Investing in gold coins is a strategic way for new investors to enter the world of precious metals. Coins offer a tangible, easily recognized form of wealth that provides diversification and a hedge against inflation. Vintage gold coins are an attractive option because they are minted in smaller denominations, have historical significance, are affordable, and have relatively low premiums over spot prices.

This guide explores some of the most affordable vintage gold coins, detailing their history, investment appeal, and average dealer premiums. Each coin on this list is widely available, liquid, and trusted by investors worldwide.

Gold Coins in Circulation

Gold coins have been a cornerstone of commerce and wealth preservation for centuries. From the bustling trade routes of Europe to the growing economies of the Americas, these coins were minted not only for their intrinsic value but also to symbolize the economic and political power of their issuing nations.

Beyond their role in trade, gold coins are a symbol wealth and security. Before the establishment of modern banking systems, they served as a primary method for saving and transferring wealth. Their intrinsic value offered individuals and nations a dependable way to store wealth over time, especially in uncertain economic conditions.

20 Francs Gold Coin

The 20 Francs Gold Coin is one of the most recognizable European gold coins. Minted by countries such as France, Belgium, and Switzerland during the 19th and early 20th centuries, these coins typically feature classic designs such as Napoleon III or the iconic “Helvetia” from Switzerland.

Weighing 6.45 grams and containing 5.81 grams of pure gold, the 20 Francs coin is valued for its gold weight consistency and purity (.900 fineness). Its size and historical significance make it a favorite among new and seasoned investors.

Why It’s Popular

- Affordability: Its smaller size keeps the purchase price within reach for most investors.

- Gold Weight: .1867 troy ounces

- Historic Value: Collectors and investors appreciate the coin’s connection to European monetary history.

- Liquidity: 20 Francs coins are widely recognized and easy to trade.

The typical premium for 20 Francs Gold Coins ranges between 2% and 10% over the gold spot price, depending on the coin’s condition and year.

British Sovereign Gold Coin

The British Sovereign Gold Coin has a storied history as the flagship coin of the British Empire. First minted in 1817, Sovereigns contain 7.98 grams of gold with a purity of .917 (22 karats). The coin often features a portrait of the reigning monarch on the obverse and Benedetto Pistrucci’s iconic depiction of St. George slaying the dragon on the reverse.

Why It’s Popular

- Prestige: Sovereigns have a strong reputation for quality and consistency.

- Global Recognition: Accepted by dealers worldwide, it’s one of the most liquid gold coins.

- Trim Size: Ideal for investors looking to make incremental purchases.

- Gold Weight: .2354 troy ounces

British Sovereigns typically carry 4% to 8% premiums over spot price, depending on the year and condition.

Mexico 5 Pesos and 10 Pesos Gold Coins

Mexican gold pesos are celebrated for their rich cultural heritage and stunning designs. The 5 Pesos Gold Coin contains 3.75 grams of gold, and the 10 Pesos Gold Coin includes almost a 1/4 oz with 7.5 grams of gold, with a purity of .900. These coins often feature a portrait of Miguel Hidalgo, a leader of Mexico’s independence movement.

Why They’re Popular

- Low Premiums: Pesos are known for their affordability compared to other vintage gold coins.

- Cultural Appeal: Their designs resonate with collectors and investors alike.

- Accessibility: Smaller denominations make them affordable and easy to acquire, with larger denominations available.

- Gold Weight: 5 Pesos: .1205 troy ounces 10 Pesos: .2411 ounces.

5 Pesos Gold Coin premiums typically range from 3% to 7%, while 10 Pesos Gold Coin premiums range from 4% to 8%.

Austria Gold Ducats

Overview

Austria Gold Ducats are among the thinnest gold coins, minted primarily for trade. The most common version, the 1 Ducat, contains 3.49 grams of .986 fine gold, while the larger 4 Ducats contain 13.96 grams of the same purity. Ducats are famous for their intricate designs featuring Emperor Franz Joseph.

Why They’re Popular

- High Purity: With .986 fineness, they offer nearly pure gold content.

- Historical Significance: They connect investors to European monetary history.

- Unique Design: Their slim profile and beautiful engravings appeal to collectors.

- Gold Weight: 1 Ducat: 4 Ducats:

1 Ducat premiums range from 5% to 15%. 4 Ducats premiums are slightly lower, typically 2% to 8%, due to their larger size.

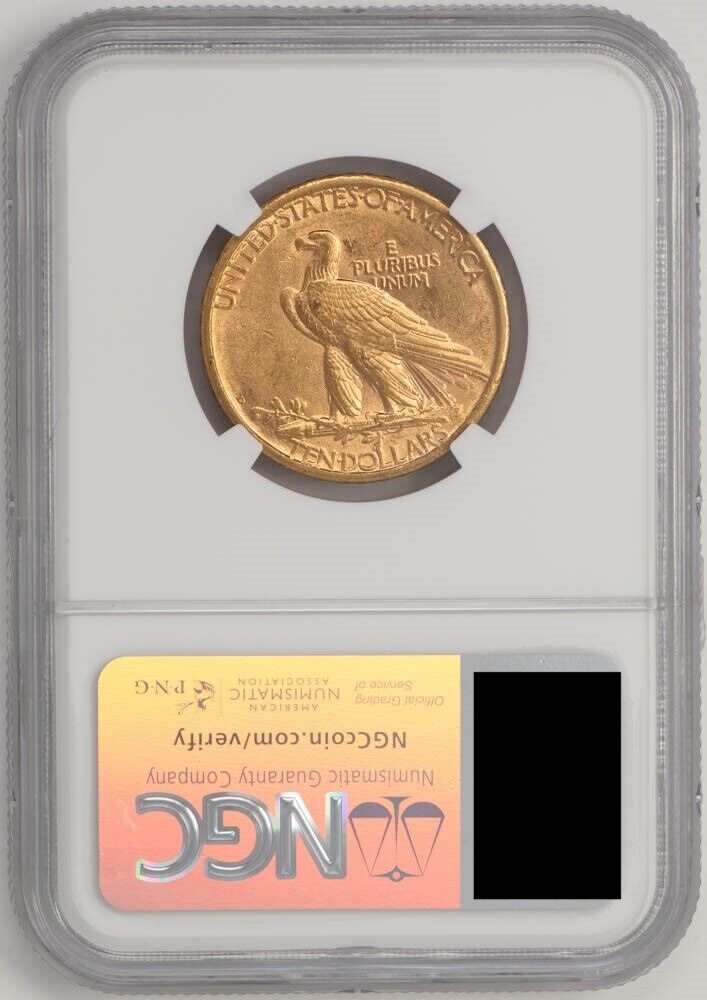

US Mint Pre-1933 Gold Coins

Before 1933, the United States minted gold coins for circulation, including the $2.50 Quarter, $5 Half, and $10 Eagle. These coins are composed of 90% gold and 10% copper, adding durability. Their designs include iconic imagery like Lady Liberty and the Indian Head.

Why They’re Popular

- Historical Importance: These coins were produced before President Franklin D. Roosevelt’s Executive Order 6102, confiscating gold to stabilize the economy.

- Collectibility: Each coin is a tangible piece of American history.

- Durability: The added copper content makes them less prone to wear

- Premium: Due to their historical status, some Pre-1933 gold coin denominations carry a numismatic premium, even in circulated condition.

Each $2.50 Quarter Eagle contains .121 troy ounces of gold and retail premiums range from 20% to 40%.

Each $5 Half Eagle contains .2419 troy ounces of gold and dealer premiums range from 4% to 10%.

Each $10 Eagle contains .4848 troy ounces of gold, with premiums typically range from 3% to 7%, making them relatively affordable for larger denominations.

Average Dealer Premiums

| Coin | Average Dealer Premium |

|---|---|

| 20 Francs Gold Coin | 2% to 10% over spot price |

| British Sovereign Gold Coin | 3% to 15% over spot price |

| Mexico 5 Pesos Gold Coin | 3% to 7% over spot price |

| Mexico 10 Pesos Gold Coin | 4% to 8% over spot price |

| Austria 1 Ducat Gold Coin | 5% to 15% over spot price |

| Austria 4 Ducats Gold Coin | 3% to 5% over spot price |

| US $2.50 Pre-1933 Quarter Eagle | 20% to 40% over spot price |

| US $5 Pre-1933 Half Eagle | 4% to 10% over spot price |

| US $10 Pre-1933 Eagle | 3% to 7% over spot price |

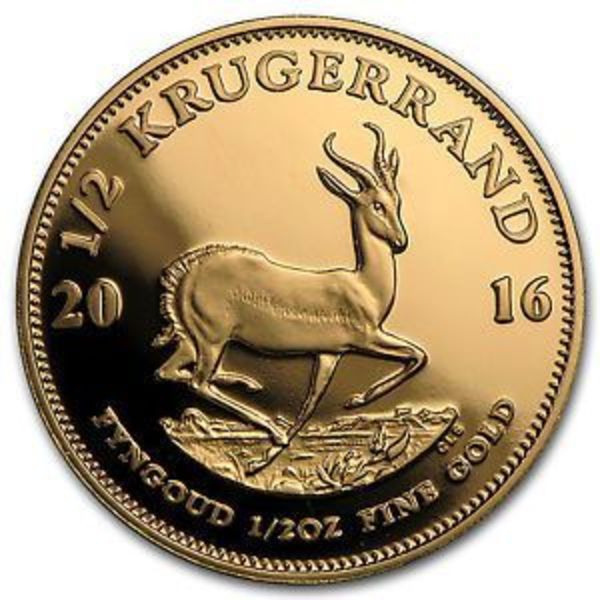

Why Vintage Gold Coins Are A Cheaper Alternative to Modern Bullion

More Affordable than Modern Gold Coins

Vintage gold coins are an attractive option for investors due to their pricing, which often hovers close to the spot value of their gold content.

Unlike newly minted bullion coins, which have higher premiums due to manufacturing and distribution costs, vintage gold coins often provide more value per dollar spent.

For the same price as modern bullion coins, investors can own a piece of history, combining investment potential with cultural and numismatic significance.

Historical Appeal

Each vintage gold coin tells a story, linking it to a specific era or cultural milestone. Whether it’s a 20 Francs coin from the era of Napoleon III or a British Sovereign minted during Queen Victoria’s reign, these coins capture moments in time. Owning a vintage coin can feel like holding a piece of history.

Global Recognition

These coins were minted by some of the world’s most prominent nations and used in international trade for centuries, establishing their reputation for consistent weight and purity.

This widespread recognition ensures liquidity in bullion markets without difficulty, as dealers and collectors alike can easily verify authenticity.

Portfolio Diversification

Incorporating vintage gold coins into your portfolio can provide greater diversification while holding a physical asset with enduring value. Vintage gold coins represent a reliable and versatile option for investors looking to reduce risk.

Buying Affordable Vintage Gold Coins

It is important to research and understand dealer premiums thoroughly before you buy gold coins. Understanding the average premiums for different coin types will help you ensure you’re paying a fair price and not overpaying compared to market standards. FindBullionPrices helps make comparing prices of various gold coin types across a wide variety of trusted and reputable online bullion dealers.

Trusted dealers provide peace of mind by offering genuine products and reliable customer service, reducing the risk of fraud or counterfeit coins.

Circulated gold coins can be a more affordable option for investors and retain their full intrinsic value, making them a practical choice.

To protect your investment, store your coins securely, such as a home safe or a third-party vault.

Considerations

For new investors, vintage gold coins like the 20 Francs, British Sovereigns, Mexican Pesos, Austrian Ducats, and Pre-1933 US Gold Coins offer an affordable and historically rich way to enter the gold market. These coins balance investment potential with cultural and historical value, making them both a practical and enjoyable asset class.

Whether you’re building wealth or diversifying your portfolio, these coins provide a time-tested foundation for financial security. By understanding their premiums, history, and market dynamics, you can make informed decisions that align with your investment goals.

FindBullionPrices.com can help you compare online dealer prices for affordable gold coins for investment: