Texas has moved beyond simply storing precious metals. With the launch of its official bullion program, the state is now offering gold and silver coins, along with modern gold-backed notes, through the Texas Bullion Depository (TXBD), a division of the Texas Comptroller’s Office.

For bullion buyers and coin collectors, this development introduces a state-administered supply channel, new design themes rooted in Texas history, and a fresh layer of jurisdictional identity in the U.S. precious metals market.

From Depository to Distribution

The Texas Bullion Depository was established in 2015 by the 84th Texas Legislature as the first state-administered precious metals depository in the United States. Its original mission centered on secure storage under state oversight.

The 2025–2026 expansion adds official Texas bullion products to that framework. Investors can now purchase:

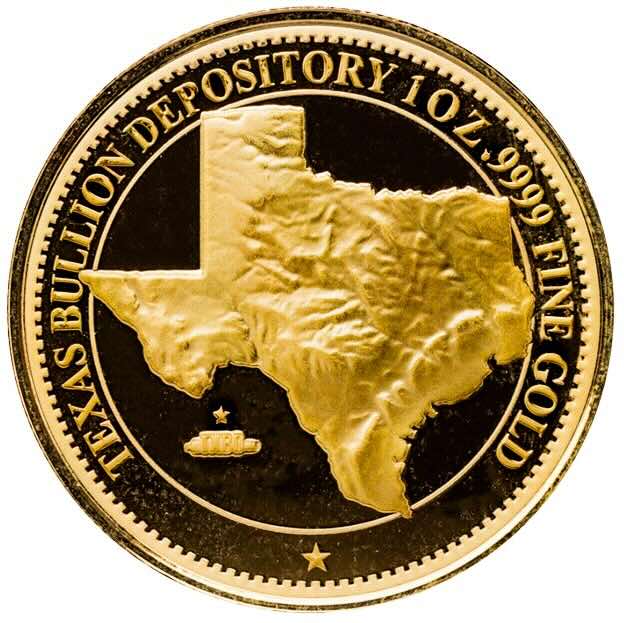

- 2025 1 oz Gold State of Texas Bullion Coin (.9999 fine)

- 2025 1 oz Gold Proof Coin

- 2025 1 oz Silver Bullion Coin

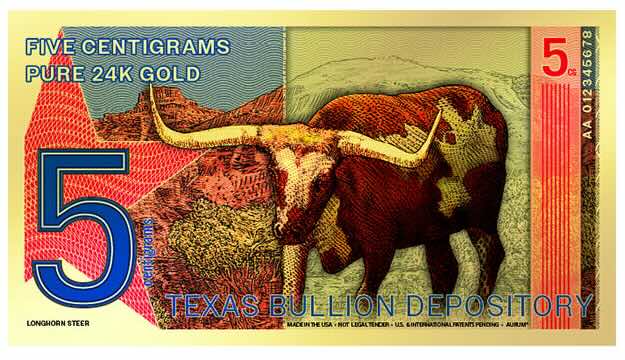

- Modern Texas “Redback” Gold Notes containing embedded 24-karat gold

These products are available through the Depository and authorized dealers. They are not legal tender, and the state explicitly positions them as commemorative and bullion products rather than circulating currency.

For context, Texas has separately authorized gold and silver for legal tender use in future transactional systems (with implementation still in development). That broader policy backdrop adds political and monetary context, but these coins themselves are bullion and collectible products.

The 2025 Texas Gold and Silver Coins

Metal and Specifications

The 1 oz gold proof coins are struck in .9999 fine gold, placing them on par with modern sovereign issues in purity. The silver version follows standard 1 oz bullion conventions.

Key features include:

- Weight: 1 troy ounce

- Gold Purity: 99.99% fine (24k)

- State-administered program through TXBD

While purity aligns with leading global mints, buyers should understand an important distinction: these are state-issued commemorative bullion products, not U.S. Mint legal tender coins.

Design Elements

The design emphasizes Texas identity:

- Relief map of the state

- TXBD insignia

- Cannon and Lone Star symbolism

- Reverse featuring a Great Seal–inspired Star of Texas framed by wreath elements

- The word “FRIENDSHIP”, referencing the Caddo origin of the name “Tejas”

For collectors, first-year releases from new programs tend to draw attention, particularly when backed by a governmental entity. That said, long-term numismatic premium is never guaranteed.

Modern Texas Redback Gold Notes

Perhaps the more unusual component of the rollout is the Modern Texas Redback Gold Note series.

These polymer notes contain a precisely measured, verifiable layer of 24-karat gold embedded in the substrate, similar to Goldback notes. They are issued in small gold weights (5 cg, 20 cg, 100 cg).

Key considerations for buyers:

- The gold content is fractional.

- Premiums relative to melt value may be significant.

- These function more as collectible novelty bullion than liquidity-focused stacking products.

Collectors of historic currency and alternative bullion formats may find them compelling.

The Texas Lone Star coins represent a notable evolution in state-level metals infrastructure. Whether they become a staple alongside Eagles and Maples, or remain a niche regional product, will depend on pricing discipline, consistent issuance, and market acceptance.

Final Thoughts

Texas has taken a visible step into the bullion marketplace. The program blends political symbolism, state oversight, and traditional precious metals fundamentals.

For collectors, the inaugural 2025 releases may hold historical appeal.

For bullion buyers, the calculus remains straightforward: purity, premium, liquidity, and jurisdiction.

The metal itself is the foundation. Everything else is structure layered on top.

Disclaimer: This article is for informational purposes only and does not constitute investment, legal, or tax advice. Precious metals involve market risk, including price volatility and liquidity considerations.