While deals on Costco gold bars can sometimes be appealing, buying gold in smaller increments is often more affordable. Fractional bars are smaller than a full ounce of gold, making them more affordable.

Investors can preserve wealth in a tangible asset by converting cash from a low-rate savings account into fractional gold bars.

Many financial analysts, like JP Morgan, expect the price of gold to continue to rise over the next few years. Buying gold bars is buying a tangible asset that cannot be printed or manipulated by central banks.

Our Gold Bar Price Compare Chart tracks prices on various denominations across a wide assortment of online dealers to make it easy to find the best price.

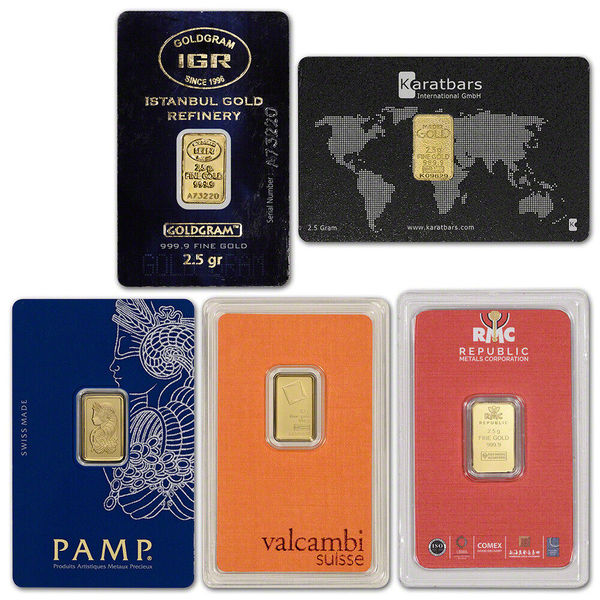

Fractional Gold Bars

Fractional gold bars are smaller bars that weigh less than the standard 1-ounce bar. They are available in weights of 1 gram, 2.5 grams, 5 grams, 10 grams, and 20 grams.

These gold bars provide an affordable entry point into investing for those who cannot purchase more significant quantities in one go.

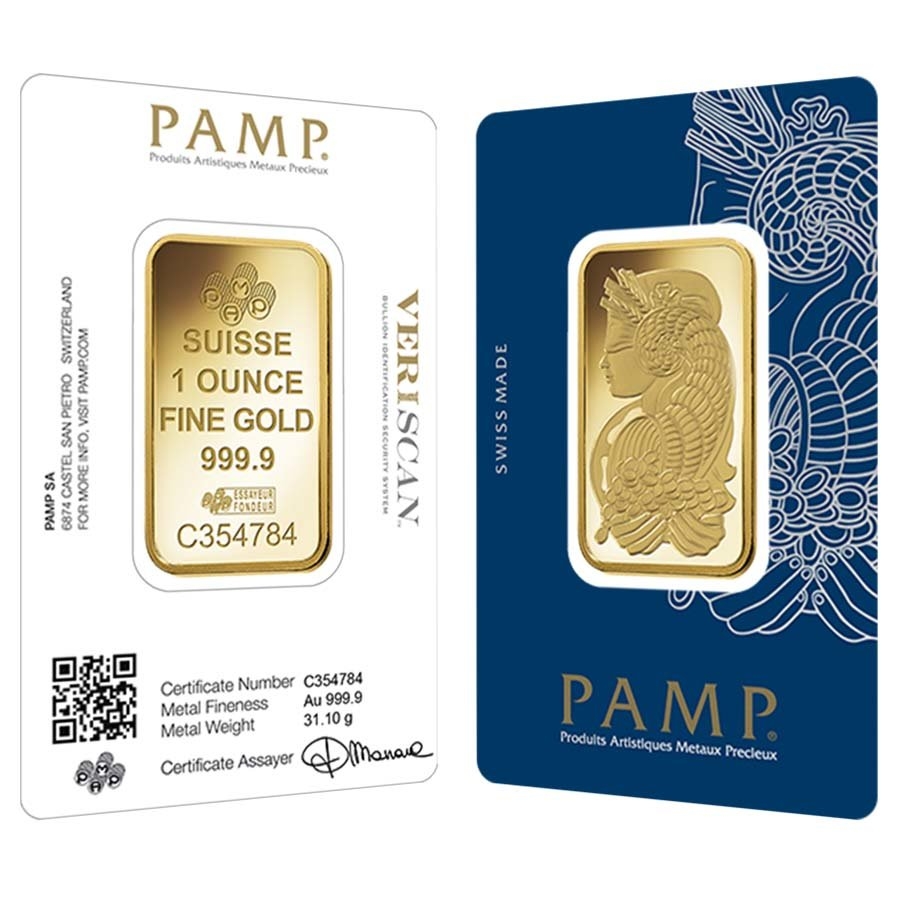

Many of the world’s leading refineries manufacture fractional gold bars, including PAMP Suisse, Valcambi, Credit Suisse, and the Perth Mint. Other less-known brands include Argor-Heraeus, Istanbul Gold Refining, and Asahi Refining.

All investment-grade gold bars are made from 24k gold refined to 99.99% purity.

Premiums Vs. Melt Value

Smaller bars, such as 1 gram or 2.5 grams, typically carry a premium ranging from 15% to 35% over the spot price of gold.

Midsize bars, like the 5-gram, have slightly lower premiums; 10% to 20% is typical.

Larger fractional bars, like the 10-gram or 20-gram sizes, have lower premiums and can be found for as low as 5% to 15%, as they are closer to the standard 1 oz gold bar.

The premium is generally higher due to the increased cost of production, packaging, and distribution per gram.

Newly Minted Gold Bar Prices

While fractional gold bars offer flexibility, their premiums are higher than larger ones. However, they are still favored by investors who want affordable, smaller increments of gold and liquidity for the future.

20 Gram Gold Bar Premium Chart

Each 20 Gram Gold Bar contains 0.643015 troy ounces of gold, roughly 2/3 of an ounce.

| Brand | Average Premiums over Spot |

| PAMP Suisse 20 g Bar | 3%-6% |

| Valcambi 20 g bar | 2.5%-5% |

| Argor Heraeus 20 g Kinebar | 3.5%-7% |

| Britannia 20 g bar | 3.5%-7% |

| Geiger Edelmetalle 20 g bar | 4%-5% |

| Valcambi 20 g Combibar | 9%-15% |

| Secondary Market 20 g bars | 1.5%-4% |

10 Gram Gold Bar Premium Chart

Each 10 Gram Gold Bar contains 0.321507 ounces, roughly 1/3 of a troy ounce.

| Brand | Average Premium over Spot |

| PAMP 10 g Lady Fortuna Bar | 5%-9% |

| Argor Heraeus 10 g Kinebar | 4.5%-8% |

| Britannia 10 g bar | 5%-9% |

| Perth Mint Kangaroo 10 g bar | 4%-8% |

| Secondary Market 10 g bar | 3%-7% |

| Valcambi 10 g bar | 4%-8% |

5 Gram Gold Bar Premium Chart

Each 5 gram gold bar contains 0.160754 ozt.

| Brand | Average Premium over Spot |

| Perth Mint 5 g bar | 5%-10% |

| PAMP 5 g bar | 7%-12% |

| Secondary Market 5 g bar | 4.5%-8% |

| Britannia 5 g bar | 8%-12% |

1 Gram Gold Bar Premium Chart

Each 1 gram gold bar contains 0.0321507 ounces.

| Brand | Average Premium over Spot |

| Valcambi 1 g bar | 17%-25% |

| PAMP 1 g bar | 18%-30% |

| Britannia 1 g bar | 25%-30% |

| Secondary Market 1 g bar | 15%-25% |

| Perth Mint 1 g bar | 20%-25% |

How to Buy the Cheapest Gold Bars

Secondary market gold bars are an often-overlooked treasure for savvy investors seeking the cheapest gold options. These bars are not fresh off the minting press; instead, they have been previously owned and circulated within the gold market.

Despite their pre-owned status, reputable dealers rigorously test each bar for authenticity, weight, and purity before offering them for resale. This meticulous verification process ensures that investors receive legitimate, high-quality gold at a reduced cost. B

ecause they bypass the initial fabrication and distribution expenses tied to newly minted bars, secondary market gold bars typically carry significantly lower premiums, making them an ideal choice for maximizing gold holdings without overpaying.

Additionally, many dealers sweeten the deal by offering extra discounts when investors choose specific payment methods. Options like ACH transfers and wire transfer payments often come with reduced processing fees, allowing buyers to save even more when purchasing gold.