Interest in gold and silver is exploding again as inflation runs hot and confidence in fiat currencies wavers. But for newcomers entering the precious metals space, the first challenge is often understanding premiums—why you’re paying above the spot price for physical bullion. That’s where “Gold at Spot Price” deals come in. These are limited-time, loss-leader offers by trusted bullion dealers that allow first-time buyers to dip their toes into the market without the typical markup.

Understanding Spot Price Deals

Spot price is the current market value of a precious metal, which dealers pay when they buy from wholesalers or the COMEX. However, when you buy bullion as a retail customer, you’re usually hit with a premium—that added cost covers minting, distribution, and dealer profit. “At Spot” offers eliminate this premium, meaning you get the metal for its raw value with no fluff.

These promotions are usually limited to new customers or first-time buyers and have quantity restrictions. Still, they’re a killer way to start stacking without getting hosed by high premiums.

Current Gold at Spot Price Offers

Several well-known online bullion dealers are running gold-at-spot promotions:

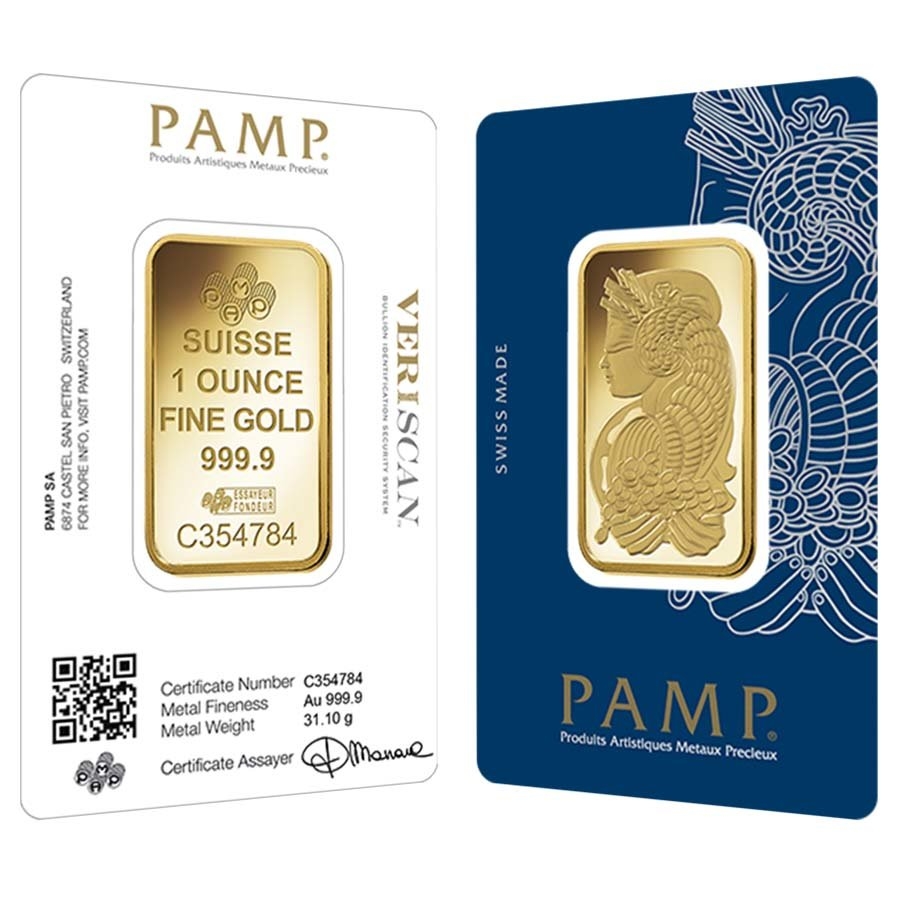

- JM Bullion Gold Starter Pack: This deal offers new customers 1 oz of gold at spot price. The limit is 1 oz per household, and it’s typically a gold bar from a respected refinery. This is one of the best gold onboarding offers in the U.S. market.

- SD Bullion 10 Gram Gold Bar at Spot: SD Bullion gives you a chance to buy a 10-gram gold bar at spot. It’s smaller than an ounce but offers a low-cost entry point for new gold buyers looking to avoid premiums and test the waters.

- Bullion Exchanges 1 oz Gold Chinese Panda at Spot Price: This is a premium offering since Chinese Pandas are typically collectible with high premiums. Getting one at spot is rare and valuable. Like the others, this is likely limited to one per new customer.

These offers are win-win. Dealers eat the cost of the first sale to build customer loyalty, and investors walk away with pure metal at a fair market value.

The Comeback of Spot Price Silver Deals

Before COVID-19 disrupted everything, silver-at-spot deals were a popular onboarding tool. Pandemic-era mining shutdowns and surging demand dried up those offers fast, but now they’re starting to make a comeback.

SD Bullion was the first to revive a 5 oz silver bar at spot offer, giving new buyers a chance to get into silver with zero premium. This is a solid way to start your silver stack while keeping costs low.

Why Gold and Silver as Matter Real Assets

Unlike stocks or crypto, physical bullion carries no counterparty risk. You own it outright. It can’t be hacked, frozen, or defaulted on. Gold has stood the test of time as a long-term store of value, and silver remains a critical industrial and monetary metal.

Gold is unmatched as a hedge against inflation, fiat debasement, and systemic risk. Spot price deals provide a unique gateway for investors to build their portfolios with real metal while avoiding overpriced, high-premium traps.

Final Thoughts

If you’re new to gold and silver, take advantage of these rare at-spot deals. Whether it’s a 1 oz gold bar from JM Bullion, a 10-gram gold bar from SD Bullion, or a premium Panda coin from Bullion Exchanges, each gives you an honest and accessible path into one of the world’s oldest and most proven forms of wealth preservation. Remember: these are one-time offers, so act fast and stack smart.