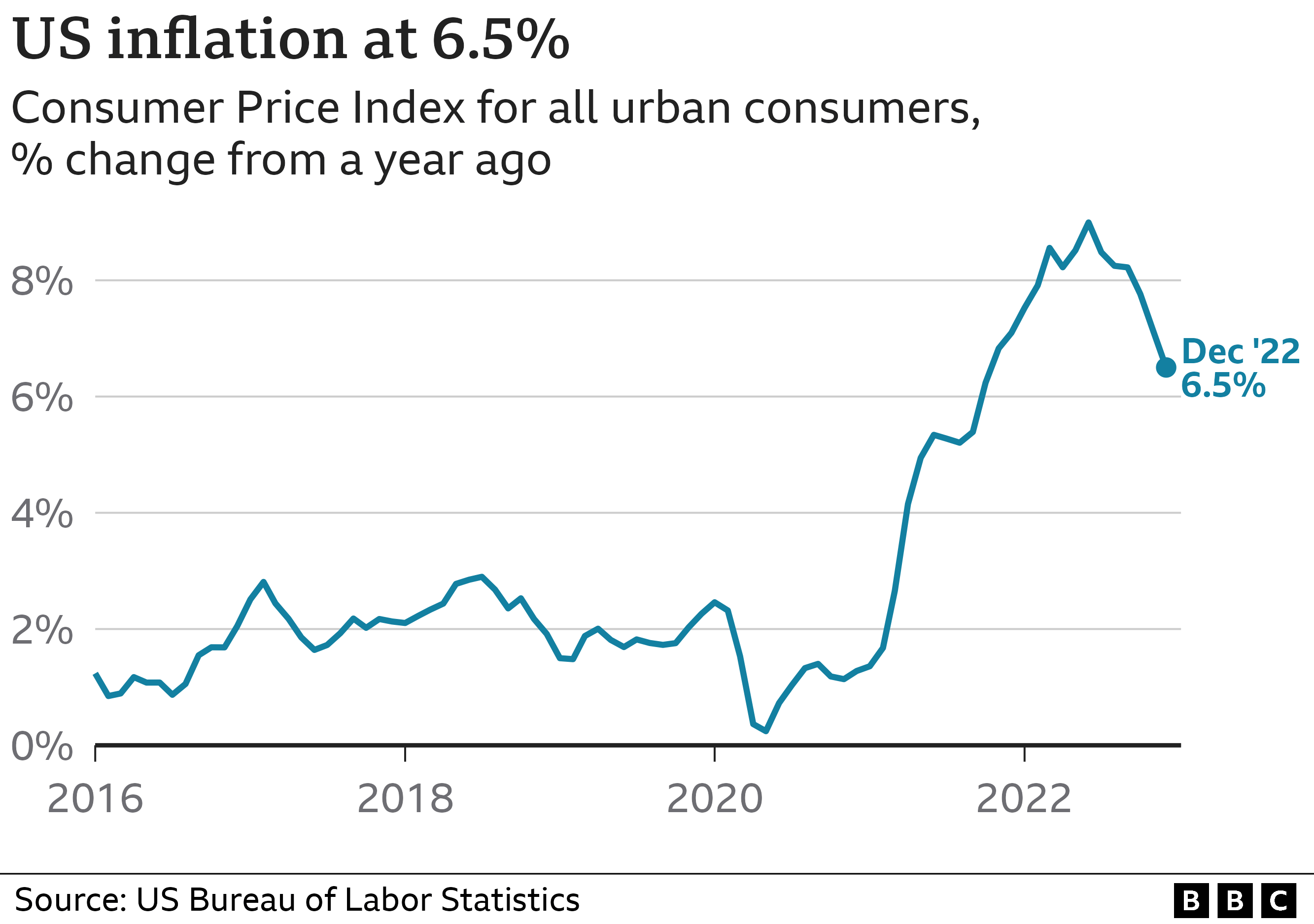

The December 2022 CPI numbers were released by the Labor Department this morning.

The latest report shows that the rate of inflation slowed slightly in December, with the index showing that overall prices increased roughly 6.5%.

The largest gains in prices were the basics of housing, food, gas and utilities.

Grocery prices continue to skyrocket with the December food numbers showing an overall increase in prices of 11.8%.

While the CPI report confirms what many analysts had expected, others are skeptical that the underlying data may not be completely accurate.

Gold futures prices today rose above $1,900 before the news.

Egg prices continue to soar. The price of a dozen eggs is up by more than 64% with California leading the list with an average of $6.72 per carton.

We have also seen the premiums for silver bars and rounds dropping significantly.

Layoffs continue to hit Wall Street Banks and hedge funds. Goldman Sachs announced that they will be cutting 3,200 jobs, citing a downturn in investment and bleak economic outlook for the year.

Leading hedgefund Blackrock Advisors is cutting 500 positions with the markets facing a recession.

The tech industry lost over 150,000 jobs in 2022. This year has begun with more layoffs announced by Amazon and Salesforce, with up to 18,000 more workers facing unemployment.

Central banks are buying gold at the fastest pace in over 55 years. China’s central bank has continued its gold buying spree into December.

After record breaking sales in 2021, the US Mint face supply chain issues early in 2022.

In March 2022, the Mint announced that they would be cancelling the commemorative $1 Morgan and $1 Peace silver dollar coins. The release was anticipating by collectors and investors.

According to sales and mintage data for American Silver Eagle coins, year-over-year, the 2022 mintage was the lowest since 2019 with only 15,963,500 coins.

By comparison, more than 25 million Type 1 silver eagle coins were sold in 2021, along with almost 3 million of the Type 2.

While demand remained strong throughout the year, the US Mint struggled to keep up with order demand driving premiums to record highs.

This led to new sales records for some sovereign government mints.

The Perth Mint announced record breaking sales for 2022. Reports from the mint show that more than 23 million ounces of silver were sold, along with 1.14 million ounces of gold.

Some experts in the industry say is a better gauge of global bullion demand.

The Perth Mint produces a variety of native animal themed bullion investment coins.

The flagship is the Australia Red Kangaroo 1 oz Silver coin is typically at a much lower premium than the ASE.