Zimbabwe has had a long history of economic instability. From 2004 until 2009 the country experienced five years of hyperinflation.

During the period of hyperinflation the country had to halt the exchange of local currency to dollars due to a meteoric rise in prices.

In early 2009, the government had abandoned the local currency, instead favoring the US dollar for all official transactions.

By 2014, there were eight legal foreign currencies being used for day-to-day transactions throughout the country.

Almost ten years later, the economy is Zimbabwe is still in shambles. The Zimbabwe dollar was reintroduced in 2019. Periods of high inflation quickly followed.

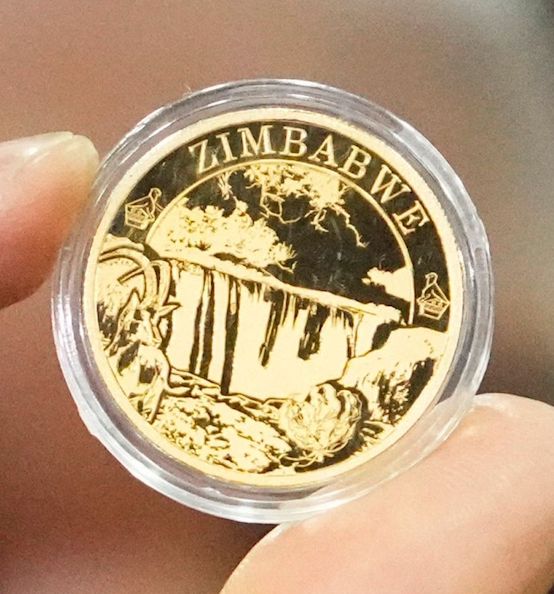

In an attempt to curb inflation last year, government leaders began to issue gold coins to try to earn the trust of investors with a store of value.

The latest announcement from the African nation says that the central bank will begin to issue a digital token that is backed by gold.

The gold-backed digital is an attempt by the country’s central bank to provide a trusted hedge against the volatility of its local currency.

The country’s central bank reports holding just 350 kg of gold bars among its reserves and estimates that it will need $100 million dollars to support the digital gold token.

Royalties from the mining industry exceed $300 million dollars per year.