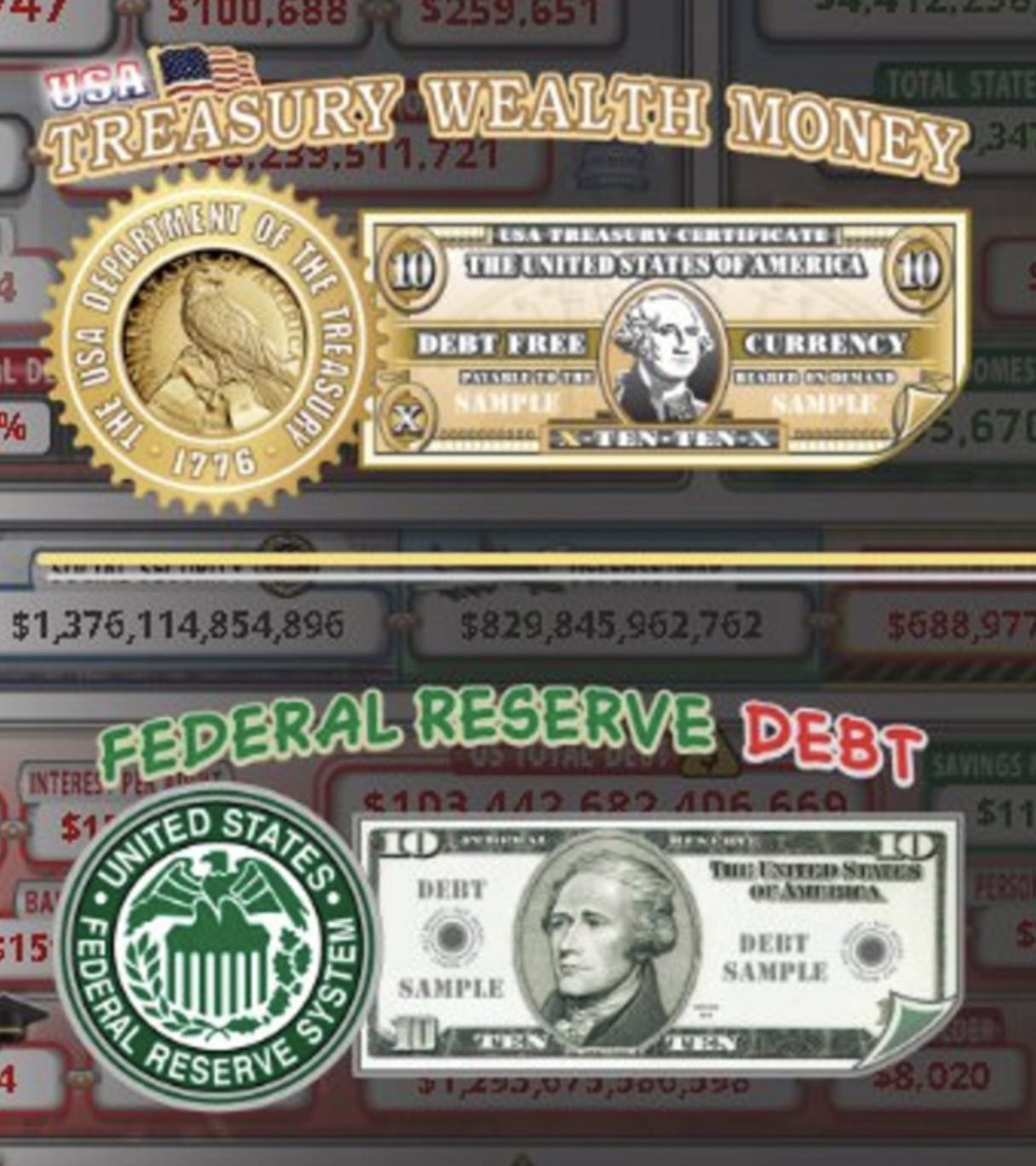

Earlier this year, the US Government hit a new milestone. The amount of government debt in the United States has grown to exceed $33.88 Trillion as a result of overspending by elected officials. The growing U.S. government debt is a complex issue with significant implications for American citizens and taxpayers.

This is a significant issue effecting all American taxpayers, whether they realize it or not.

A higher national debt leads to higher taxes in the future. As the government needs to bring in more revenue to service its debt. This leads directly to increasing taxes, pushing the financial burden on citizens and businesses.

A significant portion of the government’s budget goes towards interest payments on the debt. These payments consume resources that could otherwise be used for public services, infrastructure, education, or healthcare.

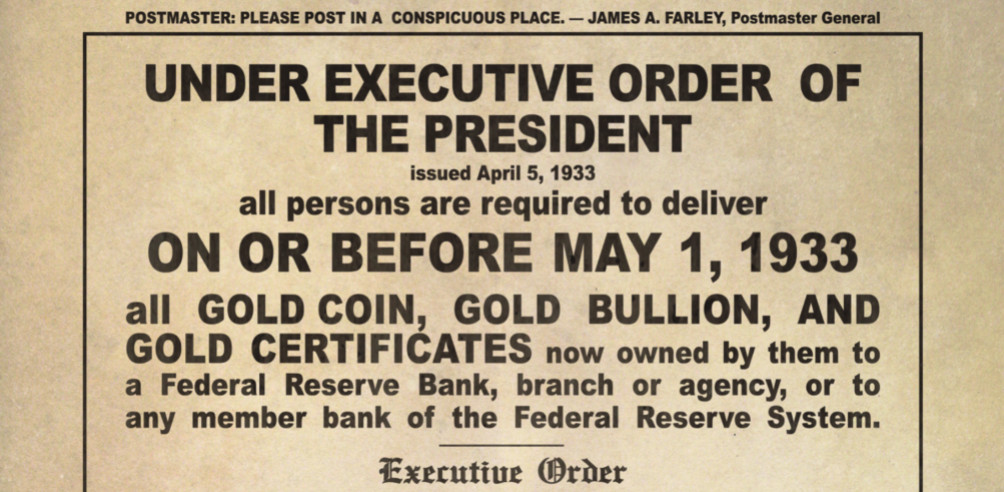

To manage high levels of debt, the government has resorted to printing more money in recent years, which has directly caused the inflation that we feel today. Inflation diminishes our purchasing power, causing dramatic increase in everyday living costs.

High debt levels also hamper economic growth. Increased government borrowing leads to higher interest rates, making it more expensive for consumers and businesses to borrow and invest, potentially slowing down economic activities.

As more of the government’s budget is allocated to servicing the debt, there is less money available for other spending priorities like social security, welfare programs, infrastructure, and education.

A heavily indebted nation finds its global economic and political influence quickly diminishing. This has been happening throughout the world, as many nations join the BRICS initiative, moving towards a universal gold-backed currency and away from the dollar for international trade and oil. The US is likely to face additional constraints for defense funding, compromising national security measures.

Escalating debt also affects investor confidence. Many already see the debt as unsustainable, which has led to increased yields on government bonds, further exacerbating the debt problem.

Despite all the efforts to stimulate the economy during the last few years, the financial stability of the country has been on a downward trajectory, according to leading economists. High debt levels make the country more vulnerable to financial crises and recession. The Federal Reserve continues the struggle to reach the goal of sub-2% inflation target, while repeatedly raising interested rates to levels not seen in decades. The government’s ability to stimulate the economy through additional spending is limited if it’s already heavily indebted.

Younger generations today are already limited in their ability to buy a house, caused by a combination of the housing bubble and high interest rates. Future generations will shoulder the additional burden with the responsibility of paying off the debt incurred today.

A significant portion of U.S. debt is held by foreign entities. This dependence creates complex international dynamics and potential vulnerabilities, particularly as geopolitical relationships shift.