Upstate Coin & Gold announced it has joined the elite roster of U.S. Mint Authorized Purchasers for gold. In practical terms, AP status lets Upstate buy new-issue Gold Eagles and Gold Buffalos directly from the Mint and downstream them to wholesalers, banks, and retailers, while committing to buy back product and make a market during both calm and chaotic periods.

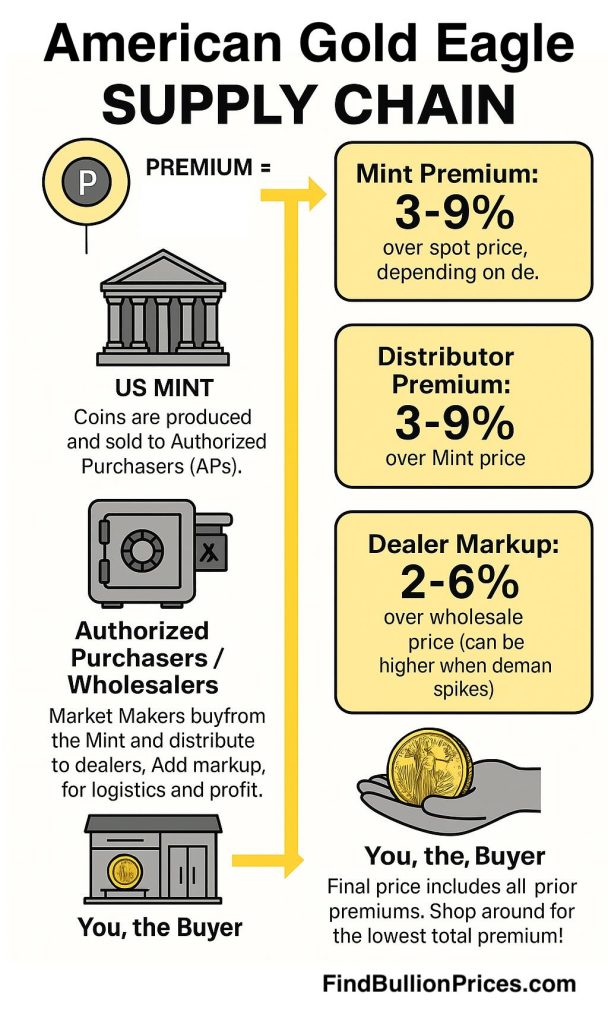

The U.S. Mint does not sell bullion to the public. Instead, it sells to APs at the prevailing metal price plus a small program premium; APs then supply the broader market. That model is designed to ensure liquidity and price continuity, especially when demand spikes.

“APs are the Mint’s shock absorbers,” as one long-time wholesaler puts it. “When retail lines get long and phones light up, it’s AP inventories and two-way markets that keep product moving and spreads from blowing out.”

Quick refresher: What’s an Authorized Purchaser?

- First in line: APs are the only entities that buy bullion directly from the Mint. The public buys from dealers who, in turn, buy from APs or their wholesale networks.

- Two-way market obligation: APs must buy and sell in size, providing ongoing liquidity—an explicit requirement the Mint highlights in annual reports.

- Large order thresholds: Minimums are set in thousands of ounces depending on program (for example, a historical Mint release cites 25,000 oz minimums for Silver Eagle orders), underscoring why AP status is limited to major wholesalers and financial institutions.

Where Upstate Coin fits in the distribution stack

Upstate has operated as a national wholesale market-maker for decades and runs PlatformGold, a 24/7 B2B trading system with integrated logistics, financing, and drop-ship capabilities. Those pipes matter: AP allocations are only useful if a distributor can warehouse, hedge, move, and finance metal at scale. Expect Upstate to route fresh 2025–2026 Eagle and Buffalo bullion into its platform, supporting independent coin shops, e-commerce dealers, and institutions.

Bottom line for the trade: More primary-tier capacity typically means

- Tighter wholesale spreads during normal conditions,

- Faster replenishment when demand surges, and

- Less single-point risk if any AP faces operational bottlenecks.

What changes for collectors and investors?

Short answer: You won’t buy from Upstate Coin directly unless you’re a B2B client—but you will feel the effects downstream.

- Availability & lead times: More AP capacity can reduce back-order risk when gold rallies or when the Mint staggers deliveries.

- Premiums: AP-level competition can compress institutional spreads; retail premiums still reflect dealer costs, hedging, and demand sentiment.

- Market resilience: The AP network’s two-way obligations improve sell-back liquidity for the trade, which ultimately supports consumer confidence in standard bullion issues.

How the AP model works (simplified)

How this compares to other Mint channels

- Bullion AP Program (this news): For investment-grade bullion (Gold Eagles/Buffalos, etc.). Not sold by the Mint to consumers.

- Numismatic “ABPP” early-access program: A separate channel that lets select bulk accounts purchase collector products a bit early under embargo (think proofs/sets)—different rules, different purpose.

Context: who the other APs are (and why it matters)

The Mint currently lists a short roster of U.S. and international APs (names you know like A-Mark, APMEX, CNT, Dillon Gage, Fidelitrade, Jack Hunt, MTB, StoneX, and The Gold Center for silver). It’s a small club by design, reflecting balance-sheet size and market-making obligations. Upstate’s addition grows that bench on the gold side.

FAQs

Does AP status mean Upstate will sell directly to me?

No. APs transact wholesale; the public buys from retailers supplied by APs.

Will premiums drop because of this?

Institutional spreads often tighten with more AP capacity. Retail premiums still reflect demand, dealer costs, and inventory risk.

Which products are covered by Upstate’s approval?

The announcement centers on the U.S. Mint Gold Bullion Program, notably American Gold Eagles and Gold Buffalos.

How are APs vetted?

The Mint emphasizes strict financial and professional criteria and a requirement to maintain a two-way market. Large order minimums apply (e.g., historic 25,000-oz minimums for Silver Eagles).