How Much Silver is Really in a Tomahawk Missile? The 500 oz Monster Box Myth, Debunked

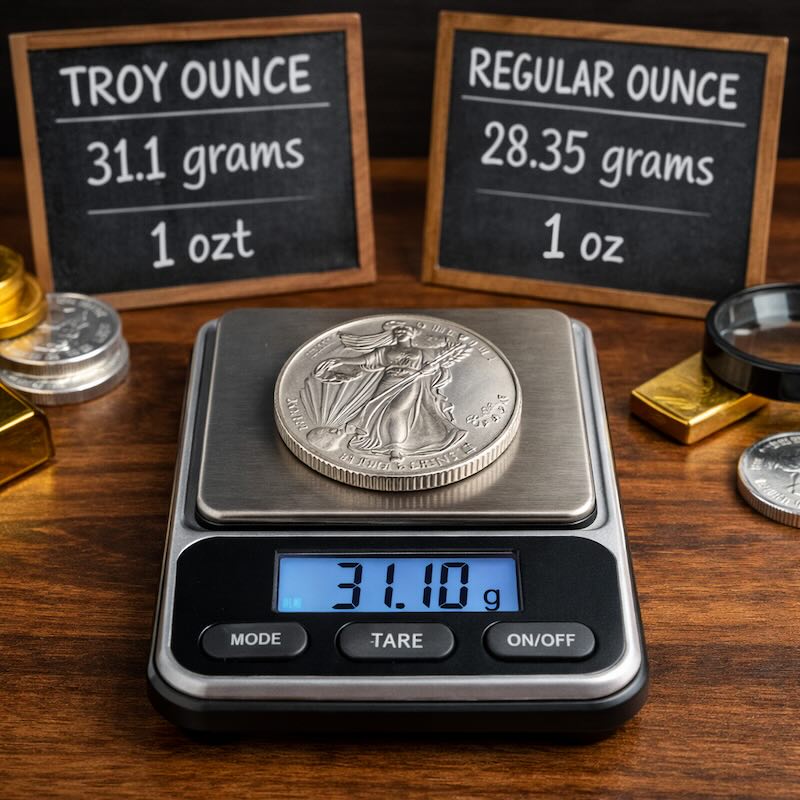

Every time the U.S. fires a volley of Tomahawk missiles, the 500-ounce silver claim resurfaces — a number that happens to equal exactly one American Silver Eagle monster box. The reality, according to credible analyst estimates, is closer to 15–20 troy ounces per missile: less than a single tube of Silver Eagles. Here’s where the myth came from, what the actual numbers look like in coins and bars, and why the distinction matters for silver investors.