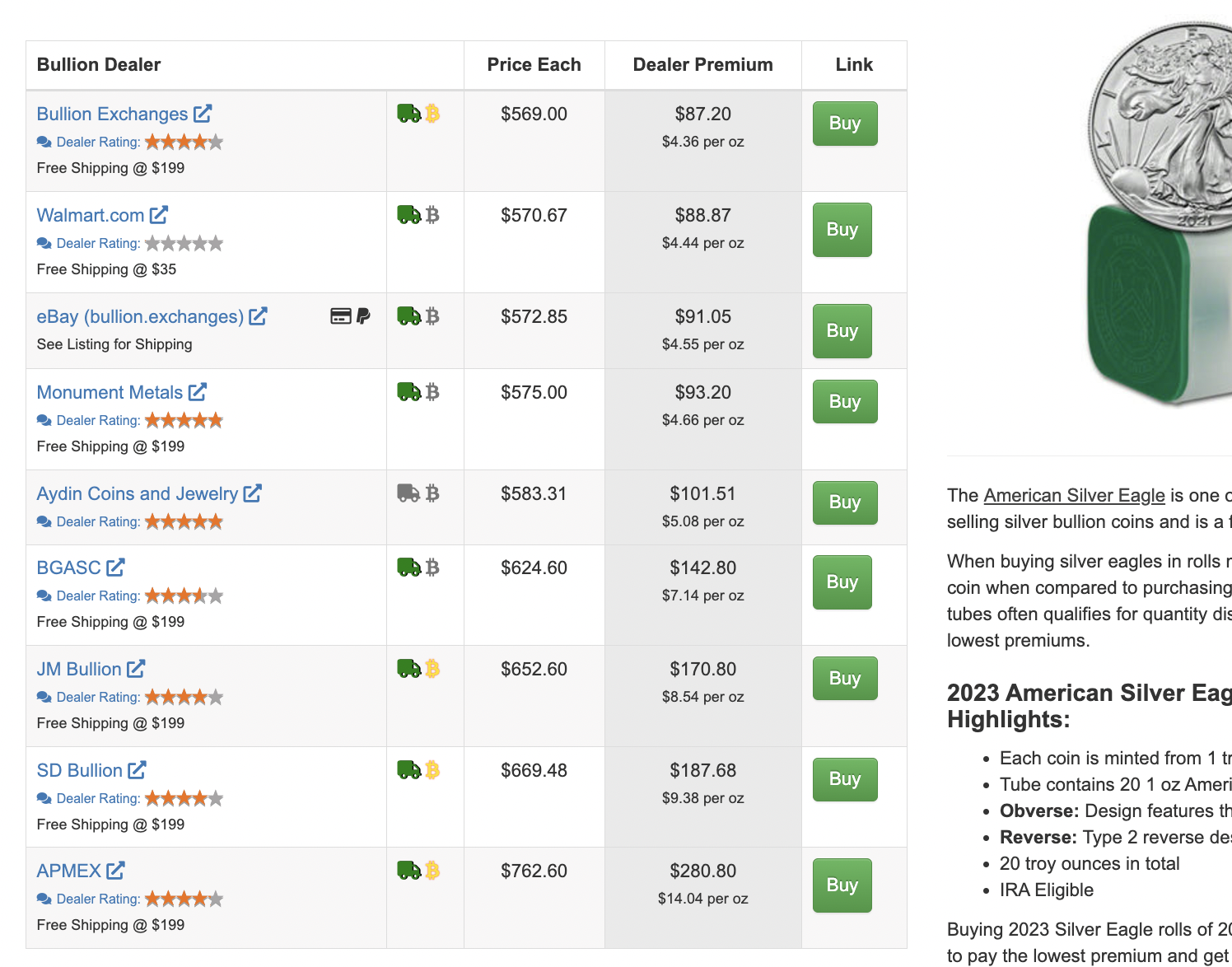

When Walmart began selling precious metals through its website marketplace last year, it became convenient for stackers to add some silver to their orders of other household goods.

As the popularity of buying precious metals online grows, many buyers have experienced issues with being charged sales tax in states where metals aren’t taxed. Some buyers turn to social media for advice on dealing with customer service when resolving sales tax issues.

Sales tax on precious metals is a contentious issue. A complicated patchwork of outdated state laws has created problems that online retailers have had to contend with since the 2018 South Dakota v. Wayfair decision.

Since that landmark Supreme Court decision, large online marketplace retailers like Walmart and eBay are required to collect state and local sales taxes and remit them to their respective government agencies.

Gold and Silver Sales Tax and Legal Tender Status

The United States was founded on sound money principles. The founding fathers included rules in the Constitution that states must follow when issuing legal tender.

Already, 11 US states have taken steps to officially recognize gold and silver as legal tender. More states have pending legislation that either eliminates sales tax on precious metals or recognizes them as currency.

“no state shall make anything but gold and silver coin a tender in payment of debts.”

Texas was the first state to establish its own bullion depository, and pending legislation aims to create the first state-issued gold-backed crypto-currency that will be redeemable for physical gold.

While the Federal Reserve continues battling inflation and interest rates, Republican lawmakers have introduced new legislation titled “The CBDC Anti-Surveillance State Act” to ban a CBDC in the United States.

In a press release, Senator Ted Cruz said: “The Biden administration salivates at the thought of infringing on our freedom and intruding on the privacy of citizens to surveil their personal spending habits, which is why Congress must clarify that the Federal Reserve has no authority to implement a CBDC.”

De-dollarization and the Return to a Gold Standard

The BRICS member nations have been making progress with developing a gold-backed common currency for trade. Last year, roughly 20% of the world’s oil trade happened in non-dollar currencies, a record high since the introduction of the petrodollar in the 1970s.

China stockpiled more than 225 tonnes of gold during 2023. According to data from the Central Bank, China’s central bank now holds 2,235.39 tons of gold reserves, almost on par with Russia’s 2,332.74 tons.

Additionally, other BRICS countries are quickly accumulating more gold. Five additional countries have announced that they are joining BRICS: Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates. At the same time, dozens of others have expressed interest.