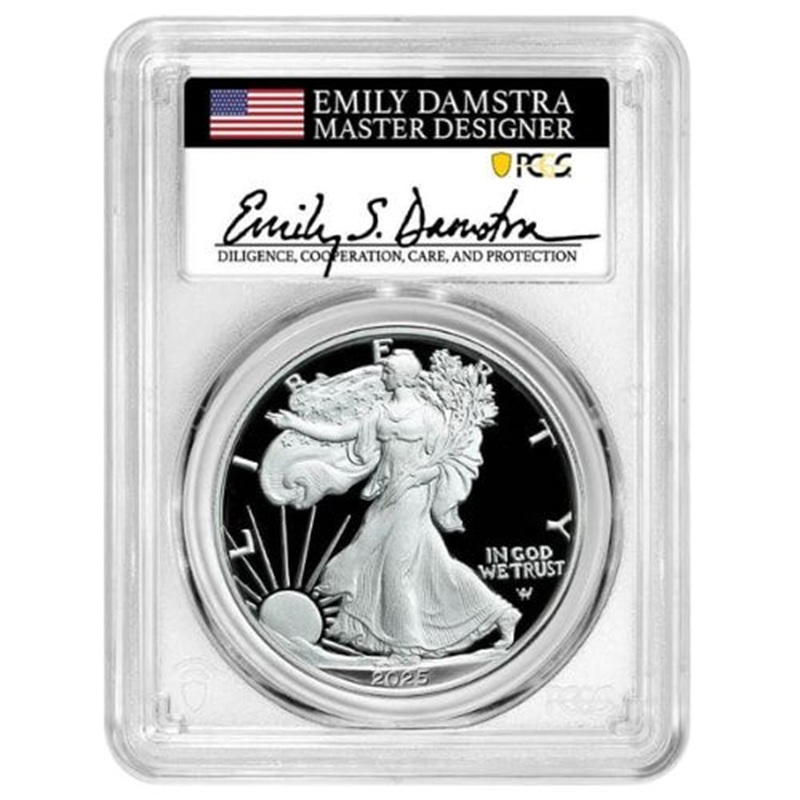

US Mint Disappoints Some Collectors with Silver Eagle Army Privy Cancellations

Discover the market excitement, collector reactions, and secondary market trends surrounding the release of the highly anticipated 2025 American Silver Eagle Proof coin, featuring a special privy mark celebrating the U.S. Army’s 250th Anniversary.