MKS PAMP Group’s Expansion into North America

MKS PAMP Group’s decision to repurpose an aviation hangar in Florida for a silver mint reflects a strategic move to capitalize on robust investment demand in North America.

By enhancing its production capacity in the U.S., MKS PAMP Group is positioning itself to better serve the North American market.

Production Capacity and Product Offerings

The new Florida facility can produce over 20 million troy ounces of silver products annually, including 1-ounce silver rounds and 10-ounce bars. These privately minted, coin-shaped pieces of silver cater to both investment and industrial demands. The ability to produce such a significant quantity of silver products positions MKS PAMP Group to meet the ongoing demand in the U.S. and potentially the Middle East, where their products have also performed well.

Global Silver Market Trends

Investment Demand Shifts

The global investment market for silver bars and coins experienced notable shifts in 2023, with significant declines in Germany and India. The slump in these major markets can be attributed to policy changes and market dynamics:

- Germany: Sales collapsed by 73% in 2023 following an increase in the Value Added Tax (VAT) on some silver products.

- India: Recorded a 38% decrease in demand due to various economic factors.

Despite these declines, the U.S. market remained relatively resilient, with only a 13% decrease in demand. This resilience is crucial for mints and refiners seeking stable outlets for their products.

Price Movements

Spot silver prices have risen by 27% in 2024, reaching an 11-year high on May 20. This increase is part of a broader rally in precious metals, including gold and copper. While global physical investment in silver bars and coins is expected to fall further after a 28% slump in 2023, the U.S. market continues to provide a significant outlet for investment products.

Strategic Implications

Strengthening Market Presence

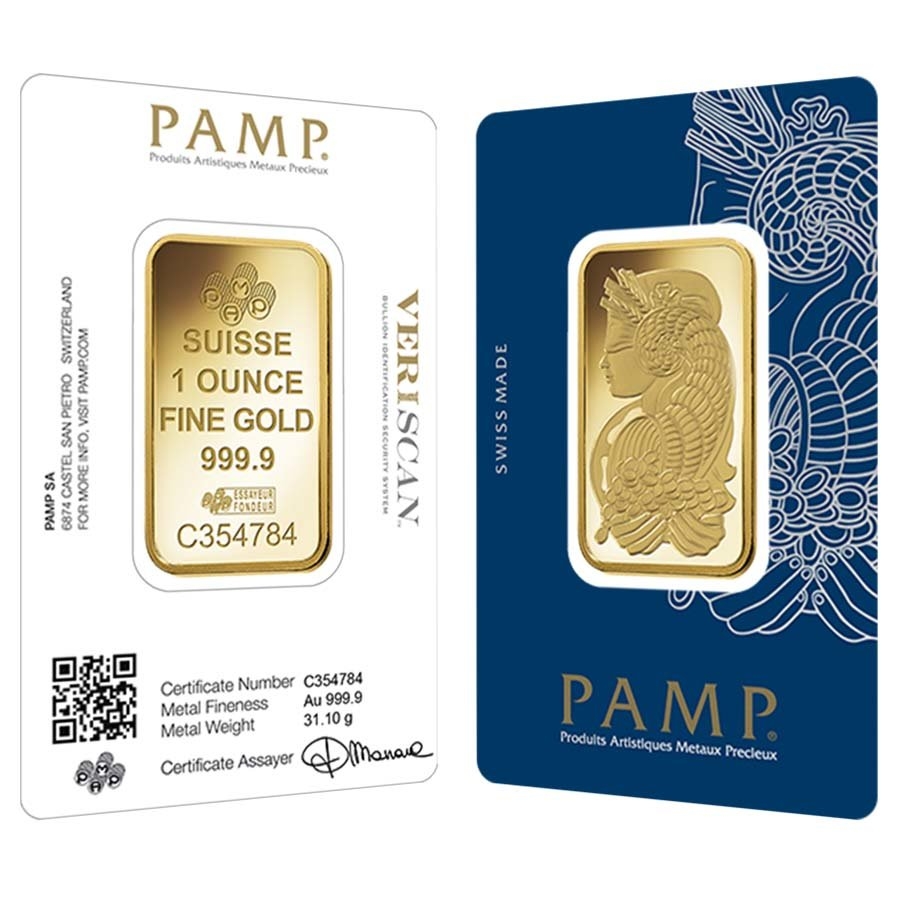

By expanding its production capabilities in Florida, MKS PAMP Group is strengthening its market presence in a key region. This move allows the company to better serve North American investors who have shown sustained interest in PAMP Suisse silver products. Additionally, the ability to produce large quantities of silver rounds and bars enhances the group’s ability to meet both current and future demand.

Adapting to Market Conditions

The shift in global investment demand highlights the importance of adapting to market conditions. MKS PAMP Group’s expansion into Florida demonstrates a proactive approach to addressing changes in regional demand patterns. By focusing on the U.S. market, which remains historically high in terms of silver investment demand, the group can mitigate the impacts of declines in other markets.

Conclusion

MKS PAMP Group’s expansion into Florida reflects a strategic response to the evolving dynamics of the global silver market. By increasing production capacity in North America, the group is well-positioned to capitalize on strong investment demand in the U.S. and other resilient markets. This move not only strengthens their market presence but also ensures they can continue to provide investment-grade silver products to investors amid shifting global trends.