eBay Bucks Certificates Issued for 2nd Quarter 2019

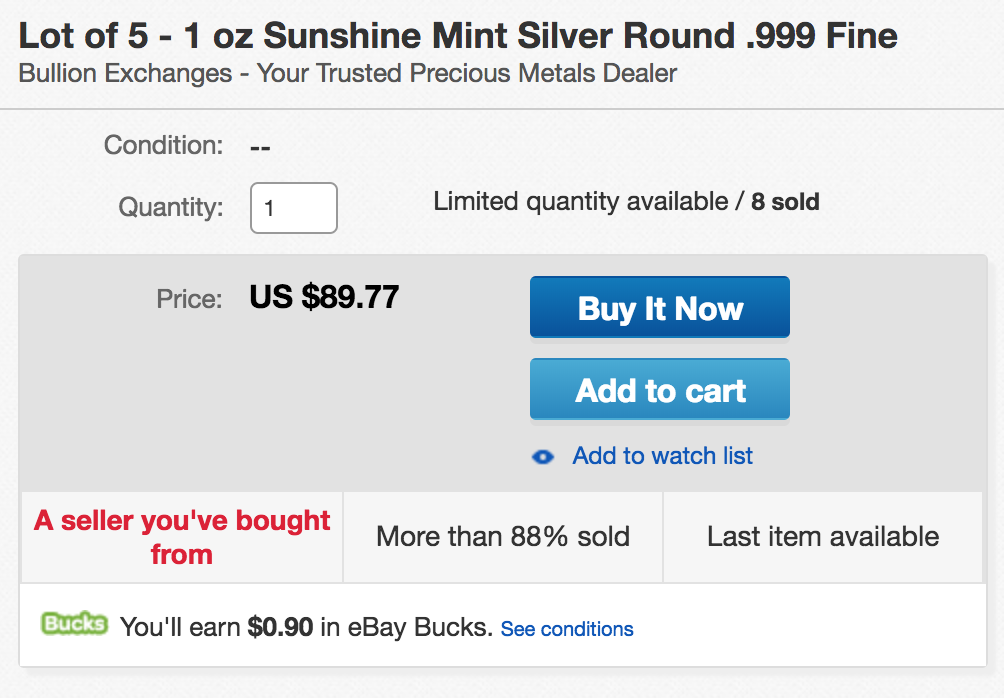

When you click on links to various merchants on this site and make a purchase, this can result in this site earning a small commission. More information about our affiliate programs can be found here. If you’re a member of the eBay Bucks program, eBay has issued the eBay Bucks Certificates for the quarter. eBay Bucks … Read moreeBay Bucks Certificates Issued for 2nd Quarter 2019