Uncertainty in the traditional investment markets brings a lot of interest in precious metals. Precious metals provide a stable investment and store of wealth when the stock market is wavering. Gold has always been looked at as a safe-haven way to hold onto wealth during an economic recession. Gold coins for investing are the best way having physical precious metals in your portfolio.

Gold has historically been a way for investors to preserve buying power from inflation.

Gold has been on the rise this year. All major financial experts are predicting that gold is going to continue to rise. Hedge fund leaders and financial analysts alike are recommending investments in precious metals.

There are ways to invest in gold like traditional stock or mutual fund investments. There are gold-mining stocks whose performance often tracks the price of gold in relation to the expenses of mining operations. There are ETF (electronically traded funds), some of which are backed by physical metals.

However, the safest way to invest in gold is to buy physical bullion.

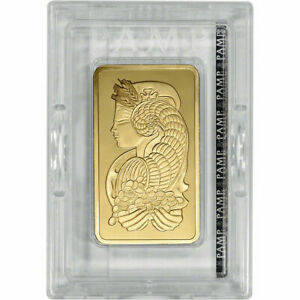

Gold Bullion comes in different forms. The most common ways to invest in physical gold is to buy coins and bars.

Gold coins are minted, backed and guaranteed by sovereign governments.

Gold bars and rounds are minted by private companies that assure the assay of the gold you’re buying.

If you want exposure to gold in your investment portfolio, then buying and holding gold coins is the best way to achieve that.

Gold Coins are different from rounds in that coins are issued by sovereign government authorities and carry legal tender status. In the majority of cases, the face value that is present on gold coins is nominal and is a fraction of the intrinsic value of the metal in the coin.

Government issued coins are more widely recognized world-wide when it comes time to sell. They are standardized and are manufactured to exacting specifications that are well known and documented.

This makes them much easier to authenticate without requiring expensive equipment to assay. With a digital scale and measuring calipers even a novice in precious metals can often be taught to easily determine the authenticity of a coin.

-

American Gold Eagle Coins

The American Gold Eagle is one of the most recognizable modern gold coins worldwide. It’s design embodies the spirit of America. The obverse (front) of the coin features the Walking Liberty design that also appeared on the St Gauden’s Double Eagle coin. The reverse (back) of the coin shows a bald eagle soaring above it’s nest.

It was introduced in 1986 and is backed in full faith for it’s purity and weight by the US Mint. Each Gold Eagle coin contains 1 troy ounce of gold. The coin also contains small amounts of silver and copper to provide strength, durability and protections from scratches while being handled.

The composition of the Gold American Eagle is 91.67% Au, 3% Ag, 5.33% Cu. It is 22 karat, which was the alloy used in American Gold coins minted prior to 1837.

Gold Eagles are widely recognized by investors. They are typically sold by dealers as individual coins. Though they are also available in tubes of 20 coins or Monster Boxes containing 25 full tubes.

-

American Gold Buffalo Coins

The American Gold Buffalo coin was introduced in 2006. It is a 24k bullion coin produced from .9999 fine gold. It was the first 24k gold bullion coin produced by the US Mint.

The Gold Buffalo mimics the design of the Buffalo Nickel. It is produced annually at the West Point Mint. Random Year Gold Buffalo coins will carry the lowest premiums over spot price, which is ideal for investors.

-

Canadian Gold Maple Leaf Coins

The Canadian Maple Leaf is one of the world’s most popular coin programs. It is the official bullion coin series of the Royal Canadian Mint and the nation of Canadian. First introduced in 1979, the Canadian Gold Maple Leaf coins were the first in the world to compete with the South African Krugerrand in terms of gold bullion demand. Prior to the release of the Gold Canadian Maple Leaf no other coin beside the Krugerrand had ever been offered strictly for investment purposes.

The obverse of all Gold Maple Leafs feature the right-profile portrait sculpture of Queen Elizabeth II. Three different incarnations of Her Majesty’s profile have appeared over the years. These include the following:

-1979 to 1989 – The image of a 39-year-old Queen Elizabeth II.

-1990 to 2004 – A depiction of Queen Elizabeth II at 64 years of age.

-2005 to Present – Susanna Blunt’s depiction of Her Majesty at the age of 79.

The reverse of all Canadian Maple Leaf coins features the image of the sugar maple leaf. Used on the reverse since the introduction of the gold version in 1979, this image has never changed. The only additions have been security measures, notably radial lines and a microscopic maple leaf privy.

-

South African Gold Krugerrand Coins

The gold Krugerrand quickly became the number one choice for investors worldwide during the bull gold market in the 1970’s. Between 1974-1985 it is estimated that 22 million gold Krugerrand coins were imported into the United States.

The success of the South African Gold Krugerrand inspired other gold-producing countries to mint and issue gold bullion coins. Including Canada, with the gold Canadian Maple Leaf; China, with the Chinese Gold Panda; the United States, with the American Gold Eagle; and the United Kingdom, with the British Gold Britannia.

The dimensions of the 1 oz South African Gold Krugerrand is 32.77 mm in diameter and 2.84 mm thick. It is minted from a gold alloy that is 91.67% pure (22 karats) so that the coin contains one troy ounce (31.1035 grams) of gold. The remaining 8.33% of the of the coins weight is copper which gives the Krugerrand it’s orange appearance. As a result, the Krugerrand’s actual weight is 1.0909 troy ounces (33.93 grams).

In 1980, the South African Mint began producing gold Krugerrand coins in fractional ounce sizes, containing 1/2 oz (15.5 grams), 1/4 ounce (7.78 grams), and 1/10 ounce (3.11 grams) of pure gold.

Many experts suggest that every investment portfolio is diversified with 10% to 15% invested in precious metals. Many investors choose to buy gold coins because of their ability to retain and maintain purchasing power over time.

The one troy ounce gold coin is the most popular size and denomination of gold bullion coins available today. These gold coins are widely recognized worldwide and can easily be authenticated with simple tools. One ounce gold coins are small and compact and many of them can be stored discreetly in a very small amount of space.

One standard mint tube of gold eagle coins contains 20 troy ounces of gold and is only slightly larger than an average pill bottle. With the spot price of gold hovering between $1,500 to $1,600 per ounce, a full tube of Gold Eagles has a bit over $30,000 in gold value. That is a remarkable store of wealth in a compact size.