Annual government-issued bullion coins form the backbone of many portfolios. These coins are minted specifically for investment, backed by sovereign mints, and traded globally with transparent pricing tied closely to the silver spot price.

The 2026 silver bullion lineup continues that tradition, with familiar mainstays from the United States, Canada, Europe, Australia, and South Africa. While each coin contains one troy ounce of silver, differences in minting standards, design, liquidity, and dealer premiums can matter—especially when buying in size.

This guide covers the most widely traded 2026 silver bullion coins and what buyers should know before choosing between them.

American Silver Eagle (2026)

The 2026 American Silver Eagle remains the most widely recognized silver bullion coin in the United States. Issued by the U.S. Mint and containing one troy ounce of .999 fine silver, Silver Eagles are legal tender and backed by the U.S. government for weight and purity.

Because of their popularity and domestic demand, Silver Eagles often trade at higher premiums than other government-issued silver coins. For buyers prioritizing liquidity and recognition, that premium is often considered the tradeoff.

Compare dealer pricing for 2026 American Silver Eagles

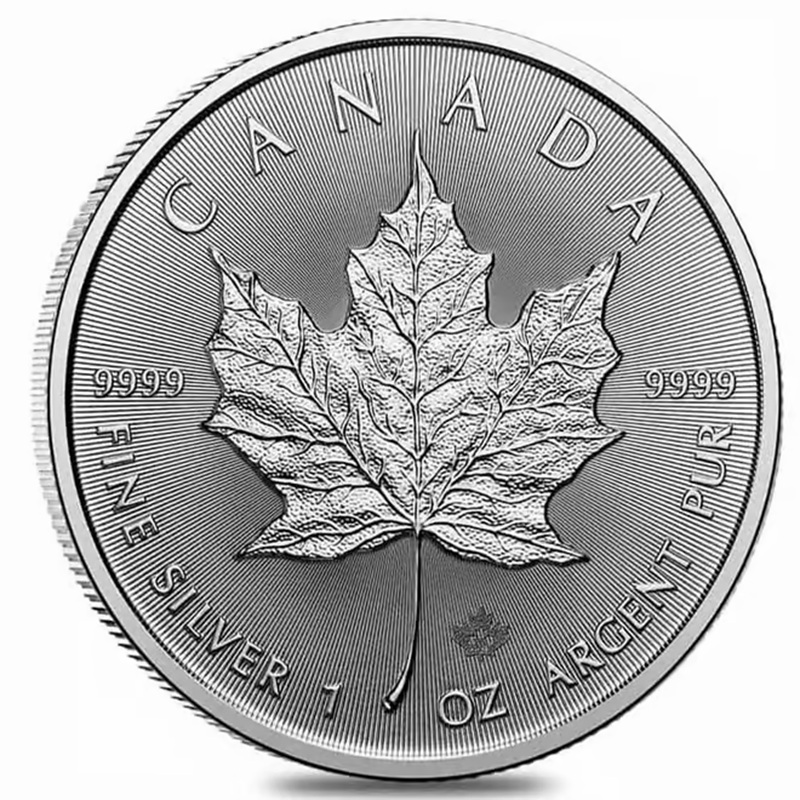

Canadian Silver Maple Leaf (2026)

The 2026 Canadian Silver Maple Leaf is minted by the Royal Canadian Mint and struck in .9999 fine silver. Known for its advanced security features and high purity, the Maple Leaf is one of the most actively traded silver coins worldwide.

Maple Leafs frequently carry lower dealer premiums than Silver Eagles while maintaining strong global liquidity. For buyers focused on maximizing silver ounces per dollar, they are often a core stacking option.

View current listings for 2026 Silver Maple Leafs

British Silver Britannia (2026)

The 2026 Silver Britannia, issued by The Royal Mint, contains one troy ounce of .999 fine silver and features advanced anti-counterfeiting design elements. Britannia bullion coins are widely traded across Europe and increasingly popular with U.S. buyers.

Premiums on Britannia silver coins often fall between Maple Leafs and Eagles, depending on market conditions and availability. Their combination of security, liquidity, and competitive pricing makes them a common alternative for diversified silver stacks.

Compare prices for 2026 Silver Britannia coins

Austrian Silver Philharmonic (2026)

The 2026 Austrian Silver Philharmonic is denominated in euros and minted by the Austrian Mint. Containing one troy ounce of .999 fine silver, Philharmonics are particularly popular with European investors but remain widely traded internationally.

While not always the lowest-premium option in the U.S., Philharmonics are well-established and liquid, making them suitable for investors who value global recognition.

See available 2026 Silver Philharmonics

South African Silver Krugerrand (2026)

The 2026 Silver Krugerrand continues the legacy of one of the most historically significant bullion coin brands. Struck in .999 fine silver and backed by the South African Mint, Silver Krugerrands offer strong recognition without the premium levels seen on Silver Eagles.

They are often competitively priced and appeal to buyers seeking a globally recognized alternative with solid liquidity.

Browse 2026 Silver Krugerrand listings

Choosing the Right 2026 Silver Bullion Coin

All of these coins contain the same amount of silver. The difference for investors comes down to premiums, liquidity, and resale preferences. Comparing dealer prices is the most effective way to avoid overpaying, especially during periods of elevated silver market volatility.