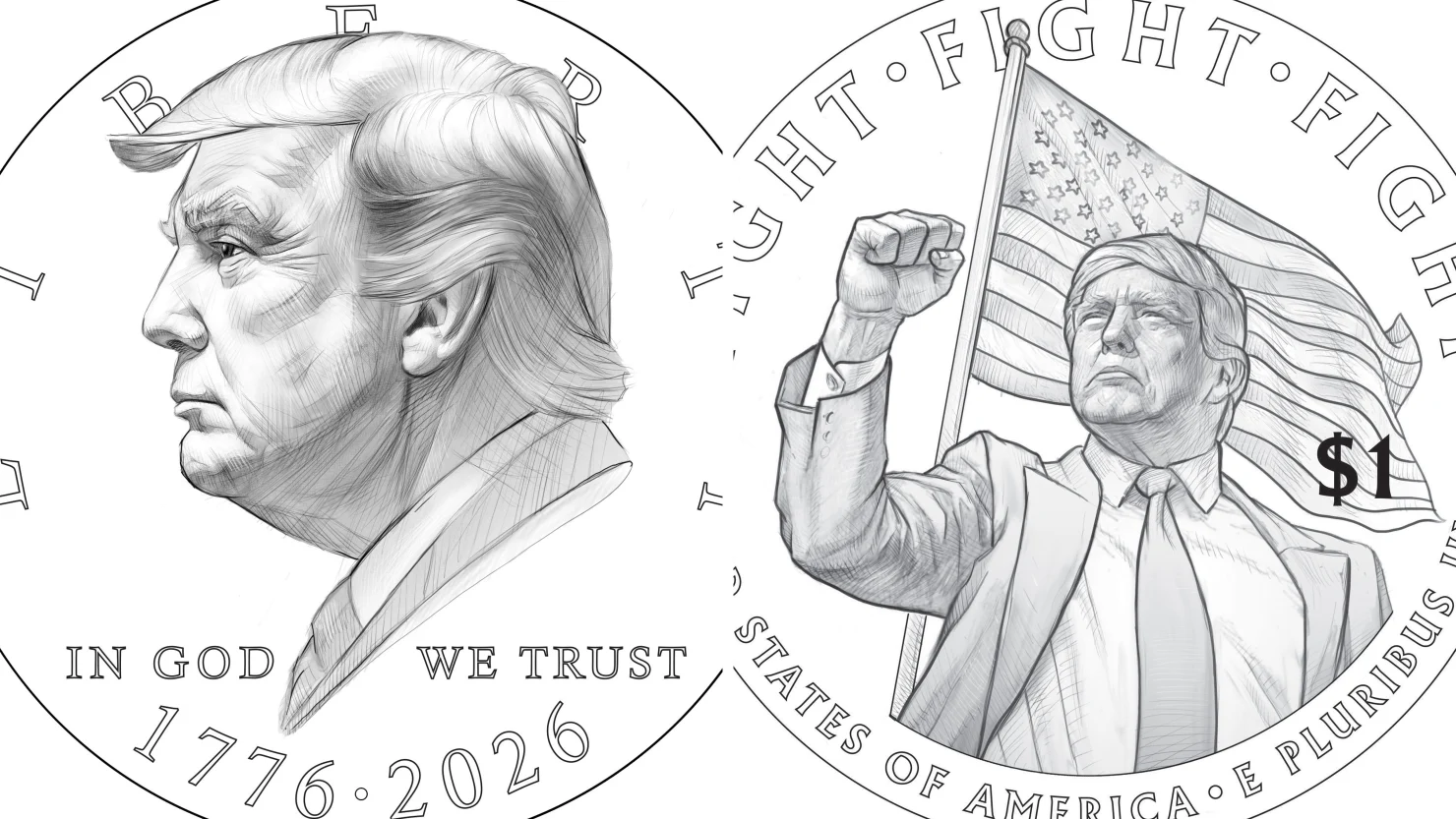

What the U.S. Mint’s Silver Pause Really Tells Us About the Silver Market

The Mint pause is not evidence of “unobtanium silver.” The Mint has paused sales before during periods of extreme price volatility. It is evidence of a silver market operating under exceptional pressure.