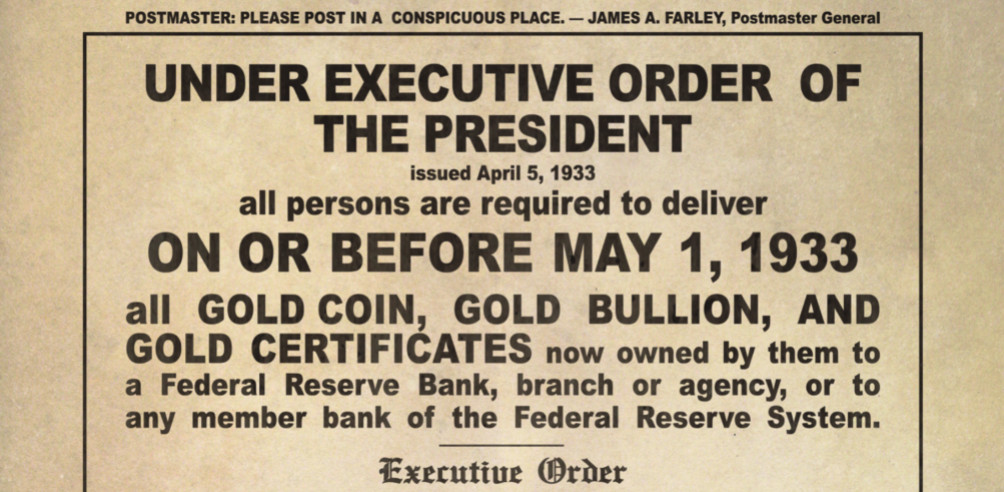

On April 5, 1933 President Franklin Roosevelt signed Executive Order 6102 which outlawed the private ownership of gold by citizens.

For a duration lasting 41 years in the mid-20th century, the government made it a crime for the people to own, hold or transact in sound money.

Following the resignation of Nixon, one of the first laws signed by President Ford included a bill which reversed Roosevelt’s Executive Orders.

It has been legal for anyone to own, hoard, buy and sell gold in the United States since December 1, 1974.