Gold has been an instrumental component of the economy since before the American Revolution.

Our founding fathers had the forethought to include gold and silver coins in the Constitution.

A metallic standard was a central foundation for the economy in the United States based on gold and silver coins.

The US Mint was established on April 6, 1792, prior to the Declaration of Independence.

Recently, legislation has been introduced into the House of Representatives that is intended to move the United States back towards a gold-standard.

The sponsor of the bill, Representative Alex Mooney (R-WV), has stated that the purpose of the Bill is to give greater visibility of the spending by politicians in Washington.

Jerome Powell has said that gold bullion has no purpose in the US economy. The rest of the world is still remembers the Nixon Shock and other major events in the global commodities markets caused by US foreign policy.

Gold has been a core, instrumental component of the global economy, politics and international trade for thousands of years.

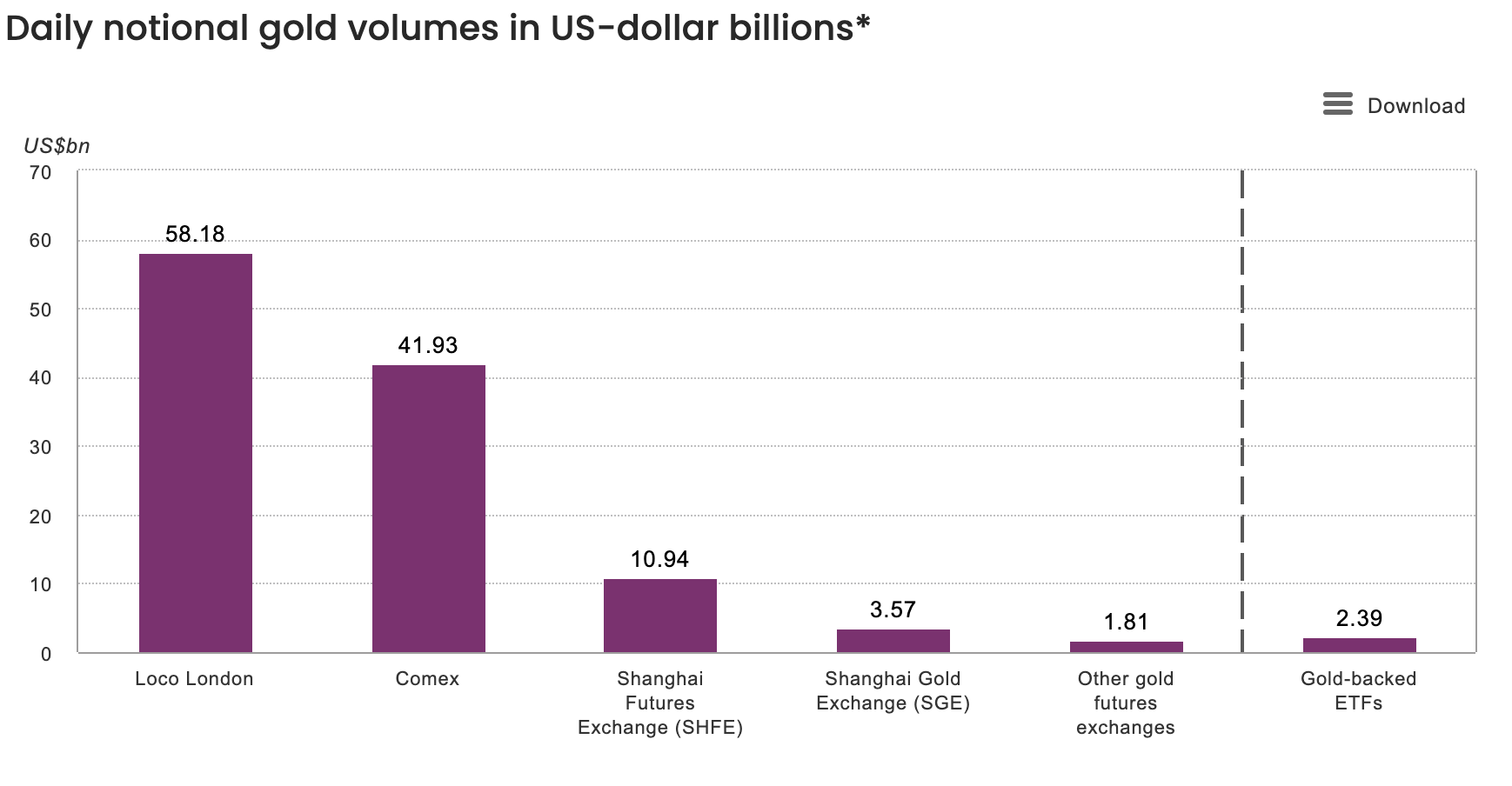

With the Moscow World Standard posited to compete with the LBMA, COMEX, Shanghai and other global trading markets.

Many speculate that Moscow is trying to position itself as an economic leader in the global economy. Earlier this year, the Moscow World Standard was announced by the Russian Finance Ministry as an open and fair competitor to the LBMA.

Moscow hopes that many of the BRICS nations and developing nations that are abundant in natural resources have opportunities to trade more fairly in global markets.

Minerals like cobalt, lithium, manganese, nickel and other rare earth minerals that are necessary for the production of batteries for electric cars, houses and other future energy needs. Silver is used in the manufacturing of solar panels and other electrical components.

All of these natural resources are also part of a national initiative to secure resources necessary to build new supply chains for the reemergence of high-tech and semi-conductor manufacturing on American soil.

An emerging Global Gold Standard built on Blockchain Auditing

Outside of the US, private gold ownership continues to grow, particularly amongst Asian markets including China and India.

Russia responded to economic sanctions by starting a program to buy gold from citizens in exchange for rubles and began requiring payment for oil, natural gas and other energy needs in Rubles as a way to stabilize the Russian economy following the invasion of Ukraine.

Bloomberg reports that at least 4 accounts in Rubles have been opened with Gazprom PJSC.

The government of Zimbabwe began to issue gold coins as currency as a way to stabilize their economy following decades of inflation due to corruption.

Many developing nations in Africa, Central and South America and Asia are rich and abundant with natural resources.

Having direct access to global markets for selling commodities such as lithium, cobalt and other minerals is of interest to leaders and businesses of many nations, some of which may be looking to renegotiate contracts with global conglomerates as a way to better leverage their local resources to rebuild their local economies following the pandemic.

Other News

- Prosecutors allege that Glencore Executives used private Jets to deliver bribes to West African officials.

- More reasons you should be bullish on Silverhttps://www.zerohedge.com/commodities/why-should-you-be-bullish-silver

- London Silver vaults being drained at record rates.

- Gold and Silver being heavily bought in Asia

- China importing gold at a 4-year high