The Reserve Bank of Zimbabwe (RBZ) announced that it will begin selling gold coins this month as a store of value to tame runaway inflation, which has considerably weakened the local currency.

The announcement comes after the country’s banking regulators raised a key interest rate to 200%, the highest in the world.

Inflation in the country has been rising at such a high pace that the Monetary Policy Committee (MPC) “resolved to introduce gold coins into the market as an instrument that will enable investors to store value.”

Fidelity Gold Refineries (Private) Limited, which is owned by the central bank, operates as the only gold-buying and refining entity in the southern African country.

US dollars are in high demand in the struggling country which recently saw the central bank involved in negotiations with bakers and other food producers to reduce the cost of basic items like bread.

The central bank’s monetary policy committee’s announcement comes at a time of “great concern on the recent rise in inflation”, which increased by 30.7% on a month-on-month basis for June 2022.

The availability of gold coins will likely ease pressure on the US dollar in the country. After all, gold is a better long-term store of value than another fiat currency. It has no counter-party risk and it cannot be created out of thin air by central banks.

The economy in Zimbabwe continues to toil with as the crisis is characterized a rapidly devaluing currency, 90 percent unemployment, declining manufacturing output and by sky-rocketing inflation.

In order for the gold coins to be effective, government officials are encouraging those seeking to buy the gold coins should pay with Zimbabwe dollars and not US dollars to help the central bank remove some of the excess local currency in circulation.

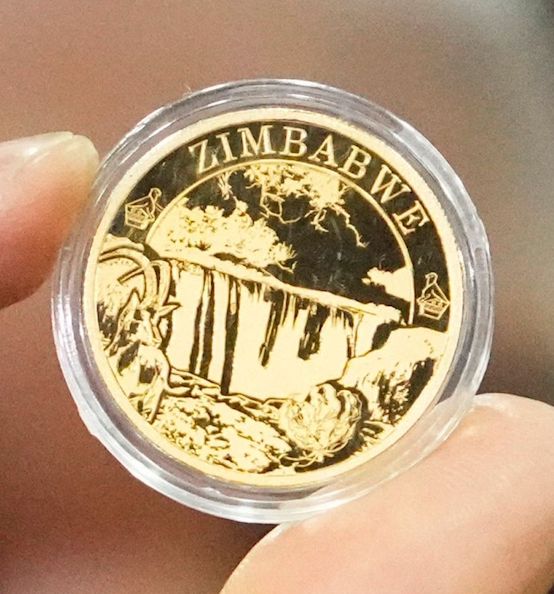

The coins are expected to be minted in an alloy of 22k, which is the same composition as other government backed coins such as the British Sovereign Gold Coin.

“These gold coins will be usable both locally and internationally because we have engaged with international banking partners. What I must emphasise is that gold is gold and it has an international value,” RBZ Governor Dr John Mangudya said in an interview.

He continued to say that those who will purchase the coins will also get bearer certificates.

“Since these coins are essentially meant to store value they can be used for the purpose of trading and also can be used as collateral. The purchaser can also convert them to cash if need be.”

He said the coins will be purchased in “all currencies in circulation in Zimbabwe including the Zimdollar.”

“Basically the gold coins will be an instrument for storing value and they will be purchasable in both foreign and local currency. Once minted they will be distributed by Fidelity Printers and Refiners, local banks and international banking partners that we will announce in due course.

“These gold coins will be usable both locally and internationally because we have engaged with international banking partners. What I must emphasize is that gold is gold and it has an international value.”

The official designs for the coin have yet to be released and officials have stated that images currently circulating on social media and fake and should be disregarded.

The coins are set to be released and available for sale sometime in mid-July 2022.