With the ongoing precious metals bull market and silver squeeze, the 2026 bullion season is shaping up to be busy. The first-struck US Mint 2026 American Silver Eagles (ASE), American Gold Eagles (AGE), and American Gold Buffaloes (AGB) are poised to hit dealer pipelines in the coming weeks. If you buy for weight, liquidity, and recognizability, these bullion coins are the U.S. benchmarks.

What’s “first struck” and does it matter?

“First struck” generally refers to coins produced at the start of a calendar issue using early die states and often allocated to APs or special packaging. For bullion investors, first-struck does not change metal content or legal status. Some collectors will pay modest premiums for slabs labeled “First Day of Issue” or “First Strike,” but that’s a numismatic decision, not an intrinsic metals one. In the eyes of most dealers, these coins bring little to no collectible value after the initial hype wears off. If you’re stacking, only pay extra when the delivered $/oz still beats alternatives.

Security features on 1-oz US Mint bullion coins

American Silver Eagle (Type 2, 2021–present)

- Reeded edge variation (edge notch): A small gap/variation in the reeding pattern acts as an anti-counterfeit signal on bullion and collector strikes.

- Refined design detail: The 2021 refresh included higher-fidelity masters and micro-tuning that make digital counterfeiting harder.

- Result for buyers: Quick, visible authenticity check (edge) + modern die work = higher confidence at trade desks.

- Availability: The U.S. Mint begins shipping coins to dealers in the beginning of January. Expect dealers to offer individual 1 oz coins. Look to Tubes of 20 and Monster Boxes for lower premiums.

American Gold Eagle (redesign 2021–present)

- Enhanced design & dies: The 2021 Gold Eagle redesign introduced higher-resolution details. The Mint does not publish a full list of anti-counterfeit elements, but the combination of modern die creation and quality controls is aimed squarely at fraud deterrence.

- Edge: Traditional reeded edge; same edge gap as the ASE.

American Gold Buffalo (2006–present)

- Classic reeded edge: The series relies on die precision, quality control, and assay program integrity.

- Takeaway: While the ASE’s reeded-edge variation is the most obvious “in-hand” feature, both AGE and AGB benefit from the Mint’s modern die and inspection processes. When in doubt, buy from reputable dealers, use weight/dimension checks, and consider third-party authentication for high-value trades.

Minting Locations

The West Point Mint is the main production site for ASE, AGE, and AGB bullion. In periods of heavy demand, San Francisco and Philadelphia may supplement Silver Eagle bullion output.

Standard bullion coins do not carry mint marks; proofs/burnished collector coins do. There’s no metal difference by facility. Supplemental runs can matter to specialists (original monster-box labels, lot numbers), but for stacking, origin doesn’t change melt value or resale basics.

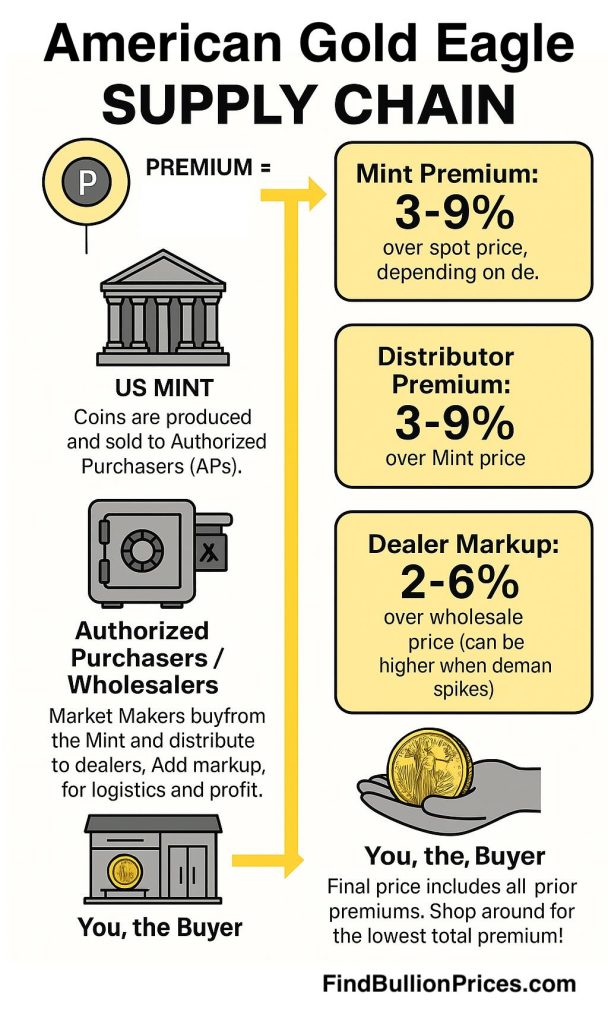

How premiums actually stack up (Mint → APs → you)

If you’ve ever wondered where the extra dollars go, here’s the simple flow:

- U.S. Mint sells only to Authorized Purchasers (APs).

- Price = LBMA spot + Mint premium (varies by program/coin).

- APs move boxes to wholesalers/large retailers.

- Add AP markup + logistics/hedging costs.

- Retailers sell to you.

- Add retail margin + payment method fees (card/crypto) + shipping/insurance + applicable tax.

Premiums widen when:

- Demand spikes (fear/greed cycles),

- Input costs rise (blanks, labor, hedging),

- Supply is throttled (facility constraints),

- Or payment method surcharges apply.

For a deeper dive into structural drivers, see: Gold Eagle premiums—why they cost more than spot.

Common questions

Do “first struck” 2026 coins have more gold/silver or better resale?

No extra metal. Any resale premium is collector-driven (labels like “First Strike/First Day”). If you’re stacking, only pay up if the delivered $/oz still beats alternatives.

Is there a difference between West Point vs. SF/Philly for bullion?

Not in metal content or face value. Silver Eagles may be supplementally struck at SF/Philly in high-demand years; bullion coins won’t show mint marks.

Which has the best liquidity—Gold Eagle or Gold Buffalo?

Both are extremely liquid. Local dealers sometimes prefer AGE (habit), while international buyers often prefer .9999 (AGB). Check the spread on the day you buy.