Learn Why Gold Bars are a Good Starting Point for Beginning Investors

Gold has been one of the most popular ways of accumulating and building wealth for thousands of years. Gold bars are one of the most economic and convenient ways to diversify investments into precious metals and preserve wealth.

There are many types, sizes, and weights available. Each bar size is intended to suit the needs of individuals with different budgets. Fractional gold bars are a popular choice for many, and there are suitable options at all price points.

Private mints operate on a different business model than sovereign mints. Thus, gold bars are typically priced lower per ounce than gold coins, which adds to their attractiveness as an investment.

Gold Bars By Weight

Each size of the gold bar has benefits and trade-offs when considering them for investments. Gold bars come in a variety of weights and sizes. Typically, there are two weight classes of gold bars: those measured in grams and those measured in troy ounces.

Gram-size gold bars are generally the least expensive and easiest to store, but they carry a higher premium than gold spot price when factored in on a per-troy-ounce basis. These bars are available in many different sizes, from as small as one-half gram up to one kilogram.

Troy-ounce size gold bars have a lower premium per ounce but require a more considerable cash outlay at the time of purchase.

1 Gram Gold Bar

One-gram-size gold ingots are one of the most common ways beginning investors buy gold. They are inexpensive, and you can buy them from virtually any online bullion dealer or your local coin shop. Newly minted 1 gram gold ingots come sealed in a manufacturer’s assay card, which displays the weight, purity, mint, and other particulars about the bar.

One significant advantage of one-gram gold bars is that they are very easy to liquidate.

2.5 Gram Gold Bar

Buying 2.5-gram gold ingots gives investors a hedge against inflation like larger bars but at a lower point. 2.5 gram gold bars made of .9999 fine gold are still very affordable and have a lower premium than their 1-gram counterparts.

5 Gram Gold Bar

Five-gram gold ingots make an excellent investment. At this weight, the premium per gram over the spot price is more reasonable for beginning investors. At current gold spot prices, 5 gram gold bars can often be purchased for a few hundred dollars. It’s a small price to pay to have peace of mind and financial security for the future.

10 Gram Gold Bar

At just under 1/3 of a troy ounce, the 10 gram gold bar provides a nice entry point for a gold investor. At this weight, one can feel the weight of this bar. This size allows you to grow and diversify your portfolio with an affordable, low-premium investment option.

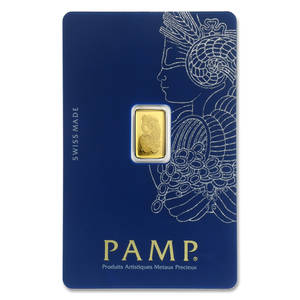

PAMP Suisse Lady Fortuna 10-gram gold bar in assay

For new investors, there is an opportunity to buy a 10-gram gold bar at a spot price from SD Bullion. More details can be found on our spot deals page.

20 Gram Gold Bar

The 20 gram gold bar is another popular option for those who want to purchase less than an ounce of gold at a time. It weighs .64 troy ounces. It is a convenient investment for those who are accumulating gold regularly.

For individuals who wish to purchase gram bars in larger sizes, options are available in 50-gram and 100-gram bars at a higher price point but often with lower premiums.

Troy Ounce Gold Bars – Advantages and Sizes

Long-term investors stack one-ounce gold ingots or larger. They are a popular size for investors due to their low premium over spot gold price.

Many private mints and some government mints produce one-troy-ounce gold bars. Depending on the mint, each bar contains purity levels ranging from .999 to .9999 gold.

1 Troy Ounce Gold Bar

One-ounce gold bars come from their respective mints and are sealed in an assay card that shows the purity, weight, and other minting details. This information is also engraved or stamped on each one-ounce gold ingot.

Buying secondary market 1 oz gold bars from online bullion dealers is usually cheaper. The dealers test the gold ingots for purity before selling them.

10 Troy Ounce Gold Bar

Serious gold investors will look to stack 10-ounce gold ingots as close to the spot price as possible. Due to the density of the gold, 10-ounce gold bars feel much heavier than their size.

Gold Bars by Mint

Both reputable private and sovereign mints mint gold bars. Popular private mints for gold ingots of all sizes include Asahi Refining, Istanbul Gold Refinery, RAND Refinery, Argor-Heraeus, and PAMP Suisse. Some sovereign government mints that produce gold ingots include the Perth Mint and the Royal Canadian Mint.

Gold Bar Premiums

Premiums on gold bars will vary from dealer to dealer and largely depend on the size of the bar. Smaller, gram-size gold ingots will carry a higher premium relative to the gold spot price. More enormous gold ingots, which contain one troy ounce or more, are often available close to the gold spot price.

The premium on 1-gram gold bars could be as high as 20% over the bar’s value. For gold bars that weigh one troy ounce, the premium can be below 1%.

Where Can I Buy Gold Bars in All Sizes?

You can use FindBullionPrices.com to search for Gold bars of all sizes and weights from many online bullion dealers. FindBullionPrices.com tracks prices of gold bars from many trusted and reputable online bullion dealers and will help you find the best price when you’re ready to purchase.