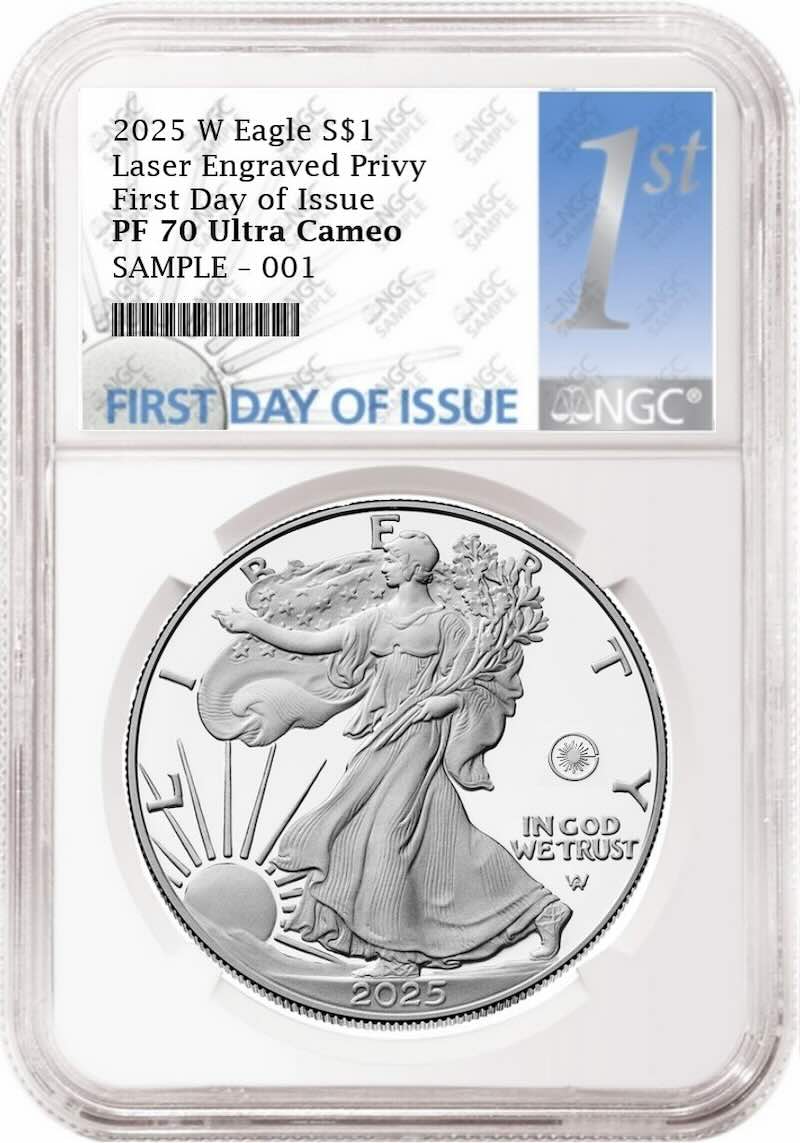

2026 Silver Bullion Coins: A Buyer’s Guide to the World’s Most Trusted Government Issues

These coins are minted specifically for investment, backed by sovereign mints, and traded globally with transparent pricing tied closely to the silver spot price.