Johnson Matthey (often “JM”) silver bars sit at the top of the vintage bullion hierarchy alongside Engelhard. Although both brands ended large-scale consumer silver bar production years ago, collector demand has only intensified, especially for earlier poured pieces and scarcer varieties.

Johnson Matthey bars tend to sell for more than generic bullion because of brand reputation, discontinued production, verifiable serials/varieties, and strong collector demand for specific weights, eras, and hallmarks.

Why Are Johnson Matthey Silver Bars More Expensive?

- Brand reputation & trust.

Founded in London in the early 1800s, Johnson Matthey built a global name in assaying, refining, and industrial precious-metals chemistry (including catalytic converters). That trust premium carries into the secondary market. - Discontinued production (scarcity).

General-issue JM consumer bars are no longer made; supply is fixed. Collectors compete for desirable weights (10 oz, 100 oz) and old poured styles, pushing prices above spot and above generic rounds/bars. - Collectible varieties.

Distinct hallmarks, mint locations (U.K., U.S., Canada, Australia), serial ranges, and finishes (poured/loaf vs extruded/pressed) create identifiable sub-series that enthusiasts actively chase, well documented by specialist communities (e.g., AllEngelhard). - Liquidity & recognition.

“JM” inside a rectangle with crossed hammers and “ASSAYERS & REFINERS” is instantly recognizable. This reduces friction when selling and sustains a brand premium. - Aesthetics and condition.

Natural poured surfaces, cooling lines, and original patina are prized. Clean stamps, legible serials, and intact edges often command stronger pricing.

Result: On any given day, a JM 10 oz silver bar may carry a meaningful premium per ounce to a modern, no-name 10 oz bar. While certain rare JM varieties can trade at multiples of melt.

Johnson Matthey: A Brief History (for bullion buyers)

- Origins & scope. Established in London ~1817, Johnson Matthey became a global refiner, assayer, and industrial chemistry firm.

- Bullion era. JM issued a wide range of silver bars (and gold bars) for commercial users and retail investors across multiple facilities (U.K., U.S., Canada, Australia) and serialized production runs.

- Industrial pivot. Over time, the company focused on industrial PM applications and divested parts of the bullion business. That transition effectively froze the retail bar supply, which fuels today’s vintage premiums.

Johnson Matthey Silver Bars: What Exists?

Common weights: 1 oz, 5 oz, 10 oz, kilo, and 100 oz. Others exist, including 1/2 kilo, 20 oz and 25 oz, but are scarcer in retail channels.

Finishes & formats:

- Poured / loaf bars: Irregular edges, swirl/cooling lines, deep-set hallmarks; favored by collectors.

- Extruded/pressed bars: Uniform dimensions, flat faces, crisp machine stamps; strong liquidity even if less “romantic.”

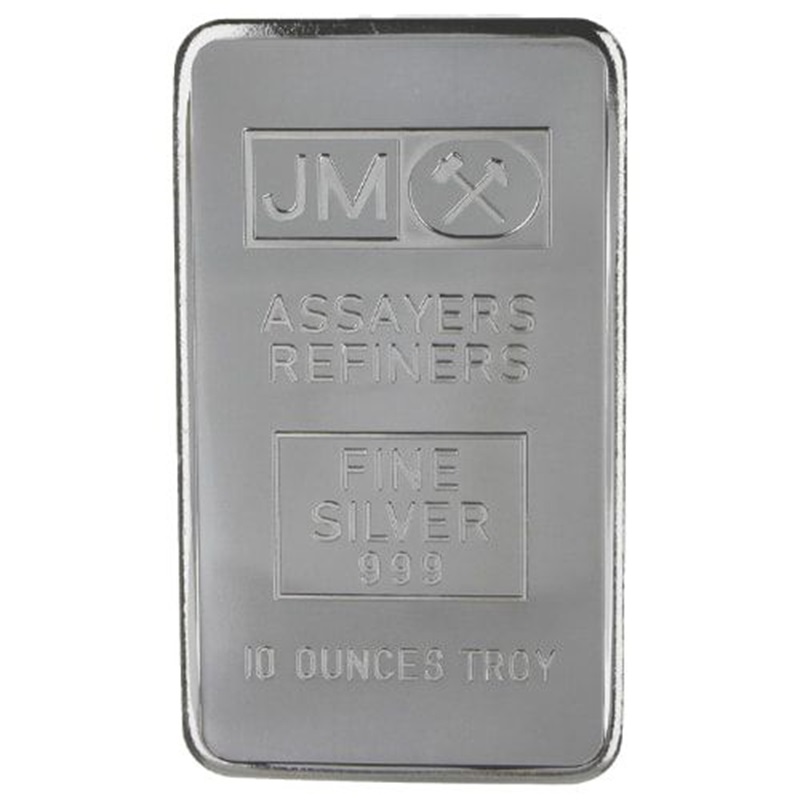

Typical hallmarks & content lines:

- “JM” in a rectangle with crossed hammers

- “Assayers & Refiners”

- “999+ Fine Silver / 999 Fine Silver / .999 Fine”

- Weight (e.g., 10 OUNCES TROY)

- Serial number (varies by run/era)

Regional tells (examples):

- U.K. / London issues (earlier poured styles, some of the most coveted)

- U.S. issues with “JM” hallmark and numeric serials

- Canada (Johnson Matthey Ltd. / JML) varieties

- Australia (JMA) pieces—often tougher to source in North America

Note: Exact die fonts, serial formats, and placement vary by period and plant; specialists consult visual guides and serial lists before bidding.

Johnson Matthey vs. Engelhard (and other vintage refiners)

Engelhard sits shoulder-to-shoulder with JM for collector recognition. Both brands share:

- Global refinery pedigree,

- Discontinued consumer bar production,

- Distinct, study-worthy varieties with documented serials,

- Strong liquidity across 10 oz, 1 kilo, and 100 oz sizes.

How they differ in the market (typical trends):

- Variety depth. Both have deep variety trees; Engelhard’s 10 oz and 100 oz landscapes are famously granular, JM’s are similarly rich, just cataloged a bit differently.

- Premium patterns. In some cycles Engelhard 10 oz trades a touch higher; in others JM does, often depending on which scarce sub-varieties are “hot.”

- Other legacy names worth knowing: Handy & Harman, Degussa, Credit Suisse/UBS vintage, Perth Mint poured, Hoffman and Hoffman, and regionals cataloged by AllEngelhard and peer sites. Many carry premium tiers when early/poured/serialized.

Price Drivers: What Makes One JM Bar Worth More Than Another?

- Poured vs pressed: Poured often brings a higher premium than extruded/pressed of the same weight.

- Era & plant: Early London or limited Australia/Canada runs can carry scarcity premium.

- Serial ranges & stamps: Short runs, unusual serial prefixes, double-stamps, or seldom-seen die fonts can attract specialists.

- Condition: Original patina, clear stamps, undamaged corners, no filing or evidence of prior destructive testing.

- Weight class: 10 oz is the sweet spot for many collectors (display, stackability, budget); 100 oz bars are efficient on premium but can be clunkier to trade; gemmy 1 oz/5 oz pieces can be sleeper collectibles.

- Provenance: Documentation from a major dealer or a known collection can help value and confidence.

Counterfeit Risks

Vintage bars are heavily counterfeited. Use layered verification:

- Dimensions & mass. Check weight to the tenth of a gram and compare measurements to known specs for the exact variety.

- Visual diagnostics. Compare stamps, font shapes, hallmark spacing, logo details (e.g., the crossed hammers), and serial style to documented examples.

- Metal tests.

- Magnet test (should not be magnetic).

- Ultrasonic or XRF at a trusted LCS/refiner for non-destructive confirmation.

- Specific gravity test as a secondary screen.

- Market venue & paperwork. Favor reputable dealers, marketplace sellers with deep vintage history, and clear return policies. Keep invoices and, when available, refinery or dealer COAs.

- Destructive testing: Avoid (drill/saw) unless handled by a refiner you trust; it harms value.

Rare & Collectible Johnson Matthey Silver Bars (What to Watch For)

While exact rarity lists are best sourced from specialist references, collectors commonly chase:

- Early London poured bars with bold, centered hallmarks and low serials.

- Australian (JMA) poured 10 oz/20 oz/50 oz/100 oz pieces with distinctive fonts (scarce in the U.S.).

- Canadian JM Ltd. variants with particular serial formats and stamp placements.

- Transitional dies or layout anomalies (off-center stamps, faint secondary strikes).

- Small-run corporate/contract hallmarks attributed to JM refinery output.

These pieces often sell at significant premiums over typical JM bars, and realized prices can surprise even seasoned stackers during hot markets.

Buying Guide: Practical Tips

- Decide your goal.

- Collector path: target poured/serialized varieties, learn die/serial diagnostics, and expect higher premiums.

- Stacker path: choose common 10 oz/100 oz JM for brand liquidity with modest premiums vs rare varieties.

- Price sanity checks. Compare per-ounce cost vs generic bars and vs similar-era Engelhard. If paying a variety premium, confirm that the variety is recognized and documented.

- Documentation. Save seller photos, serials, and invoices—critical for future resale and authenticity comfort.

- Storage. Avoid PVC; use inert capsules or sleeves. Many collectors prefer to leave natural toning intact.

- Exit strategy. Vintage premiums are collector demand–driven; understand that premiums can compress in weak markets and expand in hot ones.

Precious-metals prices and collectible premiums can rise or fall. Consider time horizon, liquidity needs, and total costs (shipping, sales tax, assay/grading) before purchasing.

Why are Johnson Matthey Silver Bars More Expensive than Generics?

| Feature | Johnson Matthey 10 oz | Engelhard 10 oz | Modern Generic 10 oz |

|---|---|---|---|

| Recognition | ★★★★★ | ★★★★★ | ★★–★★★ |

| Typical premium/oz* | High (vintage premium) | High (often similar) | Low |

| Variety depth | Extensive (poured + pressed, multiple mints/eras) | Extensive | Minimal |

| Liquidity with collectors | Excellent | Excellent | Broad with stackers |

| Counterfeit risk | Higher (popular target) | Higher | Moderate |

| Collectible upside | Significant for key varieties | Significant | Limited |

*Premiums change with spot price, market tone, and availability.

FAQs

Are Johnson Matthey silver bars a good investment?

They are high-recognition bullion with strong collector demand, which can add premium above melt. That premium can increase or compress with market cycles. If you value brand liquidity and vintage appeal, JM is compelling; if your goal is the lowest cost per ounce, modern generics may suit better.

What’s the most popular Johnson Matthey bar size?

For collectors, 10 oz poured or early pressed JM bars are the most actively traded. For stackers seeking efficiency, 100 oz JM bars offer lower premium per ounce (but can be heavier to sell in one shot).

How do I authenticate a Johnson Matthey bar?

Confirm weight/dimensions, compare hallmarks and serials to reference photos, use magnet + ultrasonic/XRF, and buy from reputable venues. When in doubt, consult a refiner or experienced dealer.

Do Engelhard or Johnson Matthey bars sell for more?

It depends on specific variety and condition. In some cycles Engelhard outruns JM; in others, JM poured bars lead. Both brands command premiums above generic bullion.

.jpg)