Gold remains one of the most actively traded physical assets in the world, and gold coin prices move constantly as global markets respond to interest-rate expectations, liquidity shifts, geopolitical pressure, and institutional demand.

For individual buyers, the challenge isn’t just tracking gold spot, it’s identifying which dealers are offering fair premiums, low spreads, and which products are best priced in the current market.

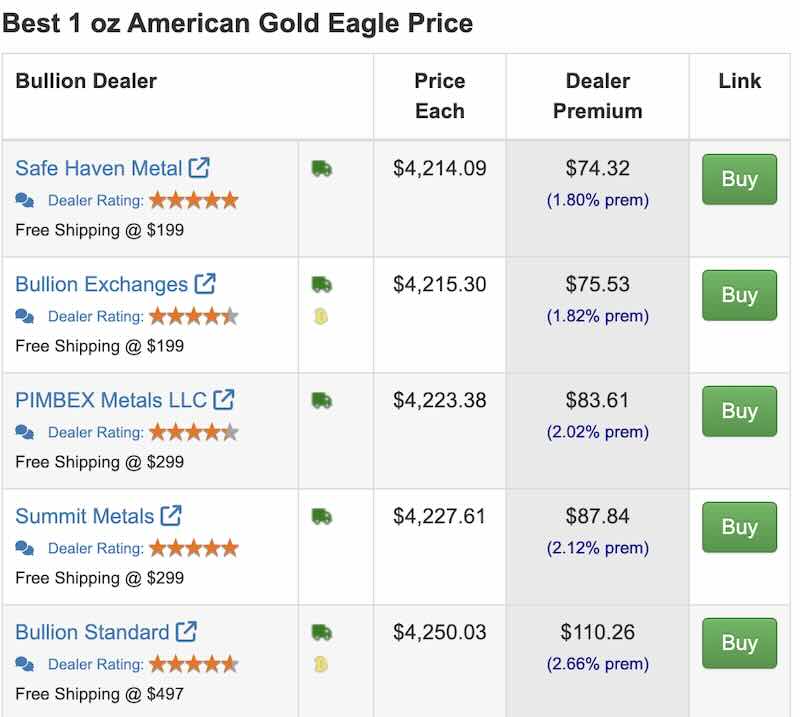

The reality is simple: premiums vary dramatically between dealers, and investors who don’t compare prices often overpay.

Why Gold Coin Prices Vary Even When Gold Spot Is the Same

Every investor knows that gold trades 24/7. But gold coin premiums are driven by multiple forces:

- Dealer inventory levels

- Wholesale premiums and market supply

- Supply chain constraints from sovereign and private mints

- Seasonal demand (tax season, Q4 holidays, volatility spikes)

- Numismatic and semi-numismatic interest

- Payment method costs (ACH vs. credit card vs. crypto)

- Shipping, insurance, and fulfillment differences

This is why comparing gold coin prices across multiple dealers is essential. One seller may be charging a 5% premium on 1 oz Gold Eagles while another is offering 2% over spot. Without transparent data, many buyers simply guess, or worse, trust advertising instead of the actual market.

Real-Time Gold Coin Price Comparison for Smart Buyers

FindBullionPrices.com was built for investors who want objective, data-driven insight. Our tools aggregate live pricing from dozens of the most reputable online bullion dealers and present them side-by-side, no sponsored manipulation, no hidden placement fees.

You immediately see:

- Actual cost per coin

- Premium over spot

- Inventory status –

- Shipping cost differences

- Payment-method pricing

This lets you enter the market with the same clarity large buyers and dealers enjoy. When you click on links to various merchants on this site and make a purchase, this can result in this site earning a small commission. More information about our affiliate programs can be found here.

Compare Modern Gold Bullion Coin Prices Instantly

Our 24k and 22k bullion-coin comparison pages include:

- 1 oz American Gold Eagle, 1 oz Gold Maple Leaf, 1 oz Gold Britannia

- Fractionals: 1/10 oz Gold Eagles and Maples

- Other global favorites: Philharmonics, Kangaroos, Krugerrands, Libertads

These pages update several times per hour, letting you evaluate real dealer premiums rather than relying on marketing claims.

Investors use these tools to:

- Identify the lowest premium per coin or per ounce

- Spot outlier pricing during market volatility

- Capture deals when a dealer aggressively marks down inventory

With record gold prices and tight spreads, small percentage differences translate into meaningful savings.

How Our Price Tracking Works

Frequency of Price Scraping and Data Feeds

Dealer sites are scanned up to twice per hour. When prices shift, you see it quickly, often before dealers update their email subscribers. Some of the dealers we work with provide pricing information via data feeds, which are updated several times per hour.

True Cost Transparency

Every listing includes:

- Listed price based on the single quantity “cash” price equivalent, such as ACH or wire transfer

- Other payment-methods may have a higher premium, often 2% to 5%

- Shipping thresholds and fees

- Discounts or minimum-order rules

You get the full picture, but always confirm dealer pricing and terms and conditions of any offer before purchasing.

Side-By-Side Price Comparison

One page. One product. Multiple dealers.

This eliminates guesswork and exposes hidden costs that inexperienced buyers often overlook.

Dealer Reputation Matters, Not Just Premiums

Even the best price is irrelevant if the dealer is slow to ship, has poor communication, or uses confusing return policies.

Our Bullion Dealer Directory provides user-submitted reviews, which include shipping quality summaries, operational notes, and payment methods.

This protects new and advanced investors from avoidable risks.

Better Prices Start With Better Data

Whether you’re building long-term wealth with 1 oz Gold Eagles or strategically accumulating historical European gold, comparing gold coin prices in a structured, data-driven way is essential.

Our Closest to Spot tool gives investors market transparency by showing dealer premiums side-by-side demonstrating how pricing can vary, depending on the product. With record high gold prices, even a small 3% difference in price can add up to over $100.

That combination of tools turns gold buying from guesswork into a disciplined investment decision by comparing across the entire market, helping you stretch your dollars further and stack smarter.