When ready to move serious capital into precious metals, 1 kilo gold bars are the go-to. Each bar contains 32.15 troy ounces, representing a powerful way to store and preserve wealth. Gold kilos are compact, efficient, and globally recognized. Buying kilo gold bars is one of the cleanest ways to diversifying your portfolio by stacking hard assets.

Why 1 Kilo Gold Bars?

Unlike smaller products, 1 kilo gold bars are reserved for those seeking a serious wealth preservation tool. They’re large enough to carry low premiums over spot price, making them one of the most cost-efficient methods of buying physical gold in bulk. Each bar is compact, discreet, roughly the size of a smartphone, making them easy to transport or store in a private vault or bank deposit box. Based on today’s gold price, each kilo gold bar is worth $143118.78.

For high-net-worth individuals, 1 kilo gold bars represent a strategic and reliable form of portfolio insurance. In times of inflation, currency devaluation, or systemic financial risk, these bars serve as a hard asset that operates outside the fiat-based banking system. Unlike paper investments or digital assets, 1 kilo gold bars offer direct ownership with no counterparty risk — a key differentiator in times of uncertainty.

One of the most significant advantages of investing in 1 kilo gold bars is their role in long-term generational wealth planning. Gold has been a recognized and trusted store of value for over 5,000 years, and kilo bars are ideal for passing wealth discreetly and securely between generations. Their high value-to-volume ratio allows a large amount of wealth to be stored in a small footprint, making them ideal for family offices, estate plans, or trust structures.

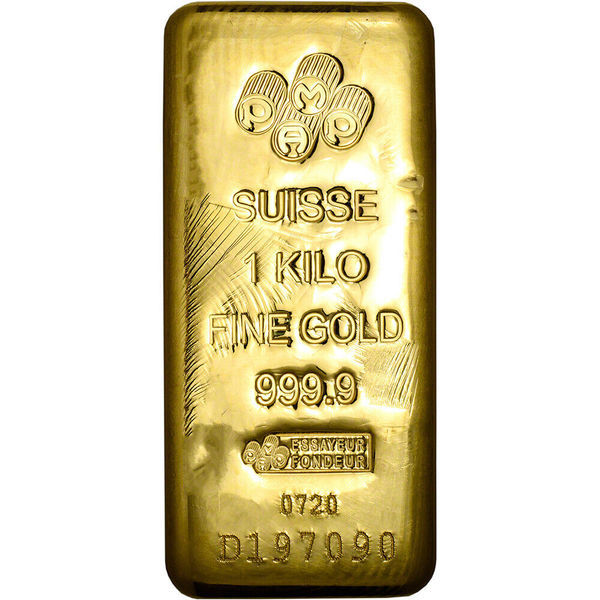

Top mints like PAMP Suisse, Valcambi, Metalor, and the Royal Canadian Mint produce 1 kilo gold bars that are .9999 fine gold, serial-numbered, and come with assay certificates — ensuring authenticity, purity, and resale value. These bars are internationally recognized and easily liquidated through global bullion markets, making them an excellent hedge and highly liquid asset when needed.

What to Buy: Sovereign vs. Private Mints

Online bullion dealers offer a variety of LBMA and IRA approved options, including kilo gold bars from government and private mints. The big players include:

- PAMP Suisse

- Valcambi Suisse

- Argor-Heraeus

- Johnson Matthey

- Royal Canadian Mint

- Perth Mint

As sovereign government mints like the Royal Canadian Mint and Perth Mint offer a level of trust that’s hard to beat. Bars from these mints have guaranteed purity and weight, official backing, and airtight reputations. For investors who want maximum assurance, these are the top-shelf picks.

Private mints, on the other hand, can offer lower premiums and sometimes more diverse options, but you need to know who you’re dealing with. The top-tier names often surpass sovereign mints regarding craftsmanship, security features, and market recognition.

Three Switzerland based refineries consistently rise to the top for gold kilos: PAMP Suisse, Metalor, and Valcambi. These refineries are LBMA Good Delivery certified, which means their bars meet the strict global standards for weight, purity, and quality.

Brand Spotlights

PAMP Suisse

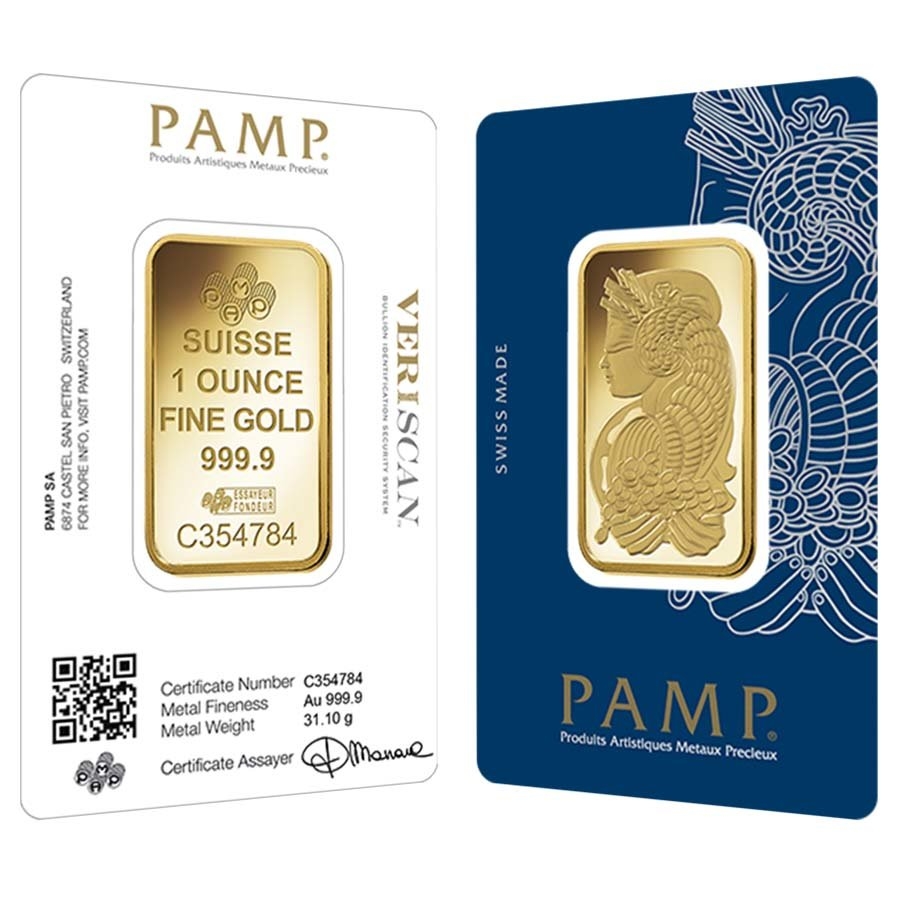

Easily one of the most recognized names in the gold game, PAMP Suisse is the blueprint for elegance and credibility. Based in Ticino, Switzerland, they’ve set the global standard with their refinery tech, secure packaging, and world-class design.

- Purity: .9999 fine gold

- Design: Their signature “Lady Fortuna” motif is iconic, but they also produce classic cast bars with serial numbers and official assay certificates.

- Security: PAMP bars come sealed with a Veriscan QR code, which provides instant authenticity verification via your phone.

PAMP bars carry a slightly higher premium than other kilo bars, but the trust, aesthetics, and global liquidity make that worth it for many investors.

PAMP has a zero-tolerance policy toward conflict gold and requires complete supply chain documentation from its suppliers. It also performs enhanced due diligence on all sources, especially those from high-risk regions.

Regarding traceable gold, PAMP is one of the most advanced mints. They offer a system called PROVENANCE™, which allows buyers to verify the origin of the gold, the refining process, and the chain of custody. This service is particularly relevant for ESG-focused investors and institutions.

Metalor

Metalor Technologies is also LBMA Responsible Gold Certified and adheres to the OECD Due Diligence framework. The company is a key bullion supplier for central banks, governments, and major institutional clients, so compliance and ethics are paramount.

In 2020, Metalor announced that it would operate at stricter standard than required and only refine gold from mine sites that it has fully audited. Due to compliance gaps, they’ve even suspended some artisanal mining operations from their supply chain.

- Purity: .9999 fine gold

- Markings: Metalor kilo gold bars are stamped with their name, weight, purity, and unique serial number. They are clean, simple, and ultra-secure.

- Reputation: Known for quality, consistency, and discretion — Metalor bars are often favored by central banks and large-scale wealth managers.

Metalor adheres to a “Track and Trace” policy and was instrumental in developing the “Mine-to-Market” initiative. However, unlike PAMP, retail buyers won’t always have access to complete digital traceability unless they buy through a specialized institutional channel.

Metalor takes a highly controlled, extremely ethical, compliance-heavy approach to sourcing. If you want gold that gets respect globally but doesn’t scream for attention, Metalor’s a strong pick.

Valcambi Suisse Kilo Gold Bars

A name that’s always in demand. Valcambi kilo gold bars are known for sleek design, Swiss reliability, and exceptional purity. Their are often chosen by institutions and large investors who want traceable, no-nonsense bullion.

- Purity: .9999

- Style: Classic cast or minted, marked with serial numbers and refinery seals.

Valcambi is LBMA and RJC certified and complies with the World Gold Council’s Conflict-Free Gold Standard. They maintain a strong internal Responsible Supply Chain Policy, requiring extensive documentation and third-party audits of all suppliers.

They are among the few major refiners that publish their due diligence reports, showcasing transparency on origin, supply chain risk, and supplier audits.

Valcambi offers its clients the ability to purchase “Green Gold”, a traceable gold that comes from segregated sourcing and is participating in pilot projects in blockchain-based gold traceability, allowing for transparency from mine to vault.

However, the exact mine of origin is not typically disclosed for standard 1 kilo gold bars sold through bullion dealers.

Secondary Market 1 Kilo Gold Bars

Secondary market gold kilo bars are one of the best options for value-focused investors who don’t need brand-new packaging or shiny finishes. These bars come from previous owners, sometimes scratched or missing their original assay cards, but they carry full intrinsic value.

- Purity: Always test or verify, but most come from LBMA-approved refiners like PAMP, Metalor, Heraeus, or Valcambi.

- Price Advantage: Lower premiums, usually significantly below newly minted bars.

Just be sure to buy from a reputable source that tests and guarantees the metal content.

How to Buy Online

Let’s be real — you’re not buying a candy bar. Here’s how to do it right:

- Only buy from trusted dealers. If they don’t publish live pricing, secure payment options, and clear shipping insurance policies, walk away.

- Look for serialized bars. Serial numbers + matching assay certificates = peace of mind.

- Understand premiums. You’ll usually pay 1–2% over spot for new kilo gold bars. In today’s marketplace, you can find secondary market bars for less than 1% over melt. If you see more than that, you’re probably getting taxed for the brand or limited supply.

- Know your storage plan. Home safes, secure vaulting, or depository services — have a strategy before you buy.

Next Steps

Kilo gold bars aren’t for the casual buyer. They’re for people looking to play in the deep end — quietly, efficiently, and with maximum impact. These bars are bright whether you’re stacking for generational wealth or insulating against economic chaos. Do your homework, buy from credible sources, and avoid the hype. Gold doesn’t care about your feelings — but it will protect your buying power when the fiat house of cards wobbles.