If you stack gold for weight and collect for history, few topics matter more than the difference between modern restrikes and original, era-struck coins. The gap in scarcity, premiums, and long-term desirability can be massive, even when the coin looks identical at first glance.

This guide breaks down six of the most important pieces in the “vintage bullion” conversation, spanning Mexico and Europe, so you can buy confidently. Whether you’re hunting affordable, historic gold at near-melt or paying serious money for certified Mint State originals.

What counts as a “modern restrike”?

A modern restrike is a coin officially produced by a national mint at a later date, to original historical specifications, often with a “frozen date.” Think Austrian coins dated “1915” or silver thalers dated “1780”: the date marks the design, not the year the piece was actually struck.

Why it matters: Restrikes trade and price like bullion because supply is ongoing or recent. Genuinely struck historical original pieces are finite and command collector premiums, especially in high Mint State.

Quick comparison table

| Coin | Fineness / Weight | AGW / ASW | Era-struck dates | Common restrike date(s) | Fast “tell” | Typical market lane |

|---|---|---|---|---|---|---|

| Mexico 50 Pesos Centenario | .900 / 41.666 g | 1.2057 oz Au | 1921–1931; 1944–1947 | 1947 (late issues) | Date + certification | Restrikes price near melt; MS-graded originals can fetch multiples of melt depending on date/grade. |

| Austria 100 Corona | .900 / 33.875 g | 0.9802 oz Au | 1908–1914 | 1915 | A 1915 date is a restrike by design | Restrikes price like bullion; true originals in MS65 are scarce and premium-worthy. |

| Austria 4 Ducat | .986 / 13.9636 g | ~0.443 oz Au | pre-1915 (scarce) | 1915 | Nearly all seen are restrikes | Artful bullion; genuine pre-1915 in MS65 are rare and auction-driven. |

| Switzerland 20 Fr Vreneli | .900 / 6.4516 g | 0.1867 oz Au | 1897–1935 | 1935-L, 1947, 1949 | “L” left of date + “B” right = restrike | Restrikes near melt; original dates in MS65 get collector premiums. |

| France 20 Fr Rooster | .900 / 6.4516 g | 0.1867 oz Au | 1899–1914 | Mid-century restrikes with same dates | Originals and restrikes can look identical—lean on certification | Restrikes near melt; certified originals in MS65 can trade well above melt. |

| Maria Theresa Thaler (silver) | .833 / 28.0668 g | ~0.7516 oz Ag | pre-1858 originals | All modern read 1780 | “1780” is normal; official restrike | Historic silver trade coin at modest premiums; originals are specialized. |

Deep dives: history, diagnostics, and market behavior

1) Mexico 50 Pesos “Centenario” (Gold)

Context: Launched in 1921 for the centennial of Mexican independence, the Centenario shows the Angel of Independence with the volcanoes Popocatépetl and Iztaccíhuatl, and the national arms on the reverse. It’s one of the most recognized large gold coins in North America.

Specs: .900 fine, 41.666 g total, AGW 1.2057 oz.

Restrike reality: Most pieces circulating in the U.S. market are 1947-dated late issues (often treated as restrikes). They are official mint products to original specs and typically trade close to melt with modest premiums.

Vintage premium: Original-era dates (1920s–1940s) in certified MS65 or higher can command strong premiums over bullion, especially scarcer dates or coins with excellent eye appeal. Verification via PCGS/NGC and auction records is essential.

How to tell:

- Date matters. If you’re paying collectible money, confirm the specific date is indeed an original-era strike and buy it in an NGC/PCGS holder.

- For stackers: a 1947 is usually the most cost-efficient way to own the design.

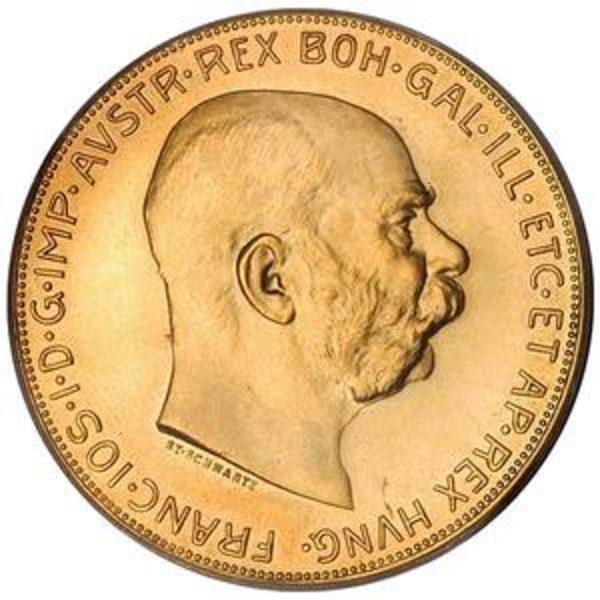

2) Austria 100 Corona “Franz Joseph I” (Gold)

Context: Struck during the late Austro-Hungarian Empire, originals date 1908–1914, right up to the eve of World War I. The design features Emperor Franz Joseph I and the imperial arms, classic fin-de-siècle Europe in a single coin.

Specs: .900 fine, 33.875 g total, AGW 0.9802 oz.

Restrike reality: After the war and into the mid-20th century, the Austrian Mint produced large runs dated 1915, a frozen date restrike. The overwhelming majority you encounter today are these 1915s.

Vintage premium: True pre-WWI dates in MS65 are much scarcer and priced accordingly when they appear at auction.

How to tell:

- 1915 = restrike. If the coin says 1915, treat it as modern for pricing.

- Originals (1908–1914) should be certified if you’re paying above bullion.

3) Austria 4 Ducat “Franz Joseph I” (Gold)

Context: The 4 Ducat is famously large in diameter and ultra-thin, with a crisp portrait of Franz Joseph. These were trade coins and presentation pieces with consistent fineness across centuries.

Specs: .986 fine, 13.9636 g total, ~0.443 oz AGW.

Restrike reality: Nearly all seen in U.S. inventory are 1915-dated restrikes, an official and ongoing product of the Austrian Mint to historical specs. They are extremely popular as “art-forward bullion.”

Vintage premium: Genuine pre-1915 4-Ducats in MS65 are uncommon; pricing is auction-driven and varies widely by eye appeal and provenance.

How to tell:

- Assume 1915 is a restrike. That’s normal.

- For storage: they’re thin—use non-PVC flips or capsules to avoid edge bending.

4) Switzerland 20 Francs “Vreneli/Helvetia” (Gold)

Context: An icon of the Latin Monetary Union era, the 20 Francs Vreneli shows the Swiss allegorical bust (“Helvetia”) and a Swiss cross within a wreath on the reverse. Originals run 1897–1935.

Specs: .900 fine, 6.4516 g total, AGW 0.1867 oz.

Restrike reality: Post-war issues are commonly found as 1935-L (also 1947 and 1949). The “L” is part of the restrike signature. You can see it shown in the video below.

Vintage premium: Common restrikes price near melt. Original-date Vreneli in MS65 (especially scarcer dates) carry collector premiums verified by price guides and auction results.

How to tell:

- The “L” left of the date with a “B” (Bern) right of the date marks a restrike.

- Originals typically have only a B mintmark.

5) France 20 Francs “Rooster” (Gold)

Context: The Marianne-and-Rooster type embodies the Third Republic’s republican symbolism and national renewal. It’s one of the most familiar French gold pieces in the U.S. coin market.

Specs: .900 fine, 6.4516 g total, AGW 0.1867 oz.

Restrike reality: The Paris Mint produced mid-20th-century restrikes using the same dates (1907–1914) as originals. That means many coins with those dates are not historic era-struck, and visual diagnostics often can’t separate them.

Vintage premium: Because originals and restrikes are visually similar, certification (PCGS/NGC) and provenance are key if you’re paying for MS65 originals.

How to tell:

- Assume any 1907–1914 Rooster could be a restrike unless certified as a true original.

- Price accordingly; don’t pay “original” premiums for raw pieces.

6) Austria “Maria Theresa Thaler” (Silver)

Context: A global trade coin with a footprint across Europe, Africa, and the Middle East for centuries. Modern thalers are official restrikes, all with the frozen date 1780 and the Habsburg empress’s bust.

Specs: .833 fine silver, 28.0668 g total, ~0.7516 oz ASW.

Restrike reality: The Austrian Mint still produces these to historical standards. They are collectible as historic bullion and offer an excellent low-cost entry point.

Vintage premium: Pre-1858 originals and specific varieties are a specialized field. For most buyers, the 1780 restrike is the right product.

How to tell:

- If it’s dated 1780, it’s almost certainly a modern restrike, and that’s fine.

“How to tell the difference” — pocket checklist

- Centenario 50 Pesos: If you want collectible value, buy the specific original date in a PCGS/NGC holder. For stackers, 1947-dated late issues are the efficiency play.

- 100 Corona & 4 Ducat (Austria): 1915 is the restrike standard. Originals show pre-1915 dates; treat uncertified 1915s as bullion.

- Vreneli 20 Fr (Switzerland): “1935-L” (and most 1947, 1949) are restrikes; originals typically show only B for Bern.

- Rooster 20 Fr (France): Originals vs. restrikes are often indistinguishable by eye. Rely on certification if you’re paying up.

- Maria Theresa Thaler (Austria): 1780 is the frozen date. Modern thalers are official and ubiquitous—perfect for historic silver exposure.

When to buy restrikes and when to pay up for originals

| Your goal | Choose | Why |

|---|---|---|

| Lowest premium per ounce with historic designs | Austrian 100 Corona (1915), 4 Ducat (1915), Swiss 20 Fr 1935-L/1947/49, Rooster restrikes | Broad dealer supply, tight spreads, easy to verify/spec. |

| Aesthetic “art-at-melt” | Austrian 4 Ducat (1915) | Oversized diameter, beautiful portraiture, usually a small premium over melt. |

| Trophy-grade collectible | Mexico 50 Pesos (original dates) in MS65+ | Deep U.S. demand; clear differentiation from restrikes; strong auction support by date/eye appeal. |

| Silver with real trade-coin history | Maria Theresa Thaler (1780 date) | Official restrike, modest premium, broad recognition. |

Risk controls (so you don’t overpay)

- Assume restrike unless proven otherwise for: 100 Corona (1915), 4 Ducat (1915), Maria Theresa Thaler (1780), many 1907–1914 Roosters.

- For MS premiums, buy slabs. If you’re paying for MS65, insist on PCGS or NGC.

- Cross-check comps. Look up recent auction prices for same date + same grade, not “similar” items.

- Mind payment method. Many dealers quote attractive prices for ACH/wire; cards/crypto add surcharges that change your true premium.

- Delivered cost wins. Factor shipping, insurance, and sales tax into your cost per ounce before you hit “buy.”

Storage, authenticity, and liquidity

- Storage: Capsules or non-PVC flips; 4-Ducats are thin, so protect edges.

- Testing: For high-value pieces, stick to reputable auctions and dealers and certified slabs. If authenticating raw bullion, use multiple checks (dimensions, weight, magnetism for silver, and a trusted ultrasonic/conductivity test if available).

- Liquidity: All six types are widely recognized. Restrikes sell fast at bullion desks; certified originals do best via auction/numismatic dealers.

Frequently asked questions

Are restrikes “real” coins?

Yes, when they’re official mint issues to original specs (e.g., Austrian 1915-dated pieces), they are legitimate gold coins. They simply aren’t era-struck and thus don’t carry the same numismatic scarcity as originals.

Why do restrikes keep the old date?

A frozen date signals the historic design and separates restrikes from circulating coinage. It also preserves the classic look collectors expect.

Do restrikes appreciate?

They track gold price and can also benefit from collector demand for the design, but they typically won’t mirror the numismatic upside of scarce, certified originals.

Is it worth grading restrikes?

Usually not for investment; restrikes price like bullion. Grading makes sense for originals where condition rarity drives value.

What’s the safest way to buy originals?

Stick to PCGS/NGC-certified examples from reputable dealers or auction houses. Verify recent sales of the same date/grade.

Bottom line

- Restrikes are your most efficient path to historic designs at near-melt.

- Originals—especially certified MS65+—are where collector premiums live.

- For Austrians, “1915” is the restrike tell; for Vreneli, watch for “1935-L/1947/49.” For Roosters, assume nothing—certification is the only safe way to pay original-level money.

- Always benchmark against current auction comps and delivered cost per ounce.

Build your strategy around what you actually want: ounces at a fair premium or true historical rarity in top grade. With these six coins, you can do either well—as long as you know which lane you’re in.