The price of gold rallied past $2,300 per ounce on Thursday, shocking retail investors and marking a new all time high for the shiny metal. During mid day trading today, the price was holding steady above $2,320.

It’s no secret that in recent years central banks have been buying gold. Last year, China’s central bank ran through several rounds of gold buying, acquiring 225 metric tons, representing roughly 25% of the overall central bank purchases of 1037 tons acquired by governments’ last year.

Reports are surfacing that China could be sitting on an unpublished stash exceeding 5,300 tons of gold bars, doubling the 2,235.39 tons in the holdings reported through Internation Monetary Fund statistics.

Despite recent reports of positive economic data, inflation remains rampant with interest rates stuck at the highest levels in decades. The inflation problem continues to baffle the Federal Reserve, with recent remarks from Chairman Powell suggest that they may be reconsidering a rate cut in the near future.

With gold investing seeing a resurgence in popularity among Gen Z in China, the Wall Street Journal is reporting that Millennial investors are the leading buyers of Costco gold bars. According to the study, a growing number of Millennials recognize gold as a store of value and hedge against economic uncertainty, with the average having up to 17% of their net worth in gold. While Baby Boomers allocate only around 10%.

Gold has historically been seen as an effective hedge against inflation. The ongoing dedollarization efforts driven by BRICS have played a roll in driving the price higher. When currency values decline, gold prices rise helping to preserve purchasing power.

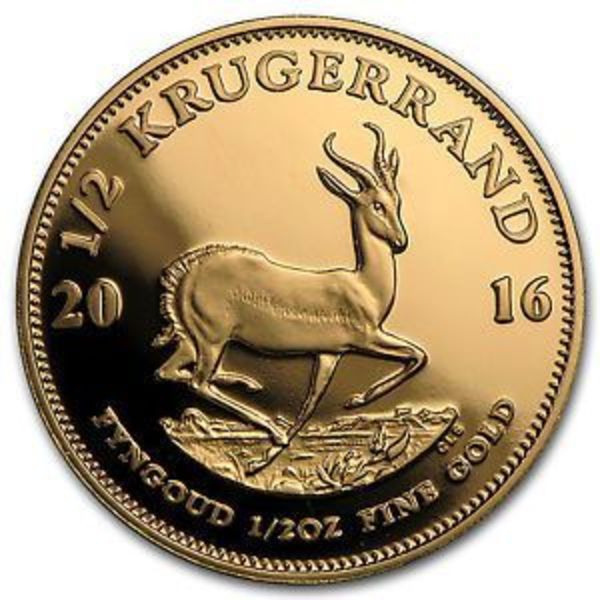

For retail investors, Gold Coins are one of the most highly liquid tangible asset. Coins are widely recognized and can be easily bought and sold from online bullion dealers, local coin shops and others.

Gold coins are minted in a variety of industry standard weight denominations that enable investors with varying budgets to participate in the gold market.