Gold investors have taken notice of the great prices on select coins and bars at Costco, and the warehouse club has responded by increasing the frequency of their offerings.

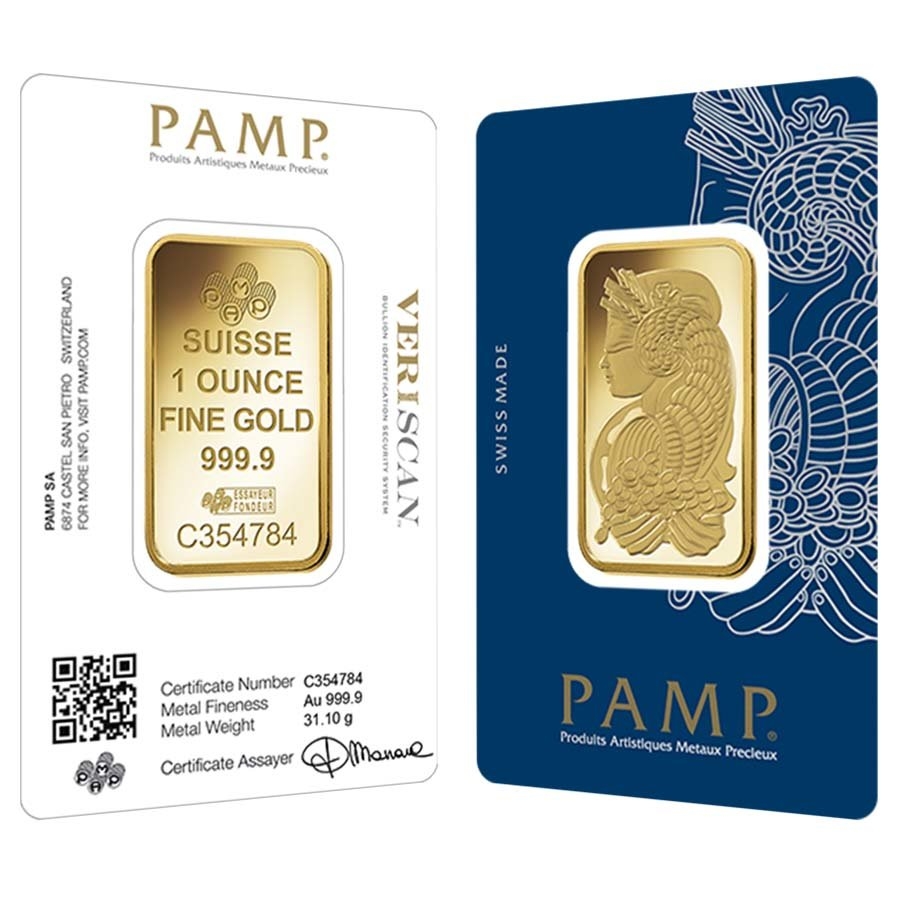

Costco sells only a handful of gold and silver coins from US Mint and Royal Canadian Mint, while limiting the selection of gold bars to PAMP Suisse and Rand Refinery.

These gold Bars from Costco are eligible for the warehouse club’s Executive Membership 2% annual reward, which provides a “cash-back” rebate on purchases that can later be used for additional club purchases. Additionally, the Costco Anywhere Visa Rewards Credit Card provides an additional 2% in cash back rewards, bringing the total combined “discount” to 4%. Some investors using other rewards credit cards have claimed cash-back rewards as high as 5%, which provides even greater flexibility.

In a recent listing, Costco had listed the PAMP Suisse 1 oz Gold Bar with a price of $2,389.99, while the daily spot gold price was trading at $2,322.90, a difference of $67.09, which is roughly a 3% premium over the melt value.

Taking into account the available rebates and discounts, the net purchase price is roughly $2294.39, which is roughly 1% below the melt value. By itself, this is a great deal for a 1 oz Gold Bar. However, when combining the additional rewards that may be available, it can bring the discount to 2% to 3% below the melt value.

The /r/CostcoPM subreddit tracks all of Costco’s product pages to notify investors when inventory is available as well as the price. Costco is now offering gold products more frequently, with some of the more popular bullion items being available daily.

What is Gold Flipping?

Gold flipping is the process of buying gold at a lower price and selling it at a higher price. It’s that simple. The challenge lies in timing your buys and sells correctly to maximize profits. The fluctuating price of gold can work to your advantage if you learn to read the market trends and make informed decisions.

Even though the price of gold has recently hit it’s all-time highest value. Many industry analysts and commodities traders believe that the gold price will climb much higher than it is today due to ongoing changes to the global economy.

In a recent report for Citi, precious metals analysts predict that the price of gold could reach easily reach $3,000 per ounce by 2025.

Factors Affecting Gold Prices

Several factors affect gold prices, and understanding these can help you time your trades better.

- Supply and Demand: Like any other commodity, the price of gold is largely influenced by its supply and demand. A higher demand and a lower supply will naturally drive the prices up. At the wholesale level, commodities markets like COMEX and SGE store large amounts of 400 oz gold bars in vaults in New York, London and Shanghai. These gold bars are sold in advance as part of futures contracts, with investors taking physical delivery at a later date.

- Economic Conditions: The state of the economy plays a significant role in gold prices. During economic downturns or times of uncertainty, investors flock to gold as a safe haven, driving the prices up. With high inflation and the highest mortgage rates in decades, many investors have been moving excess cash into gold to offset volatility in other assets.

- Inflation and Interest Rates: Gold is a tangible asset that is considered a hedge against inflation. When inflation rises, gold prices usually increase. Likewise, lower interest rates make gold more attractive as an investment, pushing up its price.

- Geopolitical Events: Any major geopolitical event, such as wars or political instability, can cause gold prices to spike as investors look for safe-haven assets. Ongoing dedollarization efforts by BRICS countries are also contributing to the price of gold, which is globally priced in dollars.

Flipping Costco Gold Bars

While they continue offering the same selection of products, the frequency of available inventory has increased, with many gold products available daily.

Both seasoned gold investors and curious newbies have discovered ways to flip Costco gold bars, turning this include a lucrative side-hustle among rising gold prices.

The gold bars sold by Costco are manufactured by PAMP Suisse and Rand Refinery. These bars are minted with 24k gold and are offered in limited supplies. These gold bars are sold in standardized weights, making them easy to trade.

When these products are available for sale on the Costco website, the pricing is very competitive compared to traditional precious metals dealers. The Costco gold bars are typically priced 1% to 2% lower than the competition. This low market price provides an opportunity that allows investors to leverage the buy/sell spread to squeeze profits from the sale.

How and Where to Sell Costco Gold Bars

Costco deviates from their traditional returns policy and has implemented a “no returns” policy with regard to gold bars. Investors looking to sell gold bars or coins that were bought from Costco will need to find another avenue for selling.

Gold bars are an asset that is easily tradable for cash in most cities and towns around the country. In most areas, the best place to sell gold is usually at local coin stores. Gold has been a form of money for thousands of years and prior to 1933, most Americans used $20 gold coins for both large transactions and as their personal savings. Local coin stores are experts and brokering physical precious metals trading.

Additionally, selling to an online precious metals dealer is an option, especially for those looking to liquidate a large collection. Online bullion dealers are regular buyers of complete portfolios for investors looking to maximize the value of their investment.

We Buy Gold Stores, Pawn Shops and other retail locations may offer convenience, but most will typically offer far below market value. It’s easy to call around and ask for price quotes over the phone when selling gold bullion bars, as these are generally bought and sold based on premiums above or below spot price.

Tips for Maximizing Profit

To make the most out of your gold flipping venture, here are some tips you can follow:

Timing is Everything

Gold prices fluctuate daily. As with any investment, target a low buying price and higher selling price while also keeping track of dollar-cost average.

While some online dealers like APMEX offer a portfolio tool that tracks purchases, many investors find that using a spreadsheet or Google Sheets to be the most effective tracking tool. This is one of the most frequently asked questions in the /r/Silverbugs subreddit. There are queries available that allow you to import the current spot price, which offers the ability to track the value of your investment in near real-time with the markets.

Build Relationships

Building relationships with local coin stores and gold dealers, pawn shops, “We Buy Gold” stores can give you a reliable selling channel and sometimes even better prices. Regular interactions can also lead to great deals when you’re looking to buy.

Store Your Gold Safely

While waiting to sell, ensure that your gold bars are stored safely. A home safe or a safety deposit box is a good investment to protect your assets. If consider a bank safe deposit box, be sure to understand that local banks typically have limited hours, which limits your access to your assets only during their operating hours. Also, many banks have begun to cancel safe deposit box services, leaving many customers’ valuable assets in jeopardy.

Understand Tax Implications

Profits from selling gold are subject to capital gains tax. Keep records of your purchases and sales, and consult a tax advisor to understand your obligations.