When you’ve come to realize that making an investment in precious metals may be of interest to you it’s important to have additional knowledge of the industry before you spend money. Here are some important factors to consider before you buy gold or other precious metals.

Price transparency

The spot price of gold is controlled by global commodities markets and changes frequently based on market conditions. When buying gold online the dealer should provide an accurate price for the gold that you’re buying based on the current spot price, plus the dealer premium.

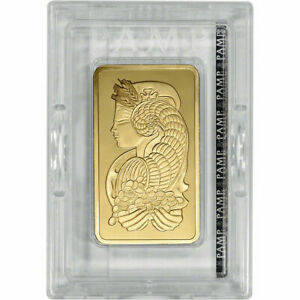

- Mint and weight: Gold dealers sell bars, coins and other forms of refined gold storage that is produced by a specific company or mint. Some Mints, such as PAMP Suisse, Valcambi, and the Royal Canadian Mint (RCM) are more reputable and widely recognized than others and may come with a higher premium.The weight of gold coin or bar is the largest contributing factor to the cost. In general, the greater the weight, the lower the premium you’ll pay over the spot price to the dealer.

- Additional fees: In addition to the base cost of the precious metals, online bullion dealers may charge a range of fees.The dealer premium is the base markup over spot price that you pay when you buy gold. Each dealer charges a different premium. This is an important factor to consider and comparing prices of the same product with different dealers can show a large difference in price. FindBullionPrices.com lists multiple dealers selling a particular product, along with the price that they charge and breaks down the price to show the fees.

Dealers may also include transaction fees based on payment methods. Typically, the lowest price will be for paying with a cash equivalent such as e-check, ACH or check. Buying gold with Credit Cards, PayPal, Bitcoin and other payment methods will incur a fee of around 4%.

Shipping charges can also be added. Some dealers include the cost of shipping for free with a minimum purchase amount. There are many dealers whose minimum purchase amounts are around $100 for free shipping. - Taxes: Some states require sales tax on gold and precious metals purchases. In some states there may be minimum purchase amounts that are exempt from sales tax. Since the Supreme Court ruled in favor of the States in South Dakota v. Wayfair, many online gold dealers have begun to charge customers taxes on bullion purchases. Some online dealers have found loopholes to avoid charging and collecting sales tax in those states.

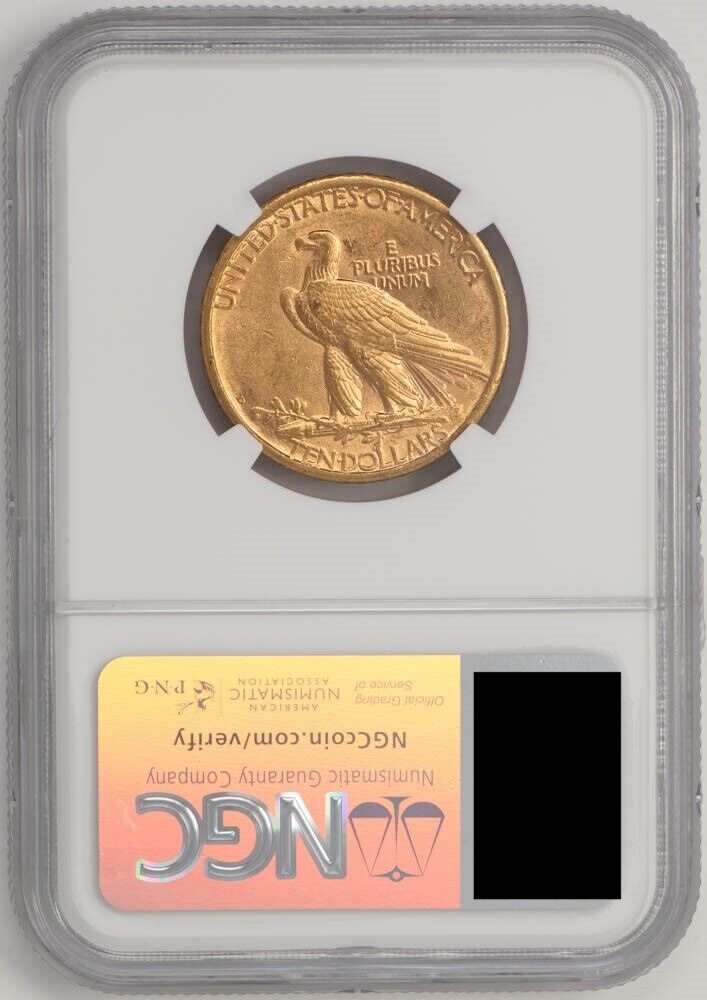

- Posted prices: Trusted and reputable online gold and silver dealers will have the price of each item prominently displayed on their website. The posted price, plus any transactional or shipping fees will be conspicuously and noticeably displayed on their website. When calling companies that do not display the price per ounce for gold or silver may try to sell you numismatic coins at a much higher premium. These bait and switch tactics are not used by trusted and reputable online bullion dealers.

- Management fees: You may choose to have the dealer store your gold after purchase, making them the custodian. Storing precious metals with a dealer will incur some ongoing management fee, similar to the fees charged at any brokerage for investment portfolios. The only way to avoid ongoing storage fees is to take physical possession of your precious metals. If you don’t have an adequate safe at home where you can store your precious metals you may want to consider storing your metals in a safe deposit box at your local bank. Taking possession of your precious metals at a later time can be time consuming. If you don’t hold it, you don’t own it.

Buying and selling

Precious metals are often used as a hedge for storing wealth in times of economic volatility or political uncertainty. The liquidity of gold and silver is important. Precious Metals dealers play an important role in the secondary gold and silver bullion market.

There are some things to consider when you are ready to sell or need to sell some of your gold investment.

Gold is typically held physically in bars or rounds ranging from as small as 1 gram to a kilo. When it comes to understanding how to buy gold, here are some things to keep in mind:

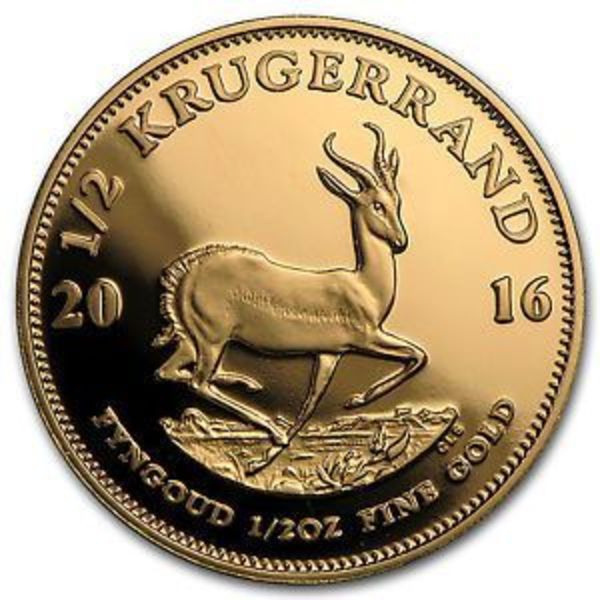

- Quality: The standard quality of gold (and silver) in fineness is .999. Gold and silver.Some gold coins, such as the American 1 oz Gold Eagle or South African 1 oz Gold Krugerrand are comprised of an alloy reducing the fineness of the gold to .900. This adds durability that allows the coin to be handled. However, the coin still contains 1 troy ounce of pure gold.Some other gold coins, such as the Canadian 1 oz Gold Maple Leaf or American 1 oz Gold Buffalo are minted with a fineness of .9999 making them softer and can be prone to scratches depending on how they are handled and stored.

- Transaction fees: Despite what some may say, it is not standard industry practice to charge customers a fee to sell their gold. When it comes time to sell your precious metals, any reputable dealer will make you an offer that is fairly based on the current spot price. The price will depend on the specific item that you are selling, the fineness and quality of the gold or silver, the mint or manufacturer and possibly several other market factors. Trusted and reputable dealers will typically offer between 90%-98% of the current spot price. There are some exceptions. Sovereign government coins, such as Gold American Eagle or Canadian Gold Maple Leaf coins can usually be sold at spot price or for a slight premium above spot price, depending on the dealer and market conditions.

- Direct sales: When selling gold, there are several options. A seller can typically sell their gold back to the dealer that they originally purchased from, but the dealer will often offer a lower price than the spot price and/or transaction fees.Online markets like eBay allow gold owners to sell directly to buyers, however, eBay auction fees and subsequent PayPal fees can quickly eat into the costs.

Storing precious metals

Misplacement or theft of your precious metals are real concerns. Gold can easily and quickly be turned into cash at any pawn shop, local coin shop or “We Buy Gold” store. Investing in a proper, TL rated safe that can be secured in some way to the foundation of your home may be necessary. Having an adequate security system is also important in deterring would-be thieves should you chose to store your precious metals at home.

Having a safe-deposit box at your local bank is also an option to consider. However, it’s important to note that the contents of safe-deposit boxes are not insured by the bank and are not covered by the FDIC.

Most home-owners insurance policy will not provide coverage for precious metals or numismatic coins without an additional policy rider.

Reputation

It’s important to find trusted and reputable gold dealers to do business with. Taking the steps necessary to ensure that you are working with a reputable gold dealer helps reduce the risks of encountering counterfeit bullion. You should have total confidence in the dealer when you are ready to buy gold.

- Transaction history: One of the simplest to determine if a dealer is trustworthy and reputable is to look at online customer reviews of bullion dealers. There are also many third-party companies that record customer transactions and customer satisfaction.