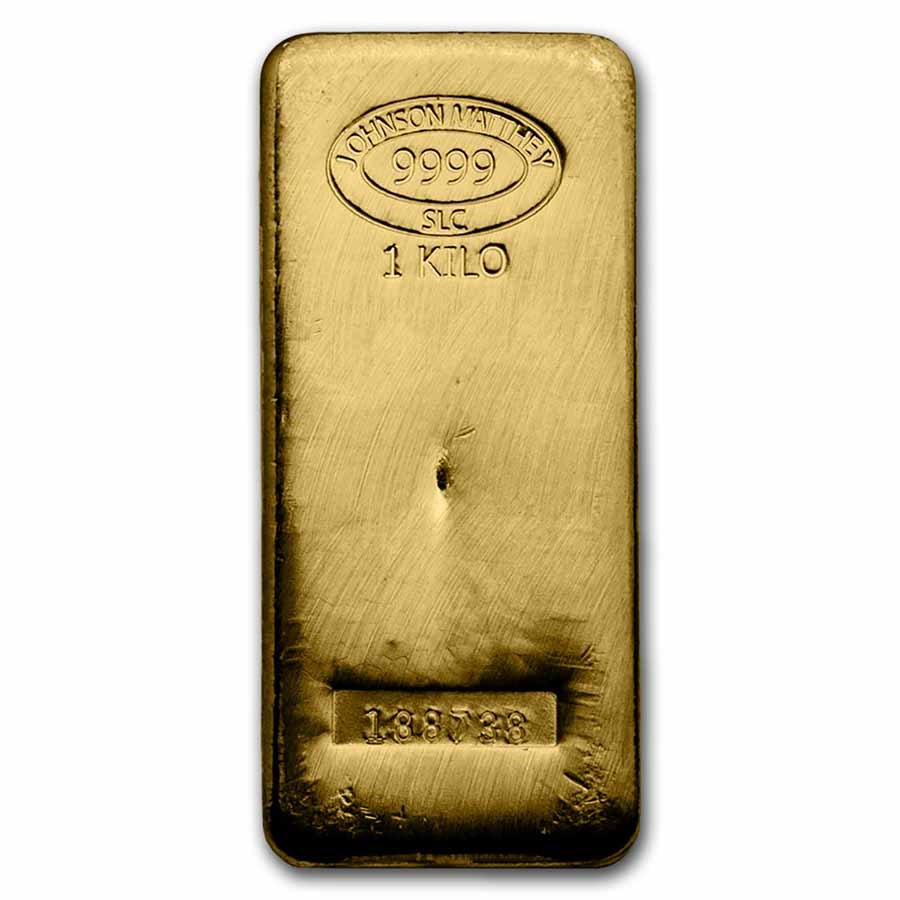

During the last year, the Reserve Bank of India upped its gold holdings from 794.63 to 822.10 tons.

According to the central bank’s fiscal year 2024 annual report, over 308 metric tonnes is currently held inside the country to provide backing for circulating currency. This shipment of 100.28 tonnes in gold bars will be held locally as an asset of the banking department.

Economist and a member of the Economic Advisory Council to the Prime Minister of India, Sanjeev Sanyal, said on Friday that India will now hold most of its gold in its vaults.

“One of the prime reasons for this is the decline in confidence in dollar assets among central banks. Even the US Treasury Department data suggest that the non-US central banks’ holdings of US Treasury bonds have dropped from 50.1 percent (of what?) in January 2023 to 47.2 percent as of January 2024,” the report said.

This brings India’s domestic gold holdings nearly equal to those held by foreign banks and trading partners. The last time that India experienced such a large shift in its gold holdings was in 1990-1991 when the country was forced to raise funds to avoid a potential sovereign debt default.

Although the loans were repaid, the gold remained vaulted in London for logistical reasons. Storing gold abroad provides potential returns by entering into swaps and other trading activities. Additionally, the central bank is a regular gold buyer and allocated storage in market locations is practical.

This move reflects the central bank’s broader strategy to diversify FX reserves and hedge against the ongoing inflation of the dollar and other currency volatility.

It’s being reported that current geopolitical tensions played a role in the bank’s decision to repatriate the gold, citing the freezing of Russian assets by Western nation raising concerns about the safety of assets help abroad.

Following the Russian invasion of the Ukraine in 2022, the US government imposed sanctions against Russia, freezing foreign reserves and prohibiting the country from trading in dollars. The sanctions were intended to disrupt the flow of Russian oil, since oil has been traded exclusively in dollars since 1973.

It’s widely reported across Asian news sources that China is rapidly reducing its holdings of US Treasury bonds while boosting its gold reserves. This follows the BRICS strategy, aiming to remove the dollars dominance in cross-border trade.

Sergey Ryabkov, the Deputy Foreign Minister of Russia, revealed in a recent interview that the dedollarization agenda would take center stage at the BRICS summit in October 2024.

“The notion of a multi-polar world holds the key to dedollarization, where BRICS countries will break free from their dependence on the US dollar,” he said.

The BRICS alliance is exploring strategies to create a new international reserve currency, potentially backed by gold to reduce reliance on the US dollar.

Five additional countries joined the BRICS alliance in 2024; Iran, Egypt, Saudi Arabia, United Arab Emirates and Ethiopia.

More than 40 countries have expressed interest in joining the alliance, which is pushing for cross-border transactions in local currencies, reducing the need for countries to hold significant US dollar reserves, either in the form of Treasury Bonds or hard currency.

In recent years, the original BRICS members, Brazil, Russia, India, China, and South Africa, have seen significant economic growth in recent years. China has become the primary trading partner for over 120 countries, with exports totaling over $3.6 trillion, causing the the decline in the US share of global GDP and shifting towards a multi-polar world.

The ongoing federal budget deficit and growing national debt have been citing by several countries who have moved forward with a dedollarization strategy to safeguard their economies.