In a significant shift in global financial dynamics, the Federal Reserve has acknowledged that the BRICS countries—Brazil, Russia, India, China, and South Africa—are progressively distancing themselves from the U.S. dollar as a reserve currency. This move is part of a broader strategy where countries are opting to transact with local currencies, signaling a potential reduction in the dollar’s dominance in international trade.

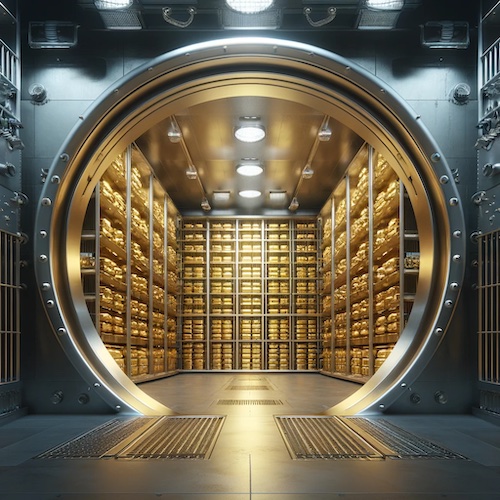

Central banks across the Global South have been quietly bolstering their gold reserves in recent years, while the US Treasury Bond market has been in a state of flux.

China plays a major role and has been consistently purchasing gold for 18 consecutive months. Since the start of the year they have sold a staggering $53.3 billion worth of U.S. Treasury Bonds.

Other BRICS countries are also following suit in enhancing their gold reserves. Russia, for instance, maintains official gold reserves of 2332.74 tons as of the end of 2023. The country’s significant gold production capabilities, coupled with the massive Sukhoi Log gold deposit—one of the world’s largest, estimated at 40 million troy ounces of gold—underscores Russia’s potential to further increase its gold reserves.

India has taken a step towards reclaiming its gold reserves by repatriating a portion of its gold from London, indicating a strategic move towards self-reliance and control over its financial assets.

South Africa, despite holding only 125 tons of gold reserves, possesses vast untapped gold deposits that could be utilized in the future.

Brazil, with 129.65 tons of gold in its reserves, has taken a proactive stance in this financial evolution. The country has recently announced a new trade agreement with China, which allows for transactions to be settled in their local currencies, the real and the yuan. This bilateral agreement is a significant step towards reducing the dollar’s role in international trade and enhancing the use of local currencies.

Saudi Arabia has expressed strong interest in joining the BRICS alliance. Rumors are circulating on social media suggesting that Saudi Arabia may have already officially joined the BRICS treaty, although official confirmation is yet to be made.

This potential addition to the BRICS alliance could have profound implications for the global financial landscape, particularly for the petrodollar system established in 1974 between the United States and Saudi Arabia. This system, which mandates that oil transactions be conducted in U.S. dollars, has been a cornerstone of the dollar’s dominance.

Saudi Arabia and China signed a local currency swap agreement last year which allows for the trading of oil in the yuan instead of the dollar. Additional, Saudi Arabia has joined a cross-border CBDC project sponsored by the Bank of International Settlements (BIS), which began in 2021 and has reached the level of a minimally viable product. The project already includes China, Hong Kong, Thailand and the UAE.

Turkey, another country mentioned in the Federal Reserve’s report, has been actively buying gold, becoming the largest buyer in several months during recent years. This trend reflects Turkey’s efforts to diversify its financial reserves and reduce its dependence on the dollar.

This shift by the BRICS countries and other nations towards local currency transactions and gold as a reserve asset represents a significant challenge to the U.S. dollar’s global supremacy. It suggests a move towards a multipolar financial system where various currencies and assets play a more significant role in international trade and the global economy.

China’s Belt & Road Initiative (BRI)

China’s actions appear to support the ongoing Belt and Road Initiative (BRI), a global strategy launched by the Chinese government in 2013 aiming to provide capital to developing countries for modernization and infrastructure.

In exchange, China gets preferred access to the country’s resources, including precious metals, minerals along with cheap labor. While simultaneously dumping excess industrial capacity of inferior products into developing markets.

China operates many strategic mining operations throughout Africa, some of which have been reported as using slave labor to harvest cobalt under harsh conditions.

In South America, China owns two of the five largest copper mines in Peru – the Las Bambas Project and the Toromocho Project. Other large scale investments include the a MegaPort in the Peruvian town of Chancay, while building a $50 billion dollar train line through the Andes and Amazon to connect ports in Peru to Rio de Janeiro. The train line is expected to cut through the Amazon Rainforest, which is already being utilized to exploit minerals and other resources from the Amazon.

The newly established Bank of BRICS is headquartered in Brazil, where China has already invested more than $71 billion in infrastructure. China and Brazil have already established a local currency trade agreement, with trade in the yuan ramping up, while China is pushing the digital yuan, the CBDC project and other cross-border payment systems.

In Argentina, Chinese firms own or have large partnership stakes in 6 of 16 active lithium mining projects. Argentina has also received funds for almost a dozen infrastructure projects ranging from railways and dams to solar power and nuclear power plants.

Bretton Woods Accord

The U.S. dollar became the world’s reserve currency in 1944, following the Bretton Woods Conference, where delegates from 44 countries agreed to the creation of the International Monetary Fund (IMF) and the World Bank. This agreement established the U.S. dollar as the primary reserve currency, backed by the world’s largest gold reserves at the time. This decision was made to provide stability and prevent currency wars, and it propelled the U.S. dollar to its current position as the world’s leading reserve currency.

Collapse of Bretton Woods

By the late 1960s, the U.S. was facing a growing deficit due to its spending on the Vietnam War and social programs, which led to a decline in the value of the dollar. The U.S. was simultaneously experiencing inflation, further weakening the dollar.

In 1968, the U.S. stopped converting dollars into gold, which was a key part of the Bretton Woods system. This decision was made because the U.S. was running out of gold reserves to back the dollar.

In 1971, President Richard Nixon announced that the U.S. would no longer convert dollars into gold at a fixed rate, effectively ending the Bretton Woods system. Known as the Nixon Shock, this decision had ripple effects that changed the face of world trade, leading the country into a long, deep recession with high unemployment.

The Nixon Shock marked a turning point in the global monetary system, signaling the end of the post-World War II era of fixed exchange rates and the beginning of a more flexible and dynamic system.

Petrodollar Era

The Petrodollar agreement helped stabilize the U.S. economy by ensuring that oil-producing countries would continue to use U.S. dollars for their oil transactions. This created a consistent demand for U.S. dollars, which helped maintain the dollar’s value and the U.S. economy’s stability.

Henry Kissinger, the U.S. Secretary of State under President Richard Nixon, played a key role in negotiating the agreement with Saudi Arabia in 1973-1974. The high-level terms of the Petrodollar agreement were that Saudi Arabia would price its oil exports in U.S. dollars and invest its surplus oil proceeds in U.S. Treasuries and other U.S. assets. In return, the U.S. would provide military aid and equipment to Saudi Arabia.

Today, the agreement’s effectiveness is being challenged by various factors, including the weaponization of the dollar with sanctions against Russia, the emergence of a BRICS currency and the increasing role of renewable energy sources.