Although it plays a significant role in the global economy, economists and policymakers have debated discontinuing the $100 bill in recent years.

While the U.S. government has yet to commit to removing the $100 bill from circulation, the idea remains a topic of interest for various reasons, including the economic consequences and the government’s eventual shift toward Central Bank Digital Currencies (CBDCs).

Why Discontinue The $100 Bill?

Although rarely used in everyday transactions, $100 bills remain widely circulated.

According to the Federal Reserve, there are more $100 bills in circulation than $1. However, only a fraction of those bills are in the hands of Americans. Most are overseas in Central Bank reserves, circulating in countries that use the dollar as a currency and where people use it to hedge against currency instability.

Proponents of discontinuing the $100 bill, such as Harvard economist Kenneth Rogoff, argue that criminals primarily use large-denomination bills like the $100 note for illicit activities, including tax evasion, money laundering, and the financing of terrorism.

Rogoff contends that eliminating high-value bills could curb the underground economy and bring more transactions into the formal banking system, where they can be taxed and regulated.

However, as the Panama Papers revealed in 2012, these illicit activities are performed at scale by large criminal enterprises within the existing financial and banking system.

Critics of the $100 bill also point to the “denomination effect,” which suggests that people are less likely to spend larger denominations, such as $100 bills, than smaller ones, like $20s.

Many leading proponents of discontinuing the $100 note, including Rogoff, also largely favor more regulations, reduced privacy, and the push for a digital dollar. These are strawman arguments that downplay deeper motivations.

Other Motives Behind Discontinuing the $100 Bill

As cash transactions become less common and experts expound on discontinuing the $100 bill, the introduction of CBDC will give the government unprecedented oversight of purchases.

The agenda hidden behind the curtain is the push to introduce CBDCs managed and controlled by the Federal Reserve at the cost of personal privacy.

Combining the programmability of CBDCs with a social credit system like those in China raises the possibility of a future where one’s financial freedoms are tied to how closely one follows the narrative.

Many are troubled that the government could use CBDCs to manipulate citizens’ spending behavior and enforce social policies.

Is Discontinuation Practical?

The Treasury has designed each $100 bill durable, and each can last up to 23 years in circulation. By contrast, smaller denominations have a more frequent replacement frequency as they wear out rapidly.

Additionally, eliminating the $100 bill will likely accelerate the push for criminal enterprises to use alternative methods like crypto for illicit activities, which would only partially address the problem.

Removing the $100 bill could also increase the demand for smaller denominations, increasing printing and maintenance costs.

Whether the Treasury will discontinue the $100 bill or not, the transition to digital currencies raises important questions about privacy, government control, and the future of money.

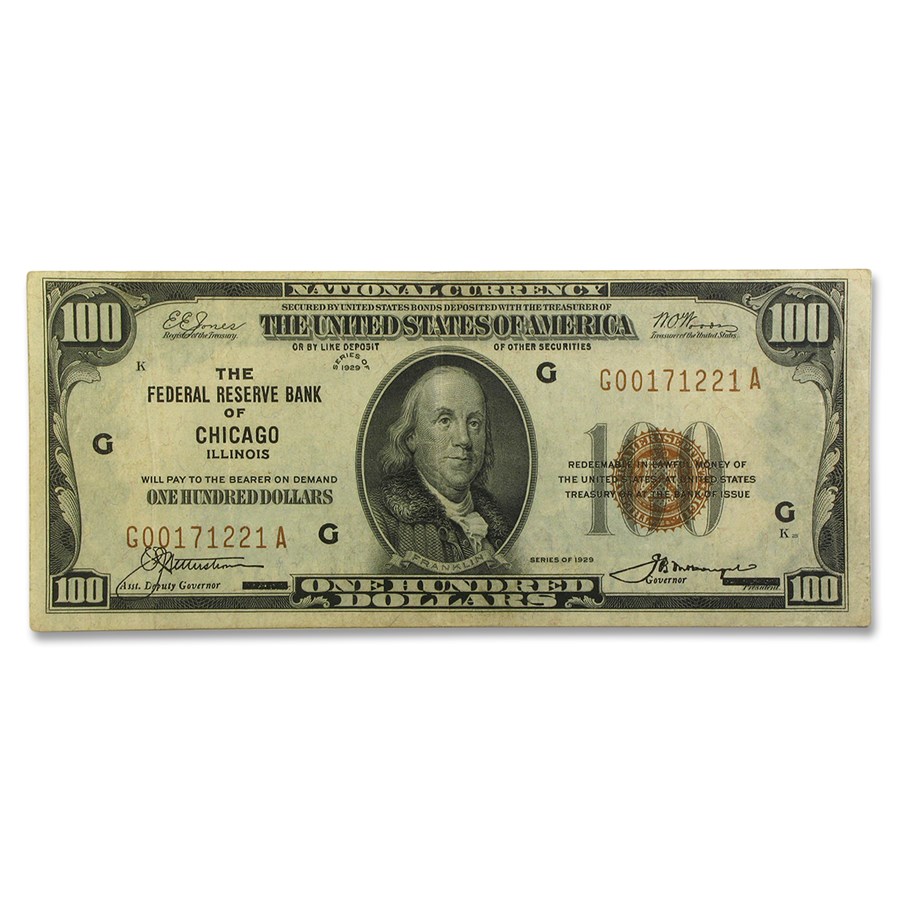

Gold and Silver Provide Privacy

Owning precious metals offers a level of privacy that is unique compared to other investments.

Generally, as long as the amounts are under thresholds, there are no government-mandated reporting requirements when buying or selling physical metals. Small, private transactions don’t usually trigger formal disclosures, giving the buyer and seller a high level of privacy.

Precious metals like gold and silver are tangible assets that aren’t tracked like digital accounts. Unlike stocks or bonds, precious metals don’t require personal information to hold in physical form, which allows owners to hold assets without a paper trail or third-party record.