In today’s world of inflation and economic uncertainty, gold remains the ultimate safe-haven. But with gold prices near historic highs, not everyone can afford a full 1 oz bar.

That’s where gold gram bars offer an affordable entry point for investing in precious metals. These small gold bars range in sizes that include: 1 gram, 2g, 2.5g, 5g, 10g, and 20g options. Whether you’re looking to buy 1 gram gold bars online, start gold stacking, or hedge against inflation, fractional gold bars make owning precious metals easy and practical.

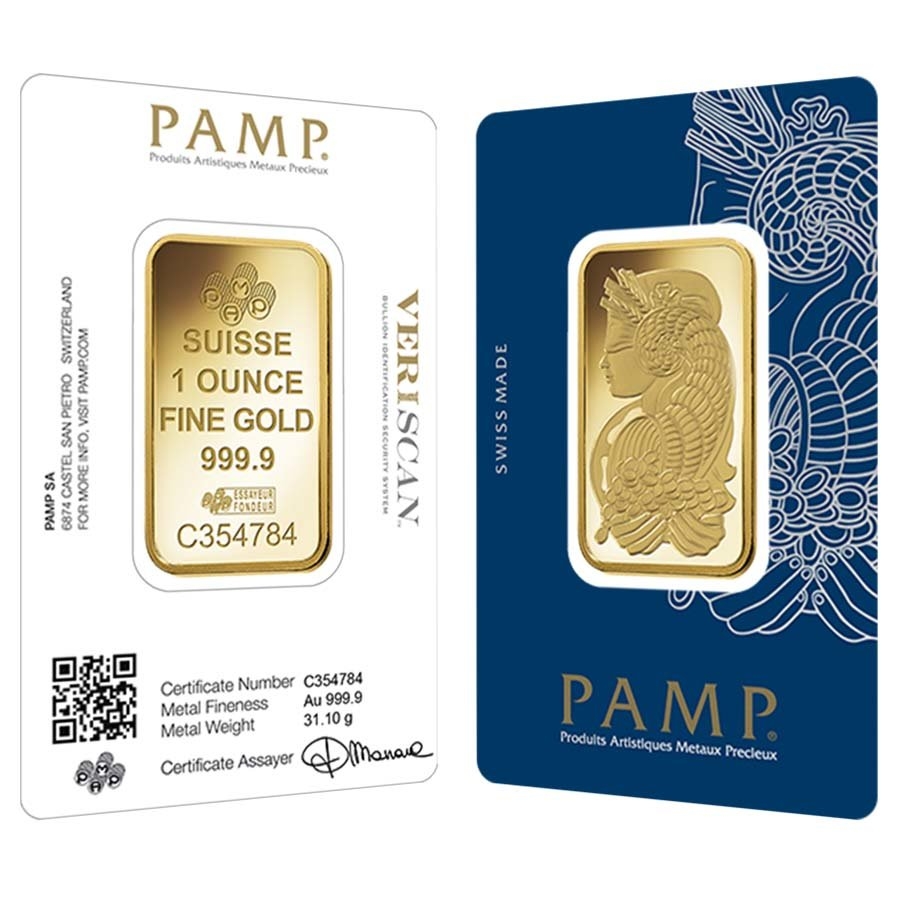

Many of the world’s leading refineries manufacture fractional gold bars, including PAMP Suisse, Valcambi, Credit Suisse, and the Perth Mint. Other reputable brands include Argor-Heraeus, Istanbul Gold Refining, and Asahi Refining.

All investment-grade gold bars are minted with 24k gold refined to a minimum 99.99% purity.

Premiums Vs. Melt Value

Smaller bars, such as 1 gram or 2.5 grams, typically carry a higher premium than larger sizes and can range from 15% to 35% over the spot price of gold.

Midsize bars, like the 5-gram, have slightly lower premiums; 10% to 20% is typical.

Larger fractional bars, like the 10-gram or 20-gram sizes, have lower premiums and can be found for as low as 5% to 15%, as they are closer to the standard 1 oz gold bar.

The premium is generally on smaller bars is usually higher due to the increased cost per gram of production, packaging, and distribution.

Gold Bar Premiums

While fractional gold bars offer flexibility, their premiums are higher than larger ones. However, they are still favored by investors who want affordable, smaller increments of gold and liquidity for the future.

20 Gram Gold Bar Premium Chart

Each 20 Gram Gold Bar contains 0.643015 troy ounces of gold, roughly 2/3 of an ounce.

| Brand | Average Premiums over Spot |

|---|---|

| PAMP Suisse 20 g Bar | 3%-10% |

| Valcambi 20 g bar | 2.25%-5% |

| Argor Heraeus 20 g Kinebar | 3.5%-7% |

| Britannia 20 g bar | 3.5%-7% |

| Geiger Edelmetalle 20 g bar | 4%-6% |

| Valcambi 20 g Combibar | 5%-15% |

| Secondary Market 20 g bars | 1.3%-6.2% |

10 Gram Gold Bar Premium Chart

Each 10 Gram Gold Bar contains 0.321507 ounces, roughly 1/3 of a troy ounce.

| Brand | Average Premium over Spot |

| PAMP 10 g Lady Fortuna Bar | 5%-17% |

| Argor Heraeus 10 g Kinebar | 5.3%-14% |

| Britannia 10 g bar | 5%-9% |

| Perth Mint Kangaroo 10 g bar | 4.3%-14% |

| Secondary Market 10 g bar | 3.8%-8.2% |

| Valcambi 10 g bar | 3.1%-8% |

5 Gram Gold Bar Premium Chart

Each 5 gram gold bar contains 0.160754 ozt.

| Brand | Average Premium over Spot |

| Perth Mint 5 g bar | 5%-10% |

| PAMP 5 g bar | 7%-12% |

| Secondary Market 5 g bar | 4.5%-8% |

| Britannia 5 g bar | 8%-12% |

1 Gram Gold Bar Premium Chart

Each 1 gram gold bar contains 0.0321507 ounces.

| Brand | Average Premium over Spot |

| Valcambi 1 g bar | 17%-25% |

| PAMP 1 g bar | 18%-30% |

| Britannia 1 g bar | 25%-30% |

| Secondary Market 1 g bar | 12%-25% |

| Perth Mint 1 g bar | 20%-25% |

How to Buy the Cheapest Gold Bars

The secondary bullion market usually contains often-overlooked treasure for savvy investors seeking the cheapest gold bar options. While these bars are not fresh off the minting press, instead, they have been previously owned and circulated within the gold market.

Despite their pre-owned status, reputable dealers rigorously test each bar for authenticity, weight, and purity before offering them for resale. This meticulous verification process ensures that investors receive legitimate, high-quality gold at a reduced cost.

Secondary market gold bars typically carry significantly lower premiums, making them an ideal choice for maximizing gold holdings without overpaying.

Additionally, many dealers sweeten the deal by offering extra discounts when investors choose specific payment methods. Options like ACH transfers and crypto payments often come with reduced processing fees, allowing buyers to save even more when purchasing gold.