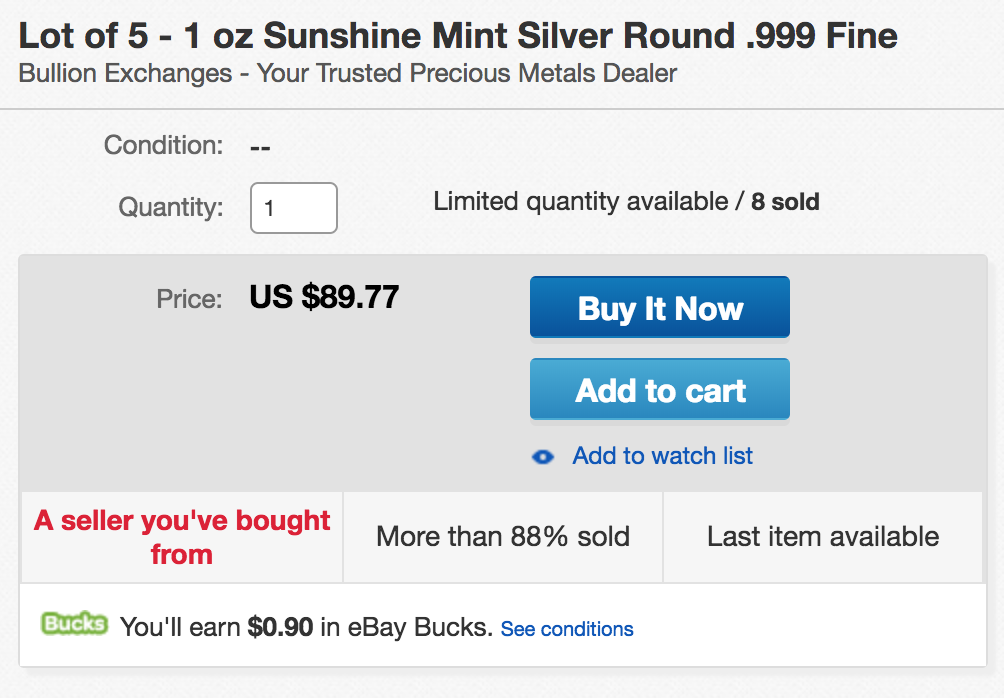

Silver Rounds at Spot Price

Several dealers offer a special deal to new customers to buy silver rounds at spot price. These special spot-price deals entice new customers to purchase with little risk to the investor. The dealers that have these offers limit them to only one per household. Buying rounds at silver spot price is an excellent way to lower … Read moreSilver Rounds at Spot Price