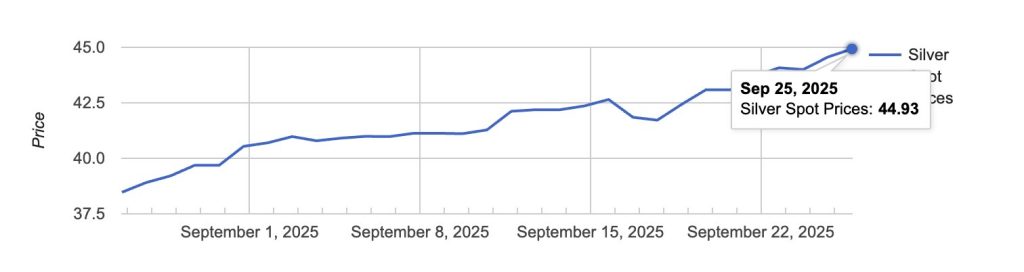

The silver price just punched through $45/oz, its highest level since 2011, capping a blistering YTD run and outpacing gold on a percentage basis. Long-time bullion investors have been waiting years for this breakout.

Below, we break down the drivers, how today differs from the last time we were here, what “all-time high” really means after inflation, what market desks are projecting into 2026, and how to take advantage of record-low premiums while they last.

How Did We Get Here?

- Macro: A risk-off bid as equities wobble, the dollar softens, and the Fed moves from “hold” toward early-cycle cuts. All are tailwinds for non-yielding assets.

- Relative value vs. gold: During previous cycles, silver historically lags and then sprints; its industrial + monetary “dual role” can amplify rallies once momentum starts.

- Structural use-cases: Electrification, solar PV, and power electronics continue to expand silver’s industrial call on supply.

- Tight near-term mine supply: Even modest disappointments in mined output or scrap flows can bite when investment demand accelerates.

2025 vs. 2011: Same Price, Very Different Market

| Dimension | 2011 spike (~$45–$49) | 2025 breakout (~$45) | Why it matters |

|---|---|---|---|

| Fed stance / rates | ZIRP; post-crisis QE | Cuts beginning from higher rates | A down-shifting rate path from high levels supports silver without the same “end-of-the-world” vibe. |

| USD backdrop | Soft dollar | Softening after a strong cycle | A weaker dollar still boosts commodities, but today’s move isn’t dollar-only. |

| Investor structure | Heavy ETF & futures froth | More balanced; strong coin/bar interest; disciplined ETFs | Less one-way speculative positioning lowers blow-off risk. |

| Industrial demand | EV/solar still early | PV, EV, grid well entrenched | Real-economy consumption is larger, more durable. |

| Supply picture | Responsive mine/scrap flows | Multiple years of tightness discussed by industry bodies | Tight baselines make spikes stickier. |

| Sentiment | “Parabolic” into late April | Choppy uptrend with macro support | Stair-step rallies can be healthier than manias. |

Bottom line: 2025’s $45 looks fundamentally sturdier than 2011’s. This time around, there is less speculative froth, more real demand, and a policy path that plausibly stays supportive.

Silver’s All-Time High

- Nominal records:

- 1980 blow-off peak near $49–$50/oz (Hunt-brothers era).

- 2011 retest just under $50/oz.

- Inflation-adjusted reality:

- The 1980 peak would be roughly $180–$200/oz in today’s dollars (range reflects CPI variations and methodology).

- The 2011 peak adjusts closer to the mid-$60s/oz today.

Takeaway: At $45, silver is making a major nominal statement—but nowhere near the 1980 real-terms peak. That context matters for long-horizon investors: the “ceiling” in real purchasing-power terms sits far above current prices.

Market Desk Silver Price Predictions for Late-2025 and 2026

To avoid over-fitting any one call, think in scenarios rather than single-point predictions:

Base Case (most discussed)

- Range: $38–$52/oz into mid-2026.

- Assumptions: Gradual Fed cuts; USD drifts lower; industrial demand stays firm (PV installations resilient); modest investor inflows; supply response limited.

- Risks: Stickier inflation or a USD rebound caps upside; a sudden mine/scrap surge softens deficits.

Bull Case

- Range: $55–$70/oz (episodic spikes).

- Assumptions:Faster/steeper cuts, weaker dollar, accelerating PV and grid build-out, continued tightness; renewed ETF/futures demand; geopolitical risk bid.

- Triggers: Surprise policy pivot, energy transition incentives, or notable supply disruption.

Bear Case (consolidation)

- Range: $30–$36/oz.

- Assumptions: Growth scare that hits industrial demand harder than the safe-haven bid helps; stronger-for-longer dollar; investment flows cool; supply stabilizes.

- Tell: Time spent below $38 coupled with rising dealer inventories and fading breadth.

Positioning idea: Treat $45 as a zone, not a cliff. Use staggered buys on weakness and keep dry powder to buy the dips.

The Silver Bullion Market Right Now

Current market conditions are good news for silver stackers: premiums are at (or near) cycle lows, and multiple national dealers are running silver-at-spot promos for all buyers (not just “first-time customer” teasers). That’s rare at this stage of a rally.

- Dealers with spot-price silver offers: JM Bullion, SD Bullion, Bullion Exchanges, Monument Metals (offers rotate; verify current terms).

- American Silver Eagles (Current Year ASE)

- Bullion Exchanges: $4.60/oz over spot (~10.18%)

- APMEX: $7.77/oz over spot (~17.19%)

- ASE (secondary market, random year)

- Monument Metals: $3.04/oz over spot (~6.73%)

- APMEX: $7.27/oz over spot (~16.09%)

| Dealer | Random-Year ASE | 2025 ASE |

|---|---|---|

| Monument Metals | $3.04 (6.73%) | $5.61 (12.41%) |

| Bullion Standard | $3.59 (7.94%) | $4.86 (10.75%) |

| Bullion Exchanges | $4.10 (9.07%) | $4.60 (10.18%) |

| PIMBEX Metals | $4.19 (9.27%) | $5.09 (11.26%) |

| Safe Haven Metal | $4.37 (9.67%) | $5.82 (12.88%) |

| Summit Metals | $4.75 (10.51%) | $6.34 (14.03%) |

| BGASC | $6.11 (13.52%) | $6.51 (14.41%) |

| SD Bullion | $6.16 (13.63%) | $7.16 (15.84%) |

| APMEX | $7.27 (16.09%) | $7.77 (17.19%) |

Values reflect dollar-over-spot and percentage premium from your provided tables based on silver spot price of $45.19. Buying low-premium random-year ASEs typically gives more silver per dollar than newly minted coins.

For Silver Eagle Stackers: Should You Buy New or Random Year?

- New 2025 ASEs at $4.60–$7.77 over spot scratch the “this year’s tube” itch and are easy to track in inventory.

- Random-year ASEs at $3.04–$7.27 over spot usually win on cost per ounce. If you’re primarily an investor, random-year is the value lane.

Key Takeaways

- $45/oz is a milestone, not the mountaintop. In real terms, silver’s prior extremes are far higher; structurally, today’s backdrop has more industrial depth than 2011.

- Scenario thinking beats single-number targets. A reasonable band into 2026 spans $38–$52 (base) with $55–$70 possible in a bullish cocktail, and the bear case of $30–$36 if macro turns against industrials.

- Low premiums are the gift of the moment. Multiple dealers have silver at spot promos and notably tight spreads on ASEs. Use them while they last.

- Process > prediction. Scale entries, compare all-in costs, favor recognizable products, and document storage/insurance.

When you’re ready to act, use FindBullionPrices.com to compare live silver bullion prices across trusted and reputable dealers like SD Bullion, Bullion Exchanges, Monument Metals, and more, so you can stack more ounces for every dollar you spend.

This article is educational, not financial advice. Precious-metals prices and premiums change quickly; always verify current quotes and terms before transacting.