Utah based Precious Metals Dealer Money Metals Exchange has opened a new, state-of-the-art bullion depository in downtown Eagle. This facility, spanning 37,000 square feet, is designed to securely store precious metals for a wide range of clients, including individuals, businesses, family offices, governments, and financial institutions.

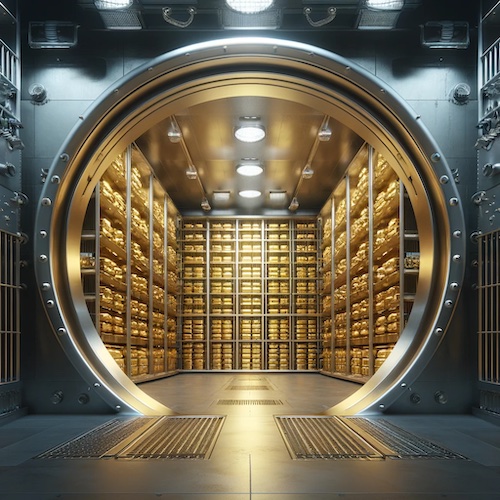

While it doesn’t have the machine-gun turrets found at Fort Knox, it is nonetheless being compared to the famous depository due to its significant capacity and security measures. The Eagle depository can store up to $100 billion in gold and silver, with the potential for expansion to 60,000 square feet.

According to the company, the bullion depository boasts the largest Class 3 vault in North America, which is the highest vault rating based on Underwriters Laboratories standards.

The facility is equipped with advanced security features, including 24/7 monitoring, secure access controls, and a security team composed of armed former law enforcement and military personnel.

This new depository not only enhances the security options available for precious metals storage in the Western United States but also brings additional employment opportunities to the Treasure Valley area.

The $28 million construction project involved a variety local Idaho businesses, including Wright Brothers Construction Co., Zions Bank, Erstad Architects, Integrated Security Resources, The Land Group, and Musgrove Engineering.

Money Metals Exchange, which currently employs around 100 people, processes approximately 40,000 gold and silver orders per month, serving nearly 750,000 customers in North America.

This new Idaho bullion depository adds a significant capability to the company’s existing infrastructure, potentially positioning it as a key player in the global precious metals storage industry.

The opening of this depository reflects the growing demand for physical precious metals, driven by concerns over currency debasement and economic uncertainty.

Facts About the Fort Knox Bullion Depository

The Fort Knox Bullion Depository is located in Kentucky, about 30 miles southwest of Louisville, situated inside the Fort Knox military base, providing an additional layer of security.

The depository was constructed in 1936 during the Great Depression in response to the need for a secure place to store the nation’s reservesr, which had been confiscated from the American people in 1933.

The depository’s security features include a combination of physical barriers, electronic systems, as well as armed guards. The vault door is blast-proof and is constructed of steel and concrete. The vault door is set to a time lock and can only be opened with multiple combinations known by different individuals.

Fort Knox houses approximately 147.3 million troy ounces of gold, a significant portion (roughly 56.35%) of the total U.S. gold reserves. The gold stored at Fort Knox is valued at over $200 billion, which fluctuates based on the current market price of gold.

The Fort Knox Vault it is not open to the public, and even high-ranking government officials rarely get to enter. The last official audit of the gold at Fort Knox took place in 1953 under the Eisenhower administration amid concerns over the adequacy and security of the nation’s gold reserves.

However, during the 1950s and 1960s, substantial amounts of gold were transferred from Fort Knox to foreign governments and central banks under the Bretton Woods system, during an era when the U.S. dollar was backed by gold, and other currencies were pegged to the dollar.

By the time Nixon closed the gold window in 1971, the U.S. gold reserves had declined significantly. It is estimated that the U.S. gold reserves were reduced from over 20,000 metric tons in the 1950s to around 8,133.5 metric tons by 1971.

About Money Metals Exchange

Already recognized for its extensive product inventory, competitive pricing, and superior customer service, the opening of this bullion depository and fulfillment center further solidifies Money Metals as a leader in the precious metals industry.

It has been named Best Overall Online Precious Metals Dealer by Investopedia multiple times and maintains an A+ rating with the Better Business Bureau. Money Metals Exchange reviews are overwhelmingly positive.

The new depository is positioned to further strengthen Money Metals’ role in the market, providing secure and cost-effective storage options that surpass those offered by traditional bank vaults and other facilities.

Money Metals offers a range of services, including the buying, selling, and storage of precious metals, gold loans, as well as investment options through IRAs and monthly purchase plans.