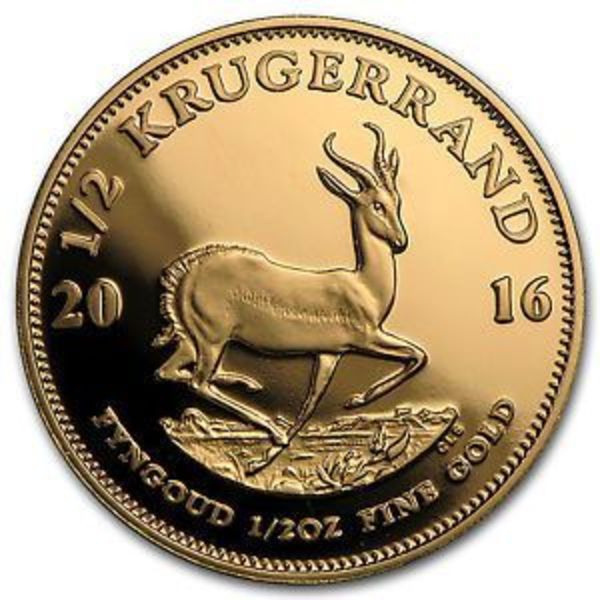

In today’s world of inflation and economic uncertainty, gold remains the ultimate safe-haven. But with gold prices near historic highs, not everyone can afford a full 1 oz bar. That’s where gram gold bars offer an affordable entry point for gold investing. The most popular range of gold bars by the gram includes: 1 gram, 2.5g, 5g, 10g, and 20g options. Whether you’re looking to buy 1 gram gold bars online, start stacking, or hedge against inflation, fractional gold bars make owning gold easy and practical.

Why Invest in Gram Gold Bars?

Fractional gold bars are ideal for investors looking for the cheapest option with flexibility, and liquidity.

- Affordability: You can start investing in gold for a little over $100 with a 1 gram gold bar.

- Liquidity: Gram bars are easy to sell, trade, or use as gifts.

- Flexibility: Diversify your holdings with various sizes, from 1g up to 20g.

- Portability: Small size means you can store or transport gold discreetly—perfect for prepping.

- Accessibility: Available from a wide range of online bullion dealers and coin shops.

How to Buy Gram Gold Bars

You can buy gram gold bars from trusted online dealers, local coin shops, and sometimes at coin & bullion shows.

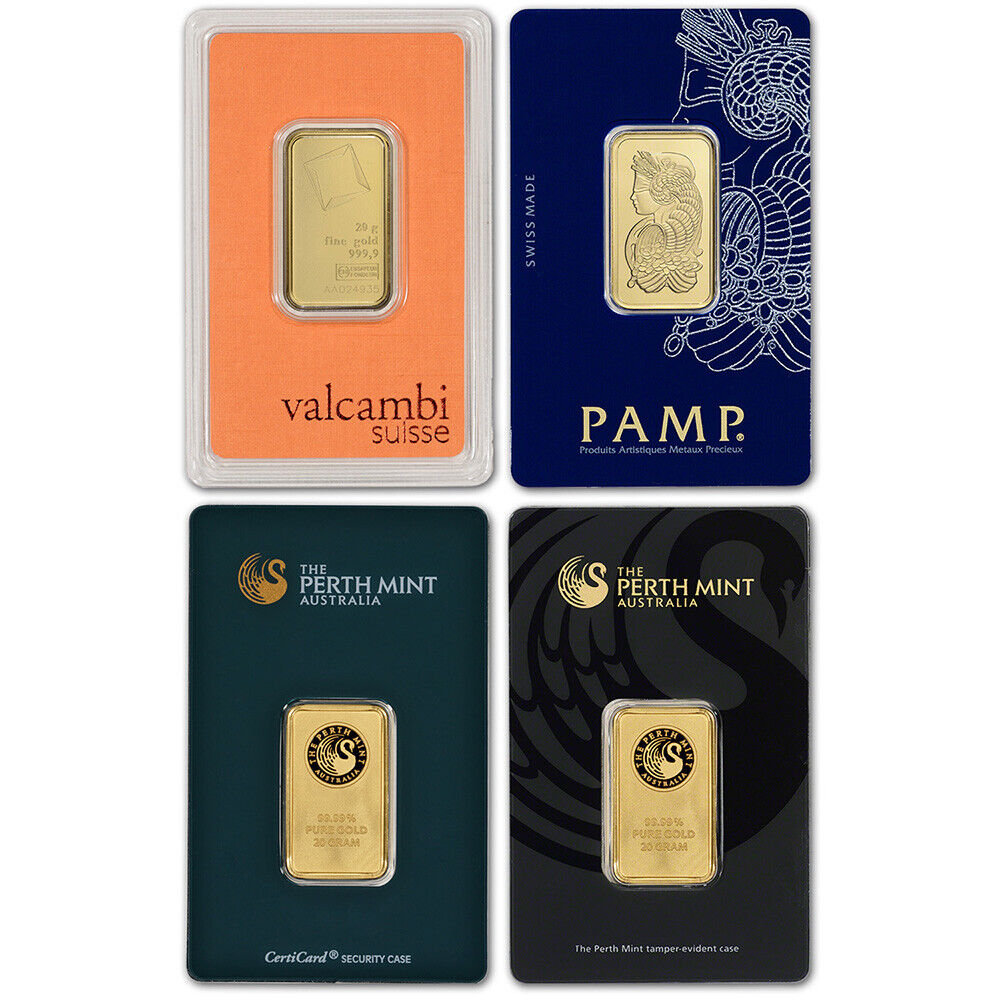

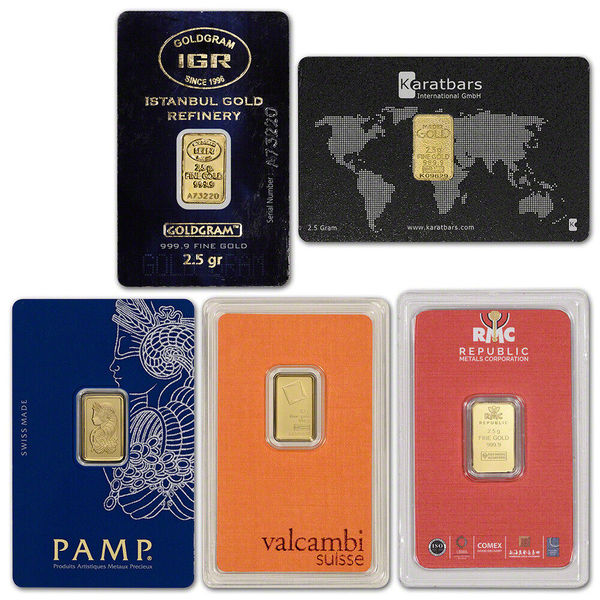

- Choose well-known mints (PAMP, Valcambi, Perth Mint, Credit Suisse, Royal Mint).

- Buy only from reputable sources—look for dealer reviews, industry memberships, and clear pricing.

- Compare prices and premiums: use online price comparison tools to find the lowest premium gold bars.

- Only purchase sealed bars with assay cards for maximum resale value and authenticity.

Many financial analysts, like JP Morgan, predict the price of gold to continue to rise over the next few years. Gold bars are a tangible asset that cannot be printed away or manipulated by central banks.

FindBullionPrices.com tracks gold bar prices of various weights and brands across a wide assortment of reputable online dealers to make it easy to find the best price.

Gram Gold Bar Premiums and Dealer Pricing

The price you pay for a gram gold bar is more than just the spot price of gold.

Premiums (the cost above spot) are higher on smaller bars, sometimes 10–25% or more on a 1 gram bar, due to higher per-unit manufacturing, packaging, and distribution costs.

| Size | Typical Premium over Spot |

|---|---|

| 1g | 15–25% |

| 2.5g | 10–18% |

| 5g | 8–14% |

| 10g | 7–12% |

| 20g | 5–10% |

To get the best deal, compare prices for gram gold bars for sale across multiple dealers. Secondary market bars can also save you money.

Premiums Vs. Melt Value

Smaller bars, such as 1 gram or 2.5 grams, typically carry a premium ranging from 15% to 25% over the spot price of gold.

Midsize bars, like the 5-gram, have slightly lower premiums; 8% to 15% is typical.

Larger fractional bars, like the 10-gram or 20-gram sizes, have lower premiums and can be found for as low as 5% to 12%, as they are closer to the standard 1 oz gold bar.

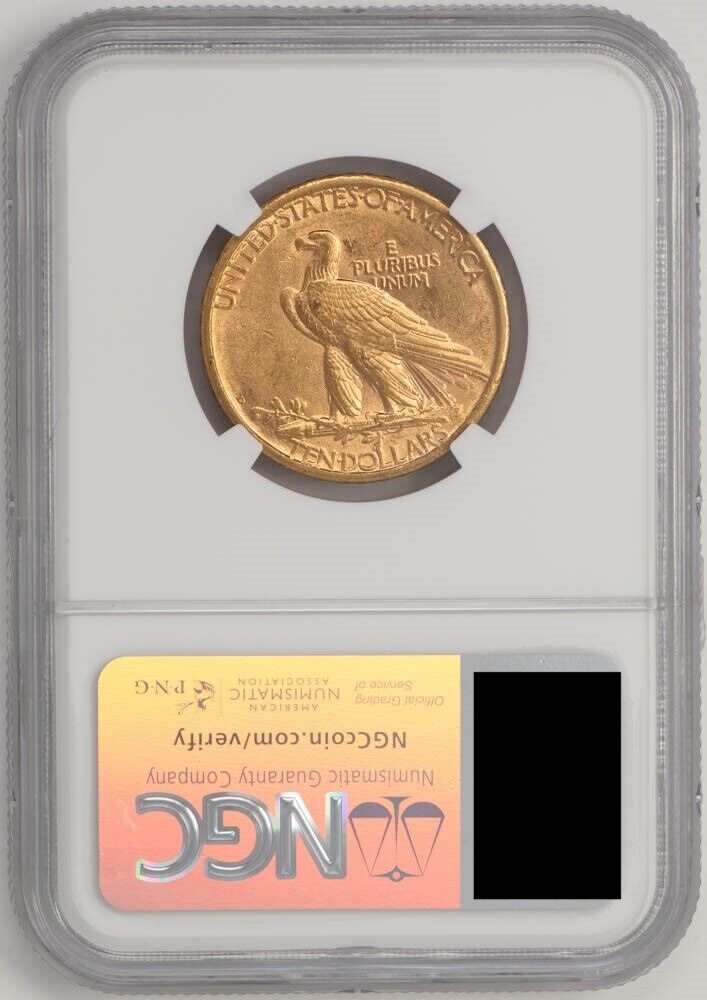

Avoiding Fakes and Counterfeits

How do I know if a 1 gram gold bar is real?

- Always buy bars sealed in assay cards with serial numbers.

- Stick with major brands and buy only from trusted dealers.

- Look for security features like holograms, laser-etched marks, or microprinting.

Selling Gram Gold Bars: What to Expect

You can sell your gram gold bars to local coin dealers, pawn shops, bullion dealers, or even online marketplaces.

What affects resale value?

- Condition of the bar (preferably unopened in original packaging)

- Brand and recognizability (PAMP, Valcambi, etc. fetch higher premiums)

- Documentation and assay cards

Tip: Before selling, check the current spot price and compare buyback offers from multiple dealers to ensure you get the best deal.

Cheapest Gram Gold Bars

Secondary market gold bars are a smart, cost-effective way for both new and experienced investors to add real gold to their holdings without paying top dollar.

Before a secondary market gold bar is made available for resale, dealers test each piece for authenticity, weight, and purity. This includes verifying mint marks, confirming the bar’s weight on calibrated scales, and some use XRF analyzers to ensure the bar contains 0.999 or 0.9999 fine gold.

Secondary-market gold bars almost always offer a cheaper entry point. When looking to maximize the number of grams or ounces per dollar, these bars consistently rank among the cheapest gold bars available.

Compare prices across several reputable online bullion dealers before you buy and make sure you understand the dealer’s return and buyback policies. Buying secondary market gold bars is one of the most effective ways to grow your gold stack on a budget.

Learn More About Specific Sizes

FAQs About Gram Gold Bars

Are gram gold bars real gold?

Yes, most gram bars are .999 or .9999 fine pure gold—check for proper markings and assay cards.

Why do gram gold bars have higher premiums than 1 oz bars?

Smaller bars cost more to produce and distribute per gram, raising the per-gram price.

Can I add gram gold bars to my Gold IRA?

Some bars from approved mints/brands are eligible; check with your IRA custodian.

How do I spot fake gold bars?

Buy from trusted dealers, look for assay cards, and compare weight/dimensions to mint specs.

What’s the best gram gold bar for beginners?

Start with a 5g or 10g gold bar from a leading brand for the best balance of price, liquidity, and recognition.