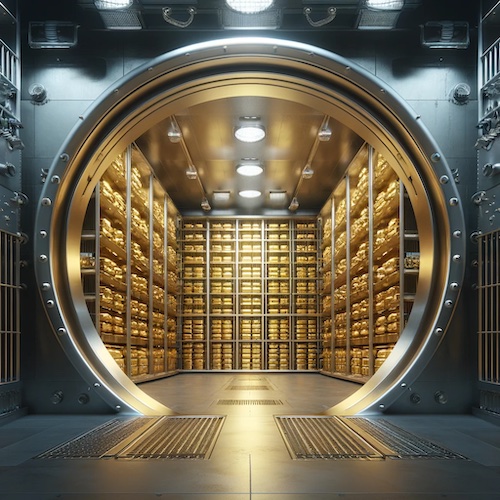

In a recent interview on Bloomberg Surveillance on February 20, 2025, U.S. Treasury Secretary Scott Bessent addressed speculation surrounding the nation’s gold reserves, firmly stating, “All the gold is there.”

His comment came in response to questions about potential plans to revalue U.S. gold holdings—currently marked at $42 per ounce since 1973, far below the market price of approximately $2,950 per ounce in February 2025—or to physically inspect Fort Knox, the famed depository in Kentucky.

Bessent dismissed any immediate need to visit the facility, noting that annual audits are conducted, with the most recent audit in September 2024. He extended an invitation to U.S. Senators to arrange a visit to the vaults through his office if they wish to verify the reserves themselves.

His remarks push back against skepticism from President Donald Trump and Elon Musk, who have hinted at auditing Fort Knox as part of broader fiscal transparency efforts tied to the Department of Government Efficiency (DOGE).

Bessent also clarified that revaluing gold reserves to fund a sovereign wealth fund, which could theoretically generate a $750 billion windfall, is “not what I had in mind.” Instead, he focused on disinflationary policies, such as lowering energy costs and deregulation, over drastic monetary shifts.

Whether his assurances will quell calls for a public audit remains an open question as gold continues to draw attention amid global economic uncertainty.

US Imported More Than 2,000 Tons of Gold

In a recent news segment on Sky News Arabia, StoneX Group Chief Executive Phillip Smith discussed concerns in the gold market, gold flows and the uncertainty surrounding Trump’s reciprocal tariffs.

“What you’re now seeing is an actual disconnect between New York…futures contracts, and London…OTC physical market,” Smith explained. This divergence is fueled by concerns mounting over whether tariffs on various products could be introduced at rates of 10%, 20%, or even 25%.

Smith also noted a substantial increase of physical gold moving into the United States in the past two months. “What we’ve seen in the past 7, 8 weeks in the market was probably one of the largest physical movements of gold from all over the world into the US. We estimate over 2,000 tons.”

Smith believes that the ongoing ambiguity around tariff policies is having a “disproportionate and distorting effect on gold prices.”