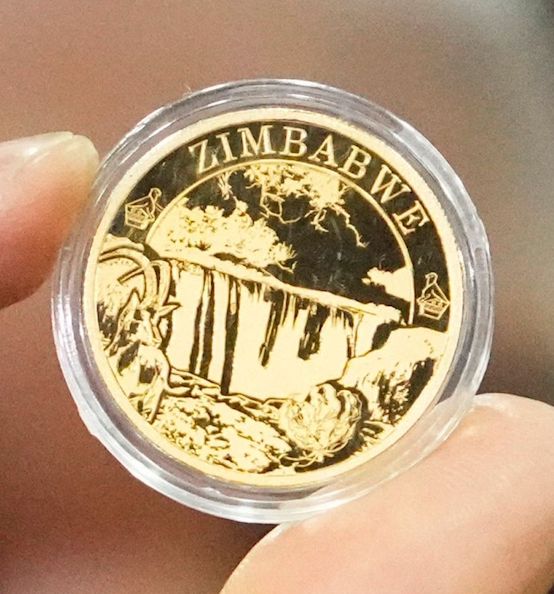

Amid an economic crisis with record high inflation over the last year, the country of Zimbabwe announced its plans to issue a gold-backed Central Bank Digital Currency (CBDC) as a way to facilitate easy payments and push for the adoption of local currencies over the US Dollar.

This week, finance minister Mthuli Ncube announced intentions to link the Zimbabwe dollar to the country’s growing gold reserves as the country attempts to stabilize the exchange rates and the economy by reintroducing the gold-standard.

In 2022, Zimbabwe enacted a law that required mining companies to pay a royalty on precious minerals and minerals to the country’s central bank. The royalty rates range between 5% for gold and platinum group metals and 10% for diamonds. Since then, the country’s central bank currently holds roughly 793kgs of gold in reserves valued at roughly $49 million at the current price with plans to grow reserves to around $100m.

Currently, the Zimbabwe gold-backed digital currency that was introduced in 2023, is in use as legal tender and a store of value alongside the Zimbabwean dollar and bond notes.

Zimbabwe has also expressed interest in joining the BRICS alliance, which has a strong preference for asset backed local currency transactions for international trade.

The land-locked Sub-Saharan country is home to a plethora of natural resources, such as large deposits of coal, chromium ore, asbestos, gold, nickel, copper, iron ore, vanadium, lithium, tin, and platinum group metals. Zimbabwe is a major exporter of platinum, cotton, tobacco, gold, ferroalloys, and textiles or clothing.

The country contains the second-largest platinum deposit and high-grade chromium ores in the world, with approximately 2.8 billion tons of PGM and 10 billion tons of chromium ore.

Leaders in Zimbabwe began the process of returning to the gold-standard in 2023 with the hopes of stabilizing its economy and establishing its local currency in global markets.