In a move indicating the strength of retail gold demand and the pressures facing mainstream supply chains, Costco has implemented new restrictions on buying for members looking to buy a 1 oz gold bar.

As of May 2025, customers are limited to one transaction per membership with a maximum of two units every 24 hours. The warehouse giant already enforced a two-bar cap last year in response to skyrocketing interest.

A Retail Frenzy Triggered by Economic Turmoil

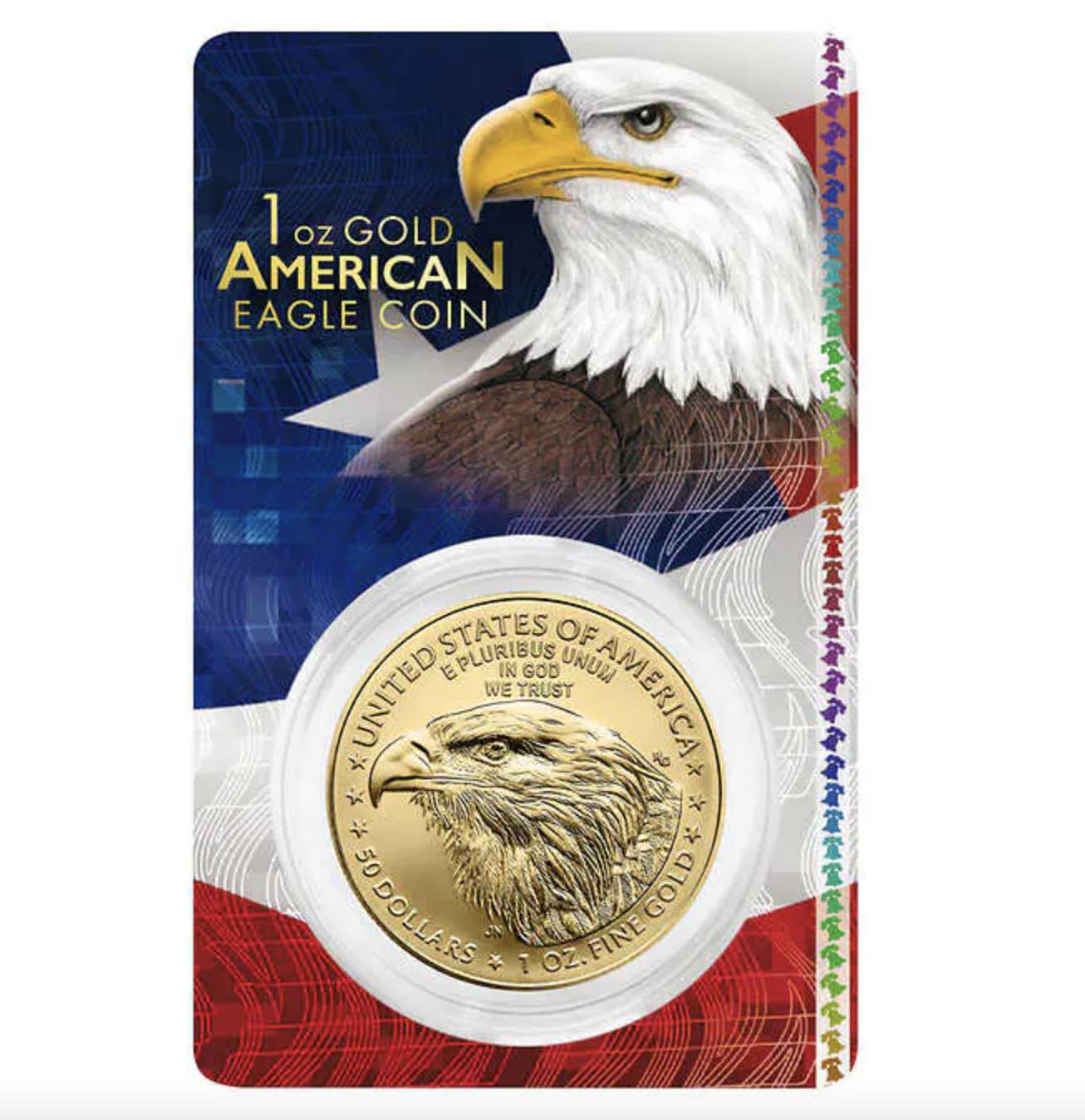

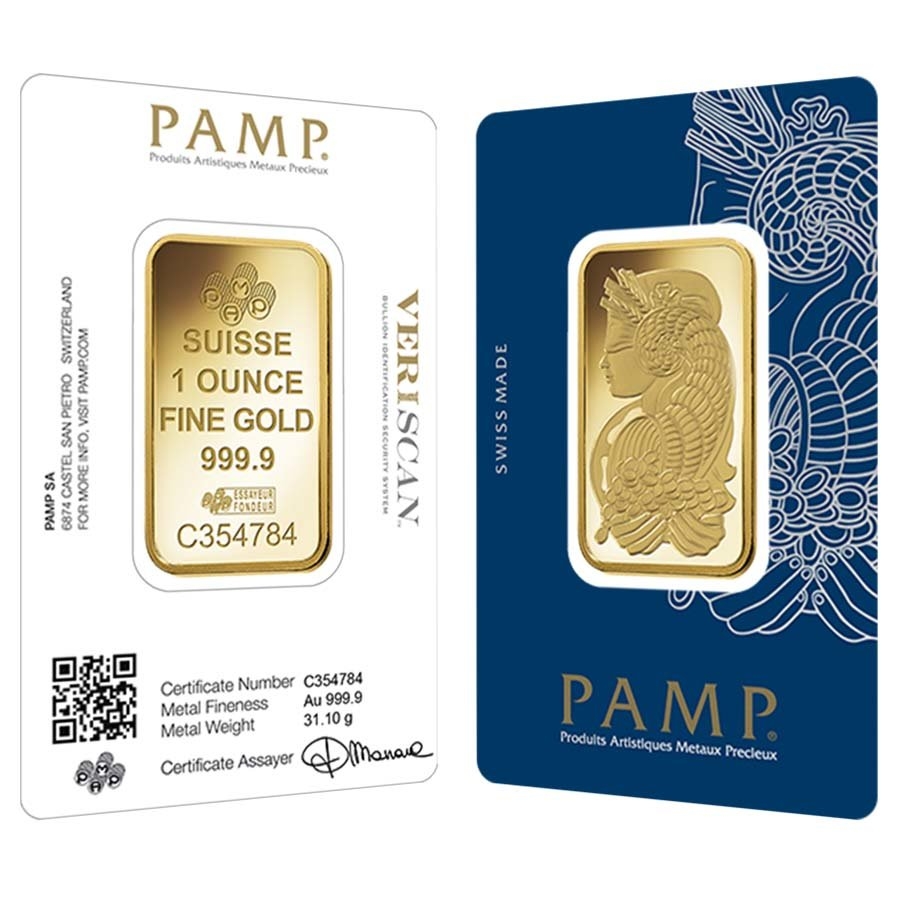

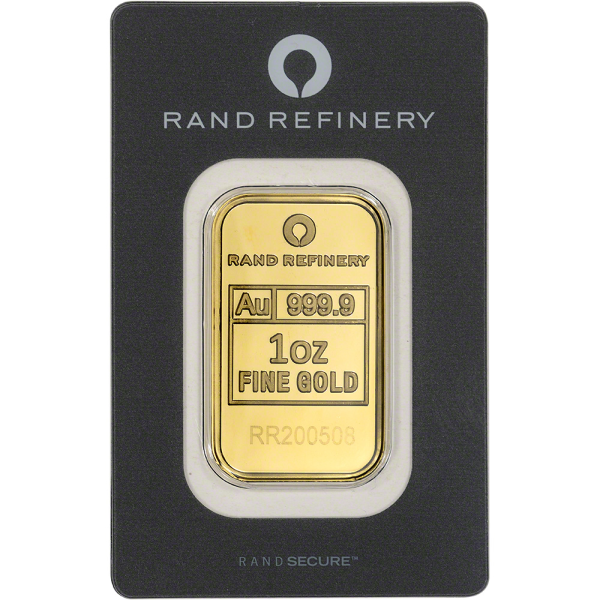

Costco’s foray into bullion sales began in earnest in mid-2023, capitalizing on its trusted brand and competitive pricing. Its offerings, including RAND Refinery and PAMP Suisse 1 oz gold bars, were priced aggressively, usually with significantly lower premiums than those seen at traditional bullion dealers.

According to reports from Wells Fargo, Costco has at times generated as much as $200 million per month in gold coin and bar sales, a staggering figure for a retail chain not traditionally associated with precious metals. With gold trading above $3,200/oz and spot prices having recently touched a record $3,500, the demand has outpaced even Costco’s logistics.

A survey conducted in late 2024 found that 77% of Costco warehouses offering gold were out of stock despite recent restocks. The momentum has only increased in 2025.

Reddit and the Rise of the Retail Investor

Costco’s gold sales have generated significant online buzz, especially on platforms like Reddit. Precious metals-focused communities like r/CostoPM, r/Gold, and r/WallStreetSilver have documented delivery stories, reviews, and even missing packages.

This grassroots interest has helped push gold further into the cultural and financial mainstream. The convenience of ordering investment-grade bullion with a Costco membership and having it shipped discreetly has tapped into a broader demographic, including first-time investors, retirees, and Gen Z savers seeking tangible stores of value.

Implications for the Precious Metals Market

While Costco’s limits may seem restrictive, they highlight a larger trend: mass-market participation is accelerating retail gold demand and it is no longer confined to coin shops and bullion dealers.

Mass-market access through major retailers like Costco, Walmart and eBay has introduced new pressures on the supply chain.

LBMA Defaults

These purchase caps respond to significant logistical stress within the bullion supply chain. In early 2025, the London Bullion Market Association (LBMA) faced unprecedented strain, with reports of delayed physical gold deliveries and withdrawals from Bank of England vaults reaching bottleneck levels. Nearly 800,000 four-hundred-ounce bars were reportedly pulled from London and routed through Switzerland, where they needed to be recast into COMEX-eligible 1 kg bars or investment-grade 1 oz bars.

Complicating matters further, some of this gold was reportedly stored in coin standard (.900 fine) or central bank-grade (.995) requiring uprefining to the .9999 fineness demanded by the LBMA and COMEX markets. That refining process isn’t instantaneous. Switzerland’s major refineries had already been operating at full capacity for months, working 24/7 to meet recasting demand amid tariff fears and skyrocketing lease rates.

This capacity crunch translated downstream into the retail bullion supply chain. Swiss-manufactured 1 oz gold bars from PAMP Suisse is one of the frequently offered products by Costco. However, when refineries face labor shortages, logistical delays, and ballooning operational costs due to surging short-term gold lease rates in Q1 2025, production of these bars slows dramatically.

As a result, inventory replenishment lags. Limiting 1 oz gold bar purchases becomes a necessary buffer to control inventory velocity against structural stress in the global refining and delivery pipeline to avoid being wiped out by backorders or resupply delays.

Costco’s updated limits reflect a logical response to a temporarily broken system. Until refining bottlenecks ease and LBMA delivery flows normalize, buyers should expect constraints to remain in place, and view these restrictions as a signal of gold’s increasing relevance and scarcity in today’s fractured global economy.

The Bigger Picture: Inflation, Geopolitics, and Retail Bullion Demand

Several macroeconomic forces are converging to push retail investors toward gold:

- Persistently high inflation and rate uncertainty are diminishing trust in fiat currencies.

- Tariff threats and global trade instability, especially between the U.S. and China, have investors seeking havens.

- Central bank gold buying continues at a record pace, particularly in Asia and the Middle East, reinforcing bullion’s long-term strategic role.

- State-level legislation, such as Utah’s recent law enabling vendor payments in gold and silver, revives physical precious metals as money.

- Public skepticism toward the Federal Reserve, amplified by calls for Fort Knox audits, is stirring interest in privately held gold.

All of these point to one conclusion: demand will likely remain strong, especially at the retail level.

A Case for Fractional and Smaller-Denomination Gold

Costco may still offer great 1 oz gold bar deals. However, these restrictions, availability issues and rising gold prices make smaller coins and bars increasingly attractive. Coins like the 1/10 oz American Gold Eagle, 1/4 oz Britannia, or vintage fractional coins like the French 10 Franc or Mexican 5 Peso allow investors to build wealth gradually, with greater liquidity and lower per-unit cost.

Platforms like FindBullionPrices.com allow investors to compare premiums and dealer inventories in real time, making it easier to locate “silver at spot” offers or discounted fractional gold that isn’t subject to Costco’s supply constraints.

Conclusion: A Retail Awakening

These latest restrictions from Costco may be frustrating for some. Still, they’re emblematic of something larger: a retail awakening to gold as a trusted financial hedge. Whether driven by distrust in central banks, fear of economic uncertainty, or simply a desire for tangible wealth, the general public is becoming more gold-aware.

As supply bottlenecks emerge and premiums widen, informed investors would be wise to explore alternate buying avenues, especially for smaller-denomination gold coins, which offer the best balance of accessibility, flexibility, and liquidity.