Saudi Arabia Taking Active Steps to End Petrodollar Dominance

As the impact of the ongoing banking crisis begins to be felt at home, many Americans are shifting their priorities to protect their financial assets.

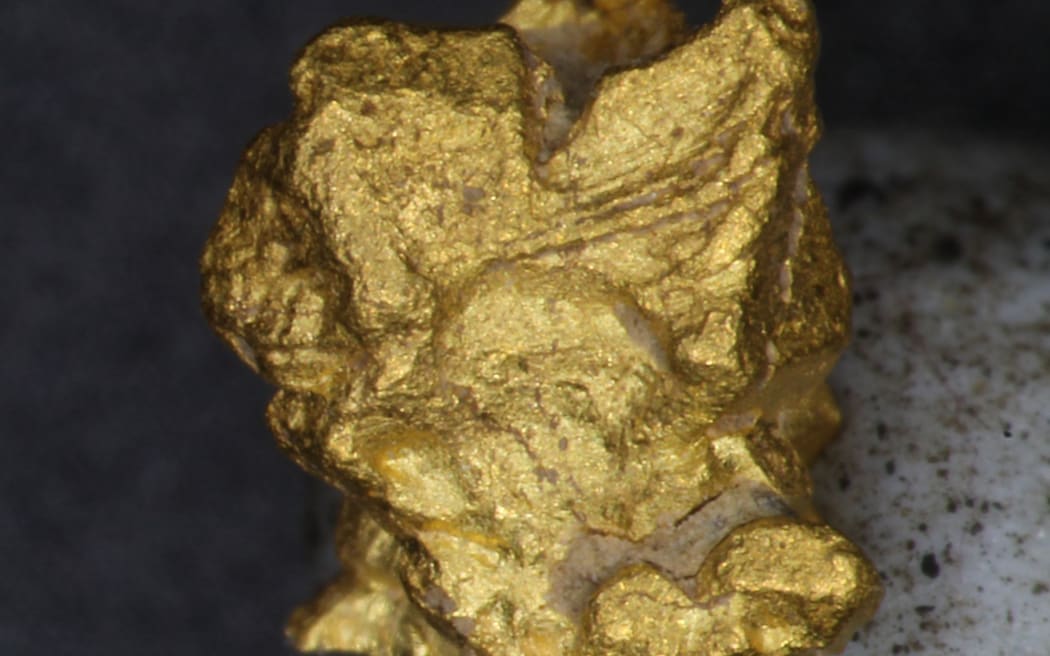

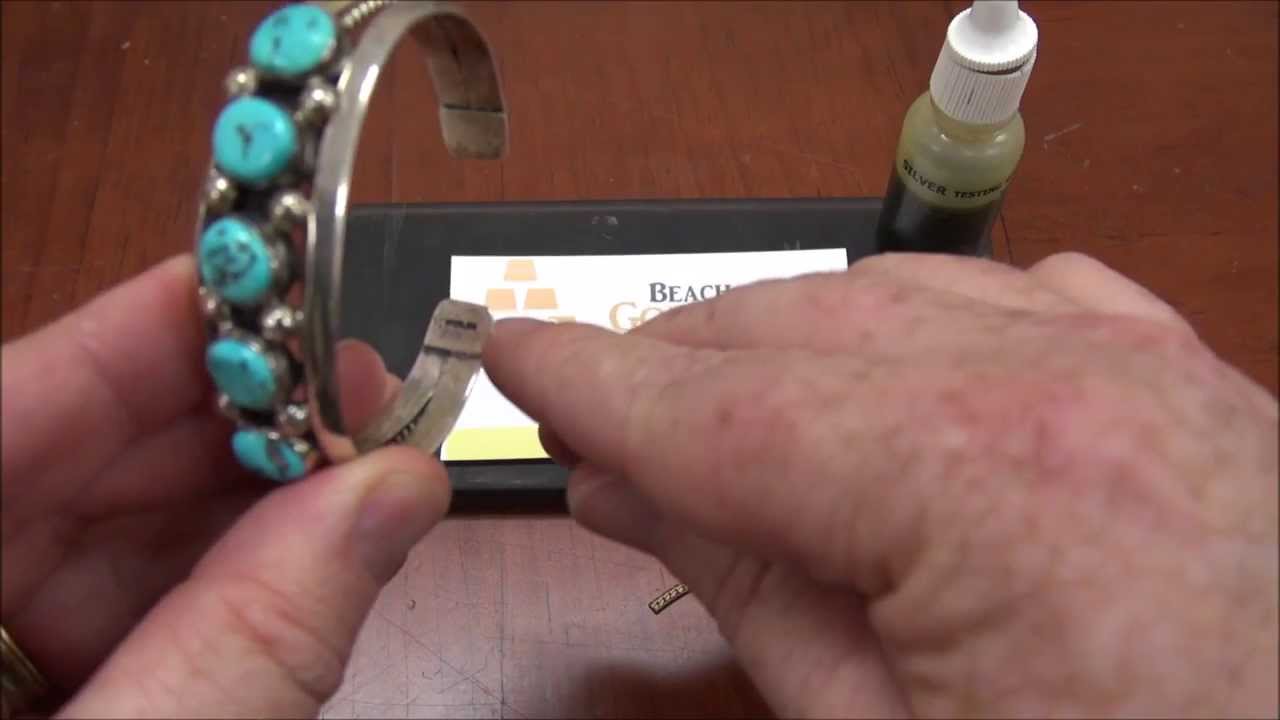

The shifting of and diversification of assets is likely continue at a rapid pace in the coming months as excess dollars and crypto funds are moved into hard assets like gold, silver, land, ammunition, firearms and stable food in the coming months as smart investors prepare for further economic hardship.