Bullion Exchanges, known across the industry for offering some of the lowest premiums on gold bullion, has now taken a significant step forward in the storage arena.

On November 14, 2025, the company formally unveiled its state-of-the-art vaulting facility inside Manhattan’s International Gem Tower, a secure building in the Diamond District and one of the world’s most concentrated high-value zones.

For investors balancing rising bullion prices with increasing security risks, this launch marks one of the most compelling professional storage options currently available in the U.S.

A Former COMEX-Rated Vault, Reinforced and Modernized for 2025

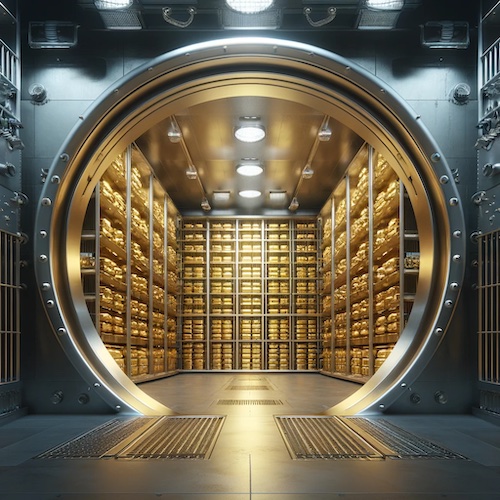

Bullion Exchanges’ new vault is operated through its newly formed entity, Legacy Bullion Vaults, and occupies roughly 3,000 sq. ft. of UL Class 3–rated space, the highest physical-security designation Underwriters Laboratories assigns.

This exact vault was previously operated by Manfra, Tordella & Brookes (MTB), a globally respected bullion firm and former COMEX depository. Bullion Exchanges acquired the facility in 2022 and spent several years reinforcing and modernizing the structure.

Location Advantage: The Diamond District Security Perimeter

The vault sits 60 feet underground, protected not only by its own fortifications but also by:

- NYPD units explicitly assigned to the Diamond District

- Undercover law-enforcement monitoring

- Private armored security

- A building designed to support billions in annual precious-metals transactions

This layering makes the vault one of the most secure bullion storage locations in North America, an essential factor for anyone considering NYC gold storage as part of their wealth-preservation strategy.

Security That Exceeds Typical Depositories

The facility incorporates security protocols rarely seen outside national-level vaults:

- 350+ HD cameras covering every hallway, lock, and entry/exit

- Biometric iris scanners and X-ray screening

- Double-door mantraps prevent tailgating and unauthorized movement

- Armed G4S guards, a global security firm specializing in high-value asset protection

- Ballistic-rated doors and reinforced safe rooms were added during the 2025 upgrades

- UL Class 3 Rating

For investors storing six-figure or seven-figure positions in gold, silver, platinum, or high-value numismatics, this level of engineering is materially essential.

Full Segregation, Full Insurance, and Real Audits

Bullion Exchanges designed its vaulting program around transparency and independent validation, both of which are increasingly important to wealth managers and collectors.

Segregated storage

Every client receives:

- Dedicated space

- Individually inventoried holdings

- No pooling, rehypothecation, or internal lending

Segregation is critical for collectors storing rare coins, graded numismatics, or limited-strike bullion with serial numbers.

Annual third-party audits

Unlike some institutional vaults, Bullion Exchanges undergoes:

- Quarterly internal audits

- Annual third-party GAAP-compliant audits

For reference: Fort Knox itself has not been publicly audited in more than 70 years.

Full Lloyd’s of London coverage

All metals stored are protected under Lloyd’s policies, providing one of the highest insurance standards available for physical assets.

Each stored bar, coin, or round is photographed and matched to the investor’s digital inventory. This provides undeniable proof of custody and eliminates concerns about substitution or commingling.

A Streamlined Buy-Vault-Sell System with Mobile App Integration

Bullion Exchanges has integrated the storage directly into its retail ecosystem, allowing investors to buy metals on BullionExchanges.com and transfer them automatically into segregated vaulting. When ready, the metals can be sold back instantly without shipping or insurance delays.

And because Bullion Exchanges regularly offers near-spot pricing on gold, investors can dollar-cost-average or deploy capital with minimal premium overhead. This eliminates many of the friction points that traditionally add cost and risk to physical metal ownership.

Bullion Exchanges supports vault customers with a mobile app offering:

- Real-time price charts

- Buying and selling

- Vault balance visibility

- Serial-number verification

- Two-factor authentication and encrypted sessions

Lower storage rates

Storage fees are marketed as up to 50% lower than many competing vaulting services, and new accounts receive a first-month-free incentive.

For investors who have watched homeowner-policy exclusions increase and private safe insurance premiums skyrocket, professional vaulting can now cost less than home insurance riders—while offering exponentially stronger protection.

A Secure and Transparent Option for Modern Bullion Investors

Bullion Exchanges’ new vaulting facility is a genuine upgrade to the entire storage landscape for physical precious metals, especially for investors who want security on par with national repositories but with the transparency that private vaults rarely offer.

For anyone holding meaningful allocations in physical gold, silver, platinum, palladium, or numismatic collectibles, this facility provides best-in-class security alongside independent auditing and Lloyd’s of London high-value insurance.

And, paired with the company’s consistently low bullion premiums, Bullion Exchanges has positioned itself as one of the most investor-friendly platforms for both acquisition and secure long-term storage.