchases are subject to sales tax in North Carolina - North Dakota

No sales tax bullion or coins. - Ohio

Sales tax exempt on the sale of precious metal bullion and investment coins that are composed mainly of gold, silver, platinum, or palladium. - Oklahoma

State and local sales taxes can apply to precious metals and coin sales. - Oregon

No sales tax bullion or coins. - Pennsylvania

No sales tax bullion or coins. - Rhode Island

No sales tax bullion or coins. - South Carolina

No sales tax bullion or coins. - South Dakota

No sales tax bullion or coins. - Tennessee

No sales tax bullion or coins. - Texas

No sales tax bullion or coins. - Utah

No sales tax bullion or coins. - Vermont

No sales tax bullion or coins. - Virginia

No sales tax bullion or coins. - Washington State

No sales tax bullion or coins. - West Virginia

Coin and precious metals purchases are subject to sales tax in West Virginia. - Wisconsin

Coin and precious metals purchases are subject to sales tax in Wisconsin. - Wyoming

Precious metals purchases are subject to sales tax in Wyoming.

As with all tax related matters it is best to consult a qualified tax professional. Check with each dealer prior to purchase to determine if they will be charging sales taxes on your purchases.